3 Undiscovered Gems in Asia Featuring HMT Xiamen New Technical Materials

Reviewed by Simply Wall St

As global markets react to favorable trade deals and economic indicators, Asian stocks are drawing increased attention, with indices like China's CSI 300 and Japan's Nikkei 225 showing positive momentum. In this dynamic environment, identifying promising small-cap companies can be key to uncovering potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Subaru Enterprise | NA | 2.03% | 4.77% | ★★★★★★ |

| Shandong Sacred Sun Power SourcesLtd | 19.09% | 13.32% | 42.32% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Pacific Construction | 22.23% | -8.29% | 37.82% | ★★★★★☆ |

| Hunan Investment GroupLtd | 4.50% | 25.84% | 15.32% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

HMT (Xiamen) New Technical Materials (SHSE:603306)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMT (Xiamen) New Technical Materials Co., Ltd. is a company engaged in the automobile parts manufacturing industry with a market capitalization of approximately CN¥13.74 billion.

Operations: HMT (Xiamen) New Technical Materials generates revenue primarily from the automobile parts manufacturing industry, totaling approximately CN¥2.28 billion.

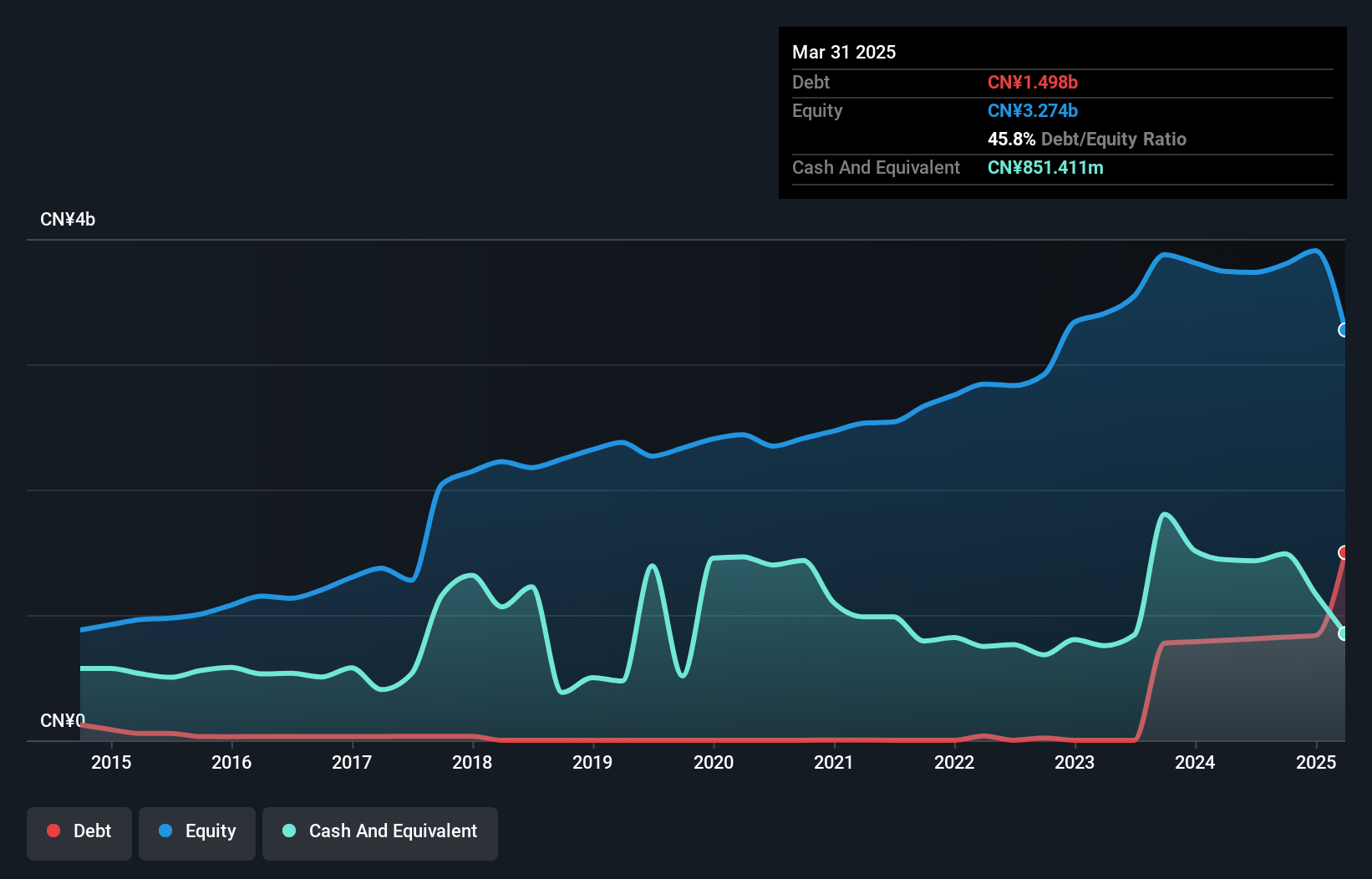

HMT (Xiamen) New Technical Materials, a small-cap player in the market, showcases robust financial health with its net debt to equity ratio at 19.7%, deemed satisfactory and well below concerning levels. The company reported an impressive earnings growth of 16% last year, outpacing the luxury industry's -5.9%. Trading at 32.6% below estimated fair value suggests potential undervaluation by the market. Recent earnings reveal net income climbed to CNY 86 million for Q1 2025 from CNY 54 million a year prior, highlighting strong performance momentum as they navigate industry challenges effectively.

Shanghai Skychem Technology (SHSE:688603)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Skychem Technology Co., Ltd. focuses on the research, development, production, and sales of functional wet electronic chemicals with a market capitalization of CN¥6.89 billion.

Operations: Skychem generates revenue primarily from specialty chemicals, totaling CN¥402.11 million. The company's market capitalization stands at CN¥6.89 billion.

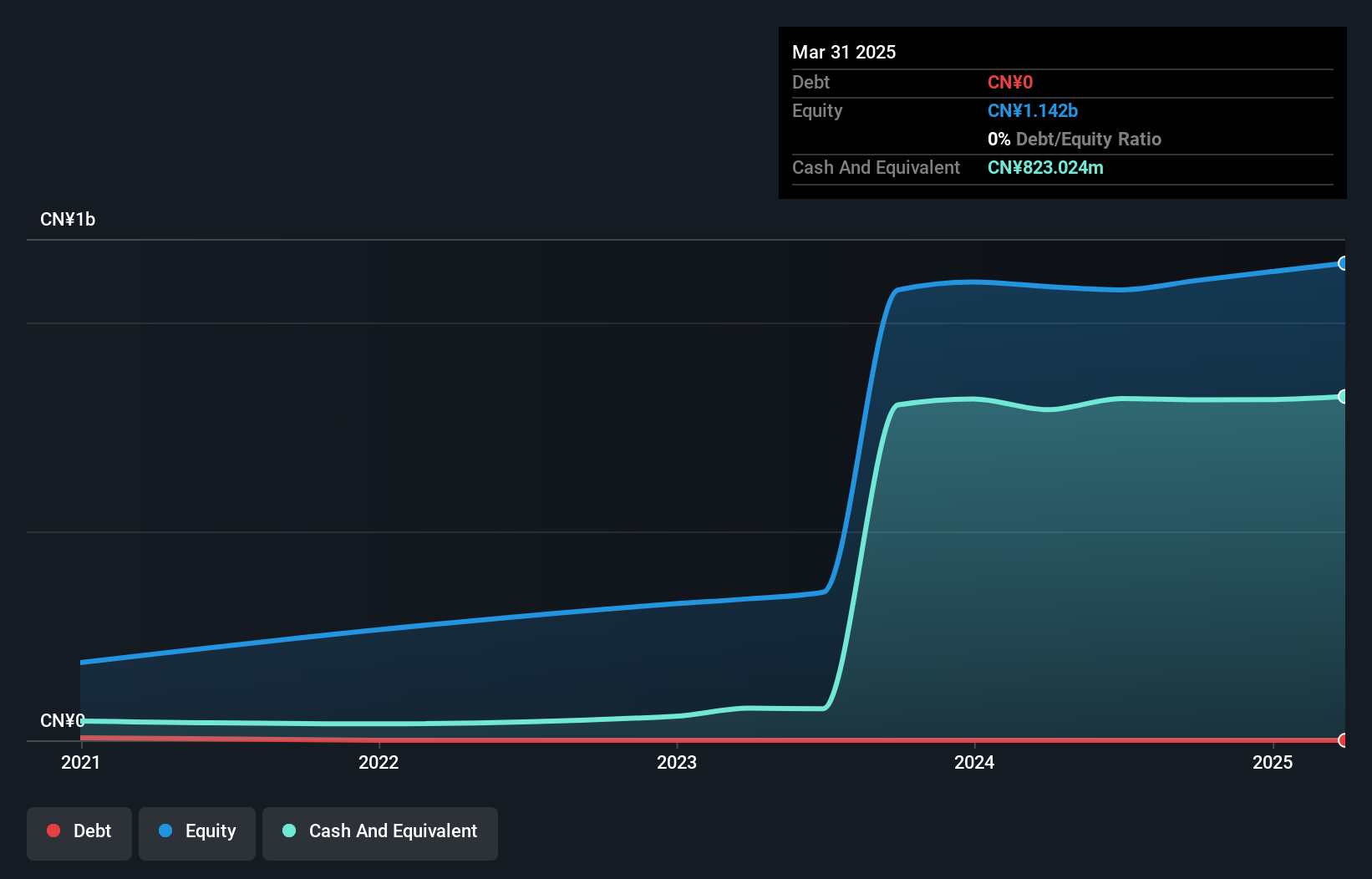

Skychem Technology, a nimble player in the chemicals sector, has demonstrated impressive financial health with earnings growth of 16.2% last year, outpacing the industry average of 4%. The company remains debt-free and boasts high-quality earnings, providing a solid foundation for future endeavors. In Q1 2025, Skychem reported revenue of CNY 101.53 million and net income of CNY 18.97 million, marking an increase from the previous year’s figures. With free cash flow turning positive at CNY 68.52 million by mid-2024 and no debt concerns on the horizon, Skychem seems poised for continued growth in its niche market segment.

Guangdong Dowstone Technology (SZSE:300409)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Dowstone Technology Co., Ltd. specializes in the production and sale of lithium batteries, carbon, and ceramic materials both domestically and internationally, with a market capitalization of CN¥13.71 billion.

Operations: Dowstone Technology generates revenue primarily from lithium batteries, carbon, and ceramic materials. The company's focus on these segments is reflected in its financial performance. Gross profit margin has shown notable fluctuations over recent periods, indicating variability in cost management or pricing strategies.

Guangdong Dowstone Technology, a nimble player in the chemicals sector, has seen its earnings skyrocket by 716.1% over the past year, outpacing the industry average of 4%. Despite this impressive growth, earnings have decreased by an average of 16.6% annually over five years. The company's net debt to equity ratio stands at a satisfactory 12.8%, having improved from 57.1% to 45.9% in five years, although interest coverage remains tight with EBIT covering interest payments only 2.9 times over. Recently approved dividends further reflect financial confidence amid substantial shareholder dilution last year and high-quality past earnings suggest potential resilience moving forward.

- Click to explore a detailed breakdown of our findings in Guangdong Dowstone Technology's health report.

Gain insights into Guangdong Dowstone Technology's past trends and performance with our Past report.

Where To Now?

- Click this link to deep-dive into the 2606 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HMT (Xiamen) New Technical Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603306

HMT (Xiamen) New Technical Materials

HMT (Xiamen) New Technical Materials Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives