High Insider Ownership Growth Companies On Chinese Exchange In June 2024

Reviewed by Simply Wall St

As of June 2024, the Chinese stock market reflects a mixed performance with sectors like real estate showing signs of recovery while overall market indices like the Shanghai Composite have experienced declines. This backdrop sets a complex stage for investors looking at growth companies with high insider ownership, which are often viewed as having aligned interests between company management and shareholders, potentially offering stability in uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's take a closer look at a couple of our picks from the screened companies.

KEDE Numerical Control (SHSE:688305)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KEDE Numerical Control Co., Ltd. specializes in manufacturing and marketing CNC systems and functional components within China, with a market capitalization of approximately CN¥6.71 billion.

Operations: The company's primary revenue of CN¥468.13 million is derived from manufacturing general equipment.

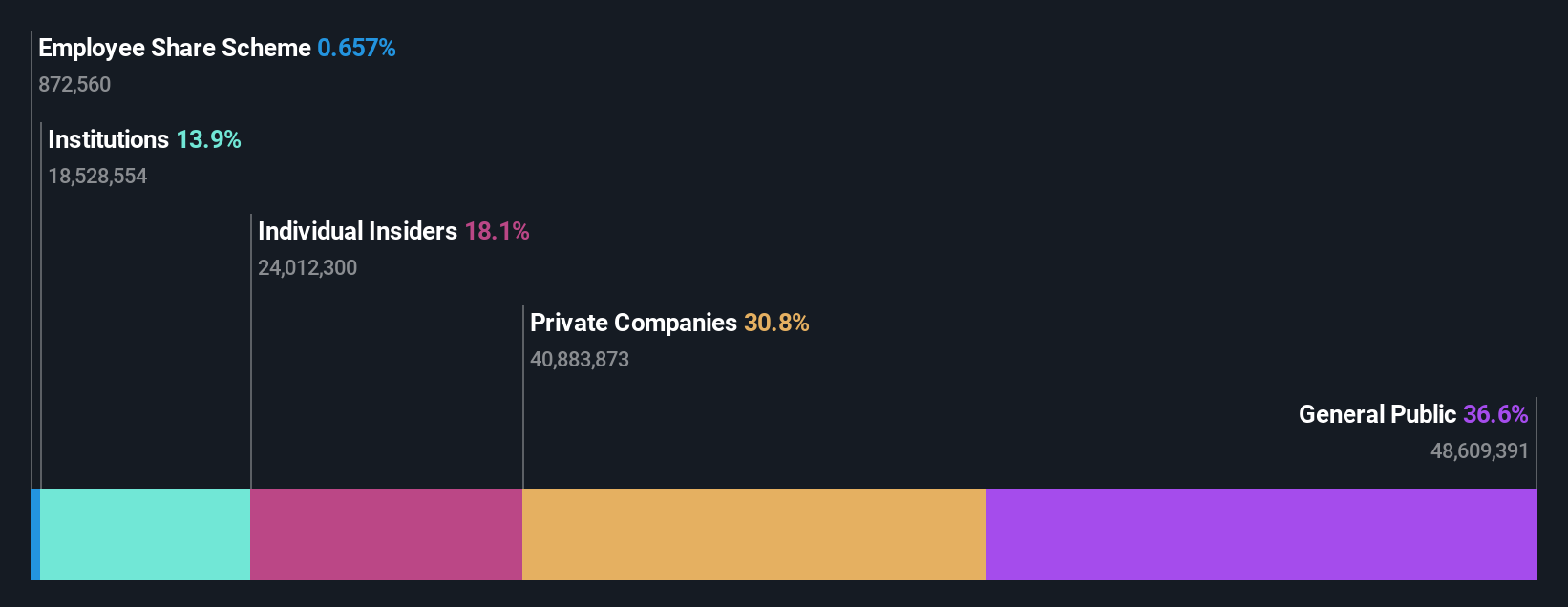

Insider Ownership: 18.1%

Earnings Growth Forecast: 43.8% p.a.

