3 Chinese Growth Companies With High Insider Ownership And Up To 35% Revenue Growth

Reviewed by Simply Wall St

In recent weeks, Chinese equities have shown mixed performance, with the Shanghai Composite Index gaining 0.5% while the CSI 300 lost 0.73%, amid concerns about weak manufacturing data and slowing export momentum. Despite these challenges, certain growth companies in China continue to attract attention due to their strong revenue growth and high insider ownership. When evaluating potential investments in this market environment, it's important to consider companies that demonstrate robust revenue growth and have significant insider ownership, as these factors can indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

Let's explore several standout options from the results in the screener.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

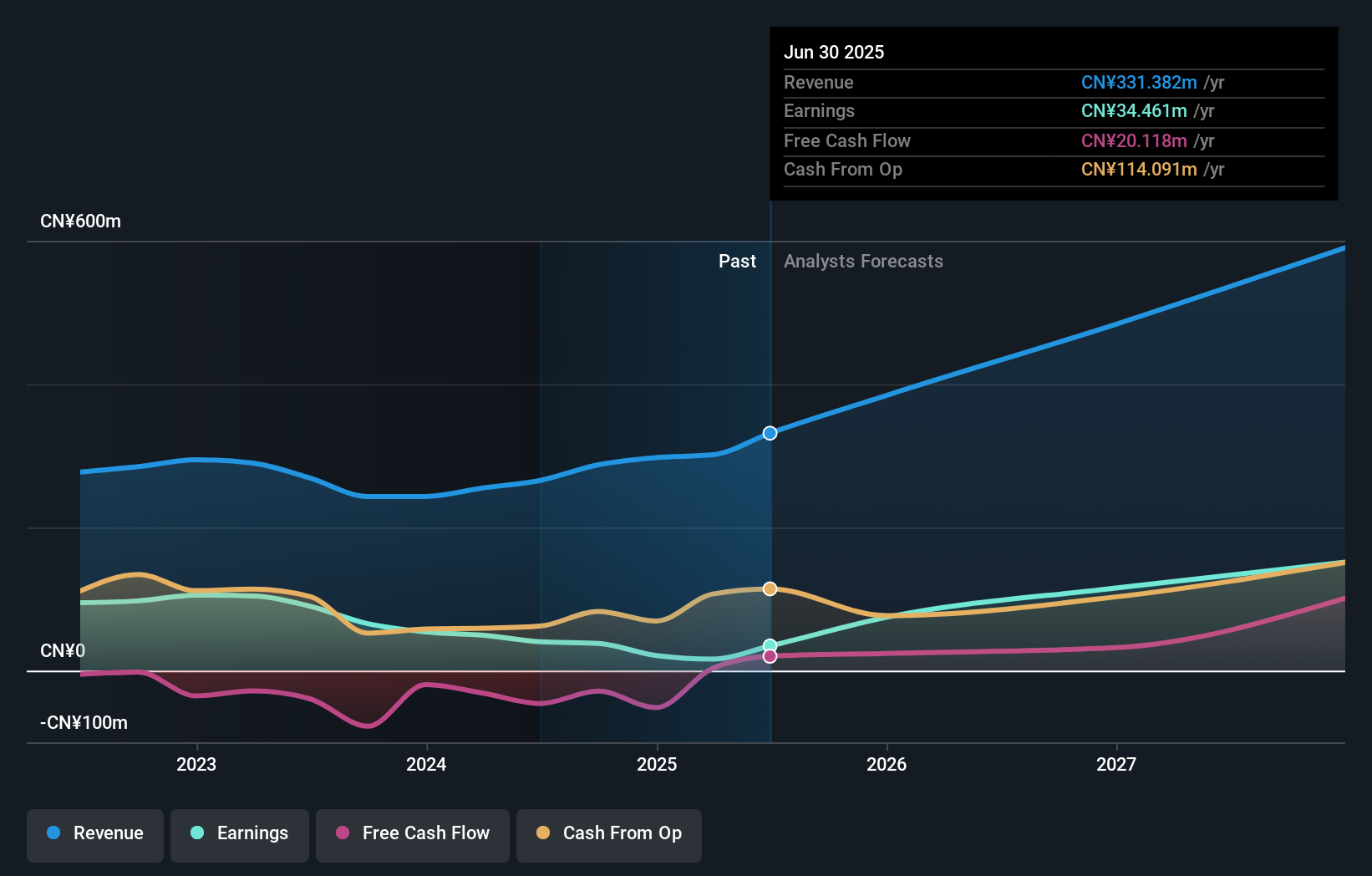

Overview: Shanghai OPM Biosciences Co., Ltd. provides cell culture media and CDMO services in China and internationally, with a market cap of CN¥3.47 billion.

Operations: Revenue Segments: The company generates revenue from cell culture media and CDMO services both domestically and internationally.

Insider Ownership: 24.8%

Revenue Growth Forecast: 35.1% p.a.

Shanghai OPM Biosciences shows strong growth potential, with revenue forecasted to grow 35.1% annually and earnings expected to increase significantly by 48.56% per year over the next three years, outpacing the broader Chinese market. Despite this, profit margins have decreased from 36% to 19.4%, and Return on Equity is projected to be low at 7.1%. The company recently completed a buyback of shares worth CNY 46.61 million, indicating confidence in its future prospects.

- Navigate through the intricacies of Shanghai OPM Biosciences with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Shanghai OPM Biosciences' shares may be trading at a premium.

Science Environmental Protection (SHSE:688480)

Simply Wall St Growth Rating: ★★★★☆☆

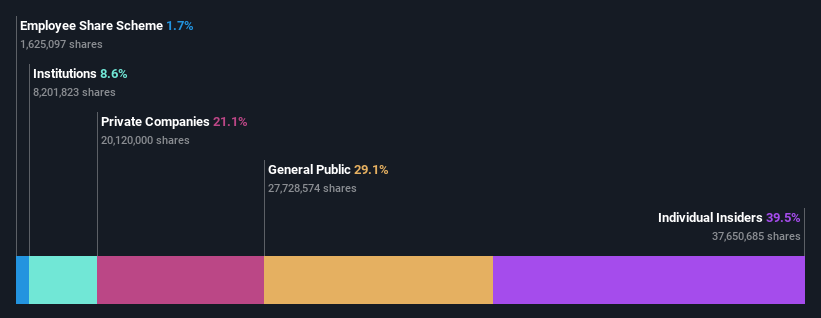

Overview: Science Environmental Protection Co., Ltd. (ticker: SHSE:688480) operates in the environmental protection industry with a market cap of CN¥2.40 billion.

Operations: Science Environmental Protection generates revenue primarily from its environmental protection operations.

Insider Ownership: 39.5%

Revenue Growth Forecast: 35.3% p.a.

Science Environmental Protection demonstrates strong growth potential with earnings forecasted to grow 20.6% annually over the next three years and revenue expected to increase by 35.3% per year, outpacing the broader Chinese market. The company trades at a favorable price-to-earnings ratio of 15.4x compared to the market's 28x, though its Return on Equity is projected to be lower at 18.4%. A Special Shareholders Meeting is scheduled for August 5, 2024, in Changsha, Hunan China.

- Click here to discover the nuances of Science Environmental Protection with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Science Environmental Protection is priced lower than what may be justified by its financials.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

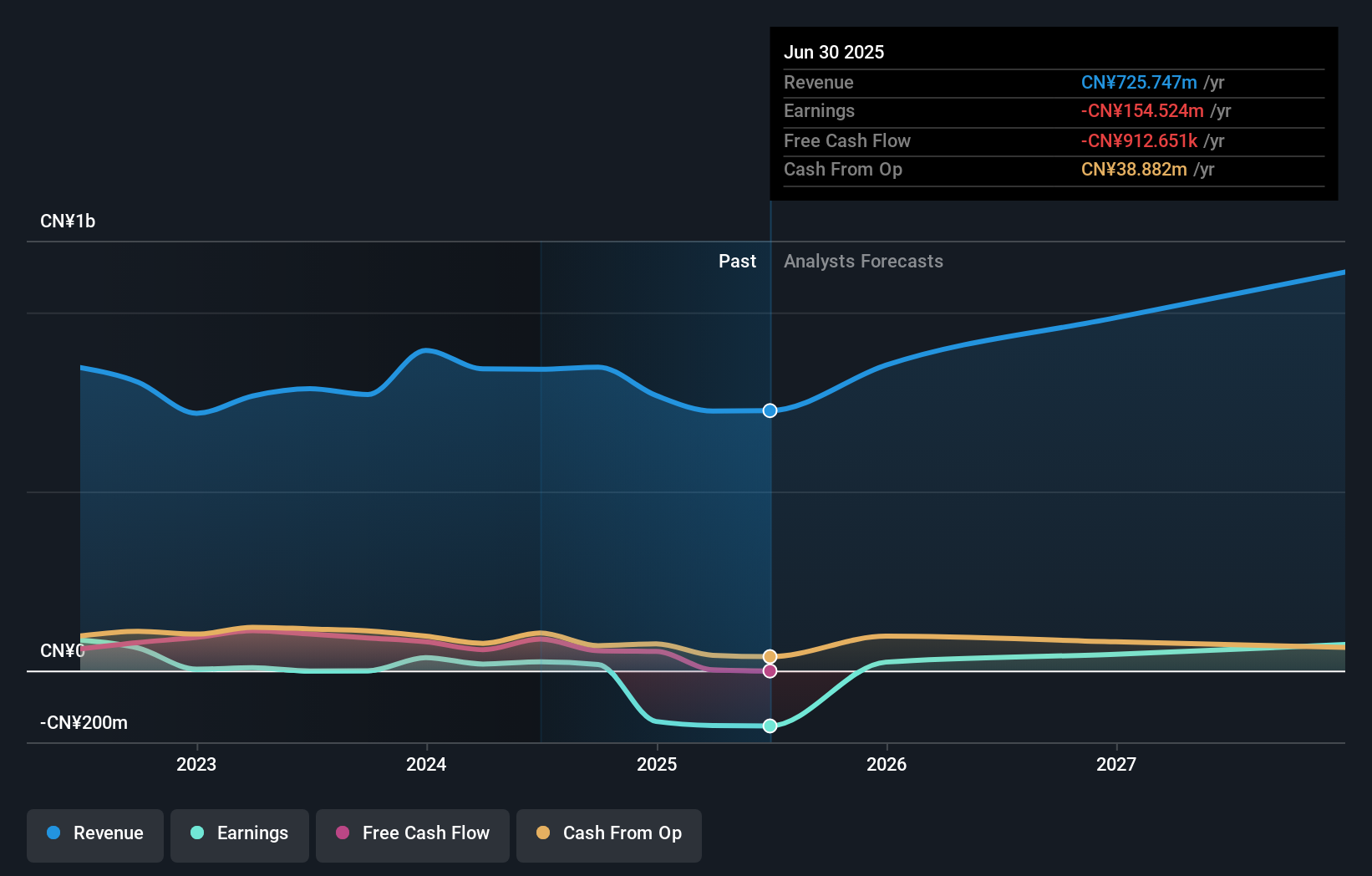

Overview: Beijing Beetech Inc. produces and sells smart sensors and optoelectronic instrument products, with a market cap of CN¥2.89 billion.

Operations: The company's revenue segments include smart sensors and optoelectronic instrument products.

Insider Ownership: 31%

Revenue Growth Forecast: 17.1% p.a.

Beijing Beetech's earnings are forecasted to grow significantly at 49% annually, outpacing the broader Chinese market. Despite a high growth rate, revenue is expected to increase at a slower pace of 17.1% per year. The company's Return on Equity is projected to be low at 7.1%. Recent events include a Special Shareholders Meeting on August 2, 2024, addressing independent director elections and capital increases, and an approved cash dividend of CNY 1 per ten shares for 2023.

- Take a closer look at Beijing Beetech's potential here in our earnings growth report.

- According our valuation report, there's an indication that Beijing Beetech's share price might be on the expensive side.

Where To Now?

- Discover the full array of 358 Fast Growing Chinese Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with high growth potential.