Investors Holding Back On Shanghai HIUV New Materials Co.,Ltd (SHSE:688680)

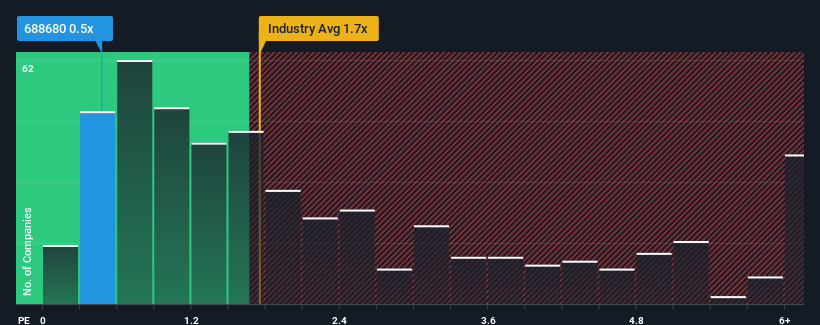

With a price-to-sales (or "P/S") ratio of 0.5x Shanghai HIUV New Materials Co.,Ltd (SHSE:688680) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shanghai HIUV New MaterialsLtd

How Has Shanghai HIUV New MaterialsLtd Performed Recently?

While the industry has experienced revenue growth lately, Shanghai HIUV New MaterialsLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai HIUV New MaterialsLtd.Do Revenue Forecasts Match The Low P/S Ratio?

Shanghai HIUV New MaterialsLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. Still, the latest three year period has seen an excellent 144% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 36% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

In light of this, it's peculiar that Shanghai HIUV New MaterialsLtd's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Shanghai HIUV New MaterialsLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You always need to take note of risks, for example - Shanghai HIUV New MaterialsLtd has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Shanghai HIUV New MaterialsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688680

Shanghai HIUV New MaterialsLtd

Engages in the research and development, manufacture, and sale of polymer films in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives