Exploring Three Undiscovered Gems in China with Strong Potential

Reviewed by Simply Wall St

As global markets experience heightened volatility and economic indicators reveal mixed signals, the Chinese market has shown resilience with a notable rise in industrial profits despite ongoing challenges. Amid this backdrop, investors are increasingly seeking opportunities in lesser-known stocks that demonstrate strong fundamentals and potential for growth. In this article, we explore three undiscovered gems in China that stand out due to their robust financial health, innovative business models, and strategic positioning within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xuelong GroupLtd | NA | -2.44% | -13.80% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 48.85% | 15.81% | 40.13% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 1.87% | 19.88% | ★★★★★★ |

| CHTC Helon | NA | 8.72% | 37.40% | ★★★★★★ |

| Tianjin Lisheng PharmaceuticalLtd | 1.12% | -7.51% | 12.08% | ★★★★★☆ |

| Sichuan Fulin Transportation Group | 30.19% | -1.47% | 13.87% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 28.44% | 9.39% | -1.94% | ★★★★★☆ |

| BGT Group | 6.98% | 1.62% | -21.98% | ★★★★★☆ |

| Shenzhen Jdd Tech New Material | 3.17% | 24.94% | 22.07% | ★★★★★☆ |

| Huaiji Dengyun Auto-parts (Holding)Ltd | 51.23% | 12.10% | -46.35% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Solbar Ningbo Protein Technology (SHSE:603231)

Simply Wall St Value Rating: ★★★★★☆

Overview: Solbar Ningbo Protein Technology Co., Ltd. engages in the agricultural and sideline food processing industry, with a market cap of CN¥3.16 billion.

Operations: Solbar Ningbo Protein Technology generates revenue primarily from the agricultural and sideline food processing industry, amounting to CN¥1.73 billion. The company's market cap stands at CN¥3.16 billion.

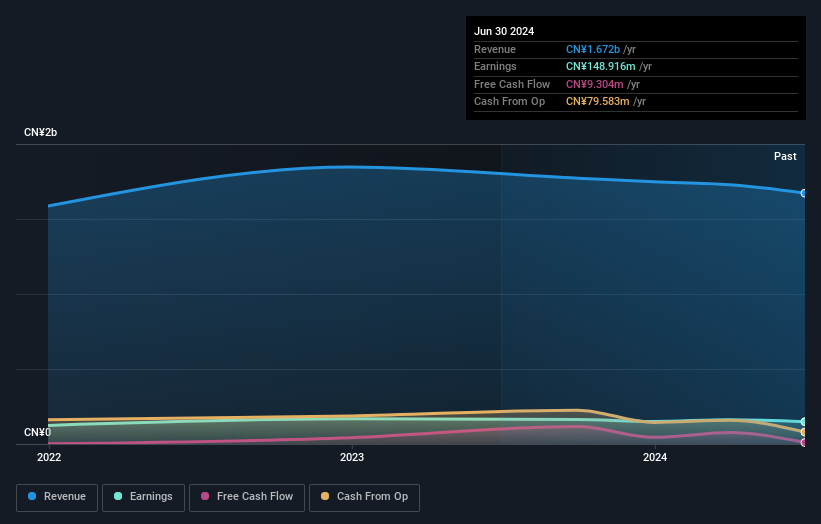

Solbar Ningbo Protein Technology, with a price-to-earnings ratio of 19.5x, is below the CN market average of 28x. The company had negative earnings growth (-2.4%) over the past year, lagging behind the Food industry average of 6.6%. Despite this, it remains profitable and has more cash than total debt, ensuring no immediate liquidity concerns. Additionally, Solbar earns more interest than it pays out and has consistently positive free cash flow (US$44M in Dec 2023).

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Skychem Technology Co., Ltd. focuses on the research and development as well as manufacturing of electronic materials for the printed circuit board, semiconductor, packaging, and touch screen industries, with a market cap of CN¥2.86 billion.

Operations: Guangdong Skychem Technology Co., Ltd. generates revenue primarily from its specialty chemicals segment, which brought in CN¥343.58 million.

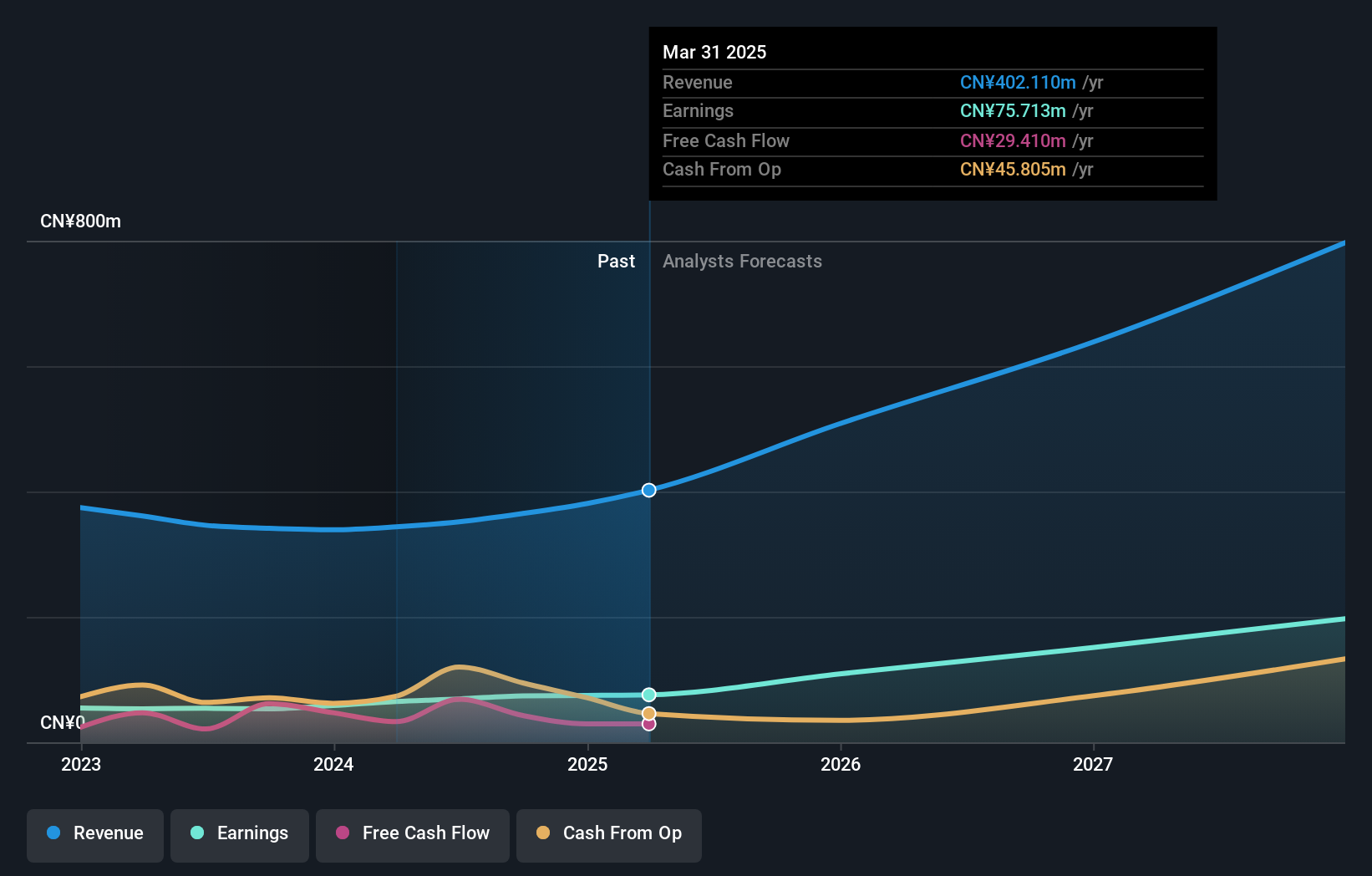

Guangdong Skychem Technology, a promising player in the chemicals sector, has shown impressive financial health with no debt and high-quality earnings. Over the past year, its earnings grew by 21.8%, outpacing the industry's -14.8%. Recently added to major indices like the Shanghai Stock Exchange Composite Index, Skychem also repurchased 758,556 shares for CNY 37.77 million this year. Earnings are forecasted to grow at an annual rate of 36.74%, highlighting strong future prospects.

Guizhou Taiyong-Changzheng TechnologyLtd (SZSE:002927)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guizhou Taiyong-Changzheng Technology Co., Ltd. (SZSE:002927) focuses on industrial operations and has a market cap of CN¥2.55 billion.

Operations: The company generates revenue primarily from its industrial segment, amounting to CN¥1.04 billion.

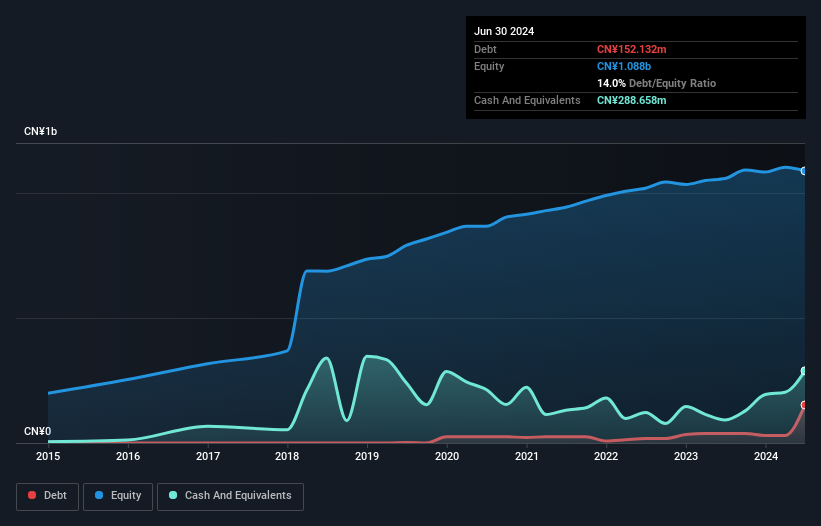

Guizhou Taiyong-Changzheng Technology Ltd. has shown promising growth, with earnings increasing by 3% in the past year, outpacing the Electrical industry’s 0.6%. Trading at 54.4% below its estimated fair value, it appears undervalued. The company repurchased shares recently and announced a cash dividend of CNY 1.35 per share for 2023. Despite a volatile share price over the last three months, its debt to equity ratio rose from 0% to just 3% over five years, indicating manageable debt levels and solid financial health.

Seize The Opportunity

- Embark on your investment journey to our 995 Chinese Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688603

Guangdong Skychem Technology

Engages in research and development and manufacturing of electronic materials in the printed circuit board, semiconductor and packaging, and touch screen industries.

Flawless balance sheet with high growth potential.