Top 3 Chinese Stocks That Might Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As Chinese equities show mixed performance amid weak manufacturing data, investors are increasingly looking for opportunities in stocks that may be trading below their estimated intrinsic value. In this environment, identifying undervalued stocks can be particularly advantageous, as these investments often have the potential to offer significant returns when market conditions improve.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥85.06 | CN¥163.42 | 47.9% |

| Shenzhen Hopewind Electric (SHSE:603063) | CN¥14.07 | CN¥26.90 | 47.7% |

| Skyworth Digital (SZSE:000810) | CN¥7.71 | CN¥15.03 | 48.7% |

| Guangzhou Tinci Materials Technology (SZSE:002709) | CN¥14.98 | CN¥28.97 | 48.3% |

| Gambol Pet Group (SZSE:301498) | CN¥42.30 | CN¥80.73 | 47.6% |

| Qingdao NovelBeam TechnologyLtd (SHSE:688677) | CN¥31.60 | CN¥62.92 | 49.8% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥8.06 | CN¥15.66 | 48.5% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥25.80 | CN¥50.09 | 48.5% |

| Shenzhen Sunline Tech (SZSE:300348) | CN¥7.29 | CN¥13.68 | 46.7% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥9.14 | CN¥17.79 | 48.6% |

Let's dive into some prime choices out of the screener.

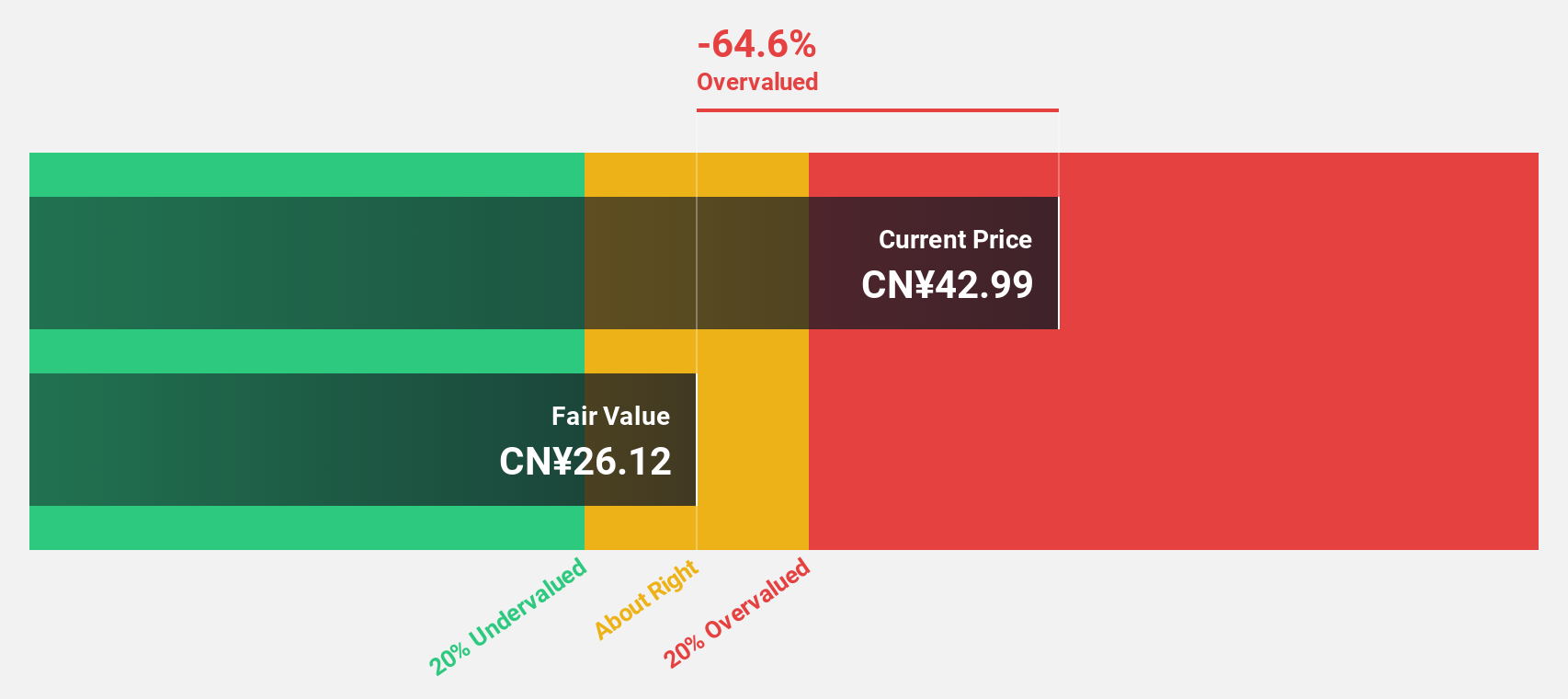

Haisco Pharmaceutical Group (SZSE:002653)

Overview: Haisco Pharmaceutical Group Co., Ltd. researches, develops, manufactures, and sells pharmaceuticals in China with a market cap of approximately CN¥30.80 billion.

Operations: Haisco Pharmaceutical Group generates revenue from research, development, manufacturing, and sales of pharmaceuticals in China.

Estimated Discount To Fair Value: 38.5%

Haisco Pharmaceutical Group is trading at CN¥27.91, significantly below its estimated fair value of CN¥45.36 based on discounted cash flow analysis. The company’s earnings are forecast to grow 36.87% annually over the next three years, outpacing the Chinese market average of 22.2%. Despite a low dividend yield of 0.72%, which isn't well covered by free cash flows, Haisco's revenue is expected to grow at 22.9% per year, indicating strong future cash flows and potential undervaluation.

- Our comprehensive growth report raises the possibility that Haisco Pharmaceutical Group is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Haisco Pharmaceutical Group's balance sheet health report.

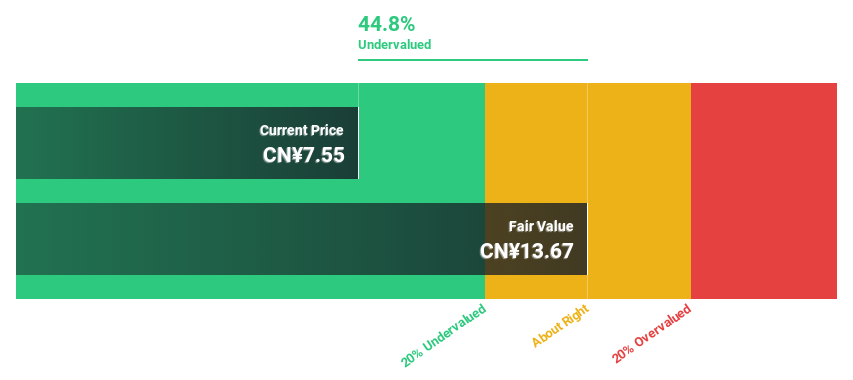

Songcheng Performance DevelopmentLtd (SZSE:300144)

Overview: Songcheng Performance Development Co., Ltd operates in the performing arts industry in China and has a market cap of CN¥21.12 billion.

Operations: The company generates revenue from its primary operations in the performing arts industry in China.

Estimated Discount To Fair Value: 48.5%

Songcheng Performance Development Ltd. is trading at CN¥8.06, significantly below its estimated fair value of CN¥15.66, indicating potential undervaluation based on discounted cash flow analysis. The company’s earnings are forecast to grow 47.8% annually over the next three years, outpacing the Chinese market average of 22.2%. Despite a recent dividend increase, profit margins have decreased from 8.4% to 3.6%, and its return on equity is expected to be low at 16.1%.

- The growth report we've compiled suggests that Songcheng Performance DevelopmentLtd's future prospects could be on the up.

- Click here to discover the nuances of Songcheng Performance DevelopmentLtd with our detailed financial health report.

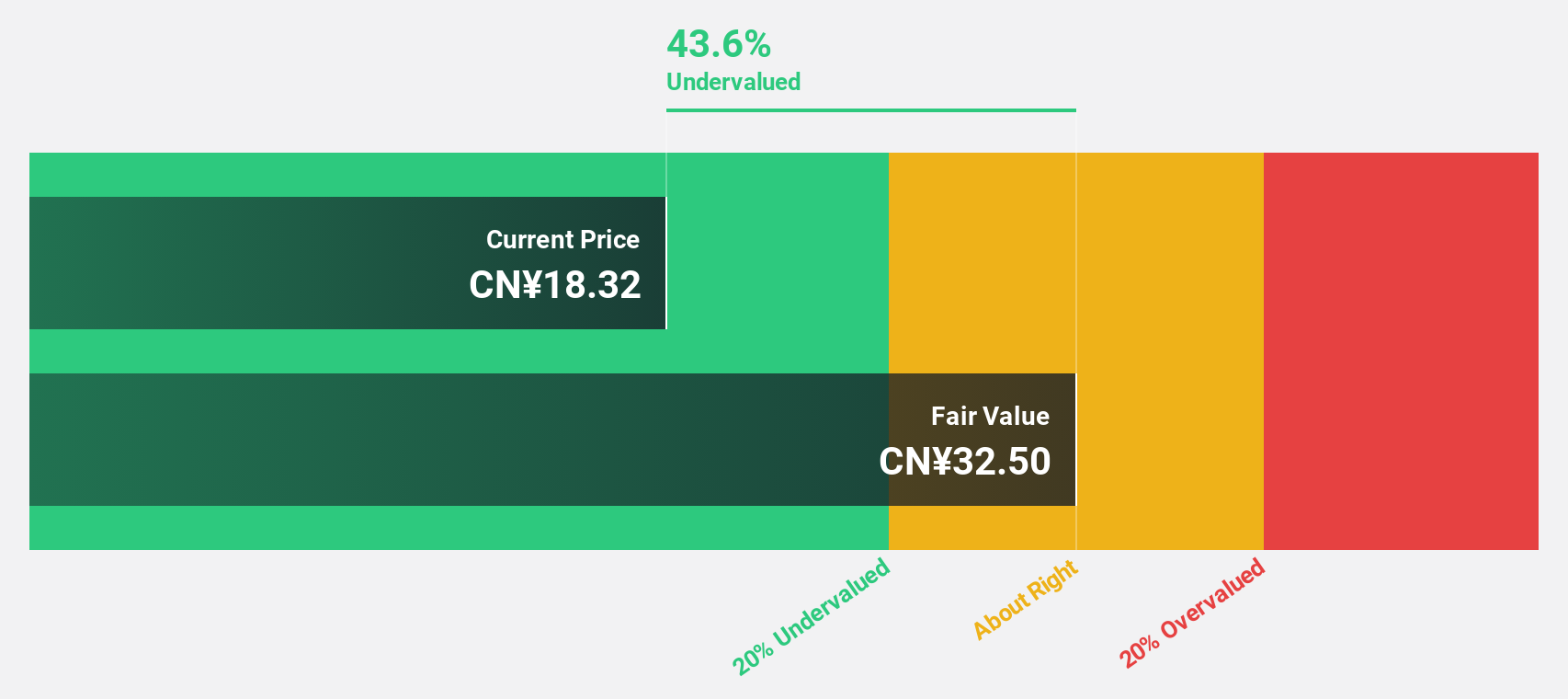

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Overview: Zhejiang Jolly Pharmaceutical Co., LTD specializes in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥10.25 billion.

Operations: The company generates revenue from the research, production, and marketing of Chinese medicinal products in China and internationally.

Estimated Discount To Fair Value: 25.5%

Zhejiang Jolly Pharmaceutical Ltd. is trading at CN¥14.59, below its estimated fair value of CN¥19.58, suggesting undervaluation based on discounted cash flow analysis. The company's earnings grew by 43.3% over the past year and are expected to grow 20.83% annually over the next three years, though slightly slower than the market average of 22.2%. Recent buyback announcements and strong half-year earnings underscore its robust financial health despite a dividend not fully covered by free cash flows.

- According our earnings growth report, there's an indication that Zhejiang Jolly PharmaceuticalLTD might be ready to expand.

- Unlock comprehensive insights into our analysis of Zhejiang Jolly PharmaceuticalLTD stock in this financial health report.

Next Steps

- Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 94 more companies for you to explore.Click here to unveil our expertly curated list of 97 Undervalued Chinese Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haisco Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002653

Haisco Pharmaceutical Group

Research, develops, manufactures, and sells pharmaceuticals in China.

Flawless balance sheet with high growth potential.