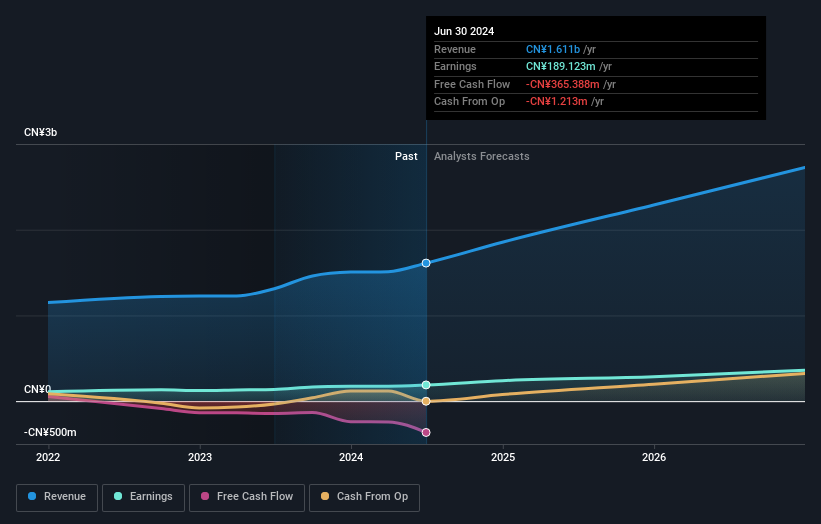

KEDE Numerical Control, a growth-oriented company in China with high insider ownership, recently reported a dip in net income to CNY 15.06 million from CNY 26.88 million year-over-year despite an increase in sales. The company's revenue and earnings are expected to grow significantly over the next three years, outpacing the Chinese market averages of 13.9% and 22.8%, respectively. However, recent shareholder dilution and a forecast of low return on equity at 14.5% could raise concerns for potential investors looking for sustainable value growth.

- Click here to discover the nuances of KEDE Numerical Control with our detailed analytical future growth report.

- Our expertly prepared valuation report KEDE Numerical Control implies its share price may be too high.

MayAir Technology (China) (SHSE:688376)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MayAir Technology (China) Co., Ltd. is a company based in China that focuses on the research, development, production, and sale of medical air purification equipment and atmospheric environment treatment products, with a market capitalization of approximately CN¥3.99 billion.

Operations: The company generates revenue primarily through the sale of medical air purification equipment and atmospheric environment treatment products.

Insider Ownership: 14.6%

Earnings Growth Forecast: 24.5% p.a.

MayAir Technology (China), demonstrating a robust growth trajectory, reported a modest increase in quarterly earnings with net income rising to CNY 35.39 million from CNY 33.57 million year-over-year. Anticipated revenue and earnings growth are expected to surpass Chinese market averages significantly over the next three years, with projections of 21% and 24.5% respectively. Despite this, its return on equity is forecasted to remain low at 13.6%, and its dividend coverage by cash flows appears weak, raising some concerns about sustainability amidst its financial gains.

- Click to explore a detailed breakdown of our findings in MayAir Technology (China)'s earnings growth report.

- The valuation report we've compiled suggests that MayAir Technology (China)'s current price could be inflated.

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Skychem Technology Co., Ltd. specializes in the research, development, and manufacturing of electronic materials for industries including printed circuit boards, semiconductors, and touch screens, with a market capitalization of approximately CN¥2.69 billion.

Operations: The company generates revenue primarily from its specialty chemicals segment, amounting to CN¥343.58 million.

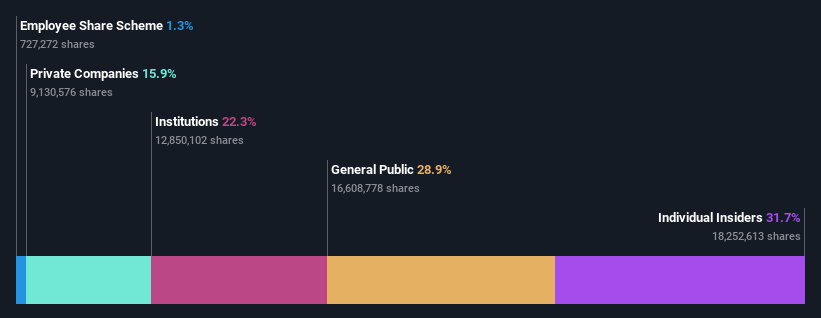

Insider Ownership: 31.7%

Earnings Growth Forecast: 31.4% p.a.

Guangdong Skychem Technology, a Chinese growth company with high insider ownership, has shown promising financial results. In the first quarter of 2024, it reported a revenue increase to CNY 80.09 million from CNY 75.44 million year-over-year and a net income rise to CNY 17.94 million from CNY 11.38 million. Despite a yearly revenue drop in 2023 to CNY 338.15 million from CNY 373.84 million, earnings still grew by an impressive rate of over the past year and are expected to continue growing significantly over the next three years at rates well above industry averages in China.

- Delve into the full analysis future growth report here for a deeper understanding of Guangdong Skychem Technology.

- Our valuation report here indicates Guangdong Skychem Technology may be overvalued.

Make It Happen

- Dive into all 395 of the Fast Growing Chinese Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if KEDE Numerical Control might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688305

KEDE Numerical Control

Manufactures and markets CNC systems and functional components in China.

Flawless balance sheet with high growth potential.