Polyrocks Chemical Co.,LTD (SHSE:688669) Doing What It Can To Lift Shares

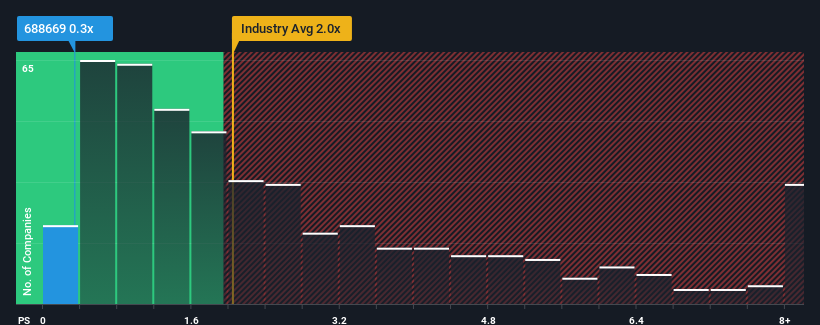

With a price-to-sales (or "P/S") ratio of 0.3x Polyrocks Chemical Co.,LTD (SHSE:688669) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Polyrocks ChemicalLTD

What Does Polyrocks ChemicalLTD's Recent Performance Look Like?

The recent revenue growth at Polyrocks ChemicalLTD would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Polyrocks ChemicalLTD, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Polyrocks ChemicalLTD's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.9% last year. The latest three year period has also seen an excellent 86% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 23% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Polyrocks ChemicalLTD's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Polyrocks ChemicalLTD revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

Plus, you should also learn about these 5 warning signs we've spotted with Polyrocks ChemicalLTD (including 3 which don't sit too well with us).

If these risks are making you reconsider your opinion on Polyrocks ChemicalLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688669

Polyrocks ChemicalLTD

Researches, produces, and distributes environmental halogen-free flame retardant plastics.

Slightly overvalued with very low risk.

Market Insights

Community Narratives