Little Excitement Around Zangge Mining Company Limited's (SZSE:000408) Earnings

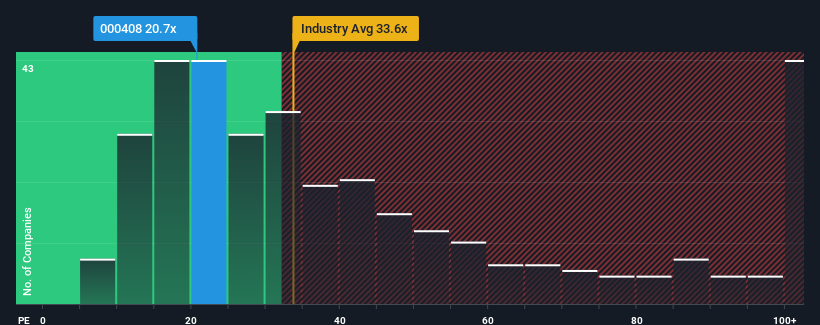

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 35x, you may consider Zangge Mining Company Limited (SZSE:000408) as an attractive investment with its 20.7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Zangge Mining has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Zangge Mining

How Is Zangge Mining's Growth Trending?

In order to justify its P/E ratio, Zangge Mining would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 48%. Still, the latest three year period has seen an excellent 203% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% during the coming year according to the four analysts following the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Zangge Mining's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Zangge Mining's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zangge Mining maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Zangge Mining that you should be aware of.

If these risks are making you reconsider your opinion on Zangge Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zangge Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000408

Zangge Mining

Produces and sells potassium chloride and lithium carbonate in China and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives