Top Growth Stocks With High Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by AI competition fears and fluctuating interest rates, investors are keenly observing the performance of major indices like the Nasdaq Composite and Dow Jones Industrial Average. Amidst these challenges, growth companies with high insider ownership often attract attention due to their potential for alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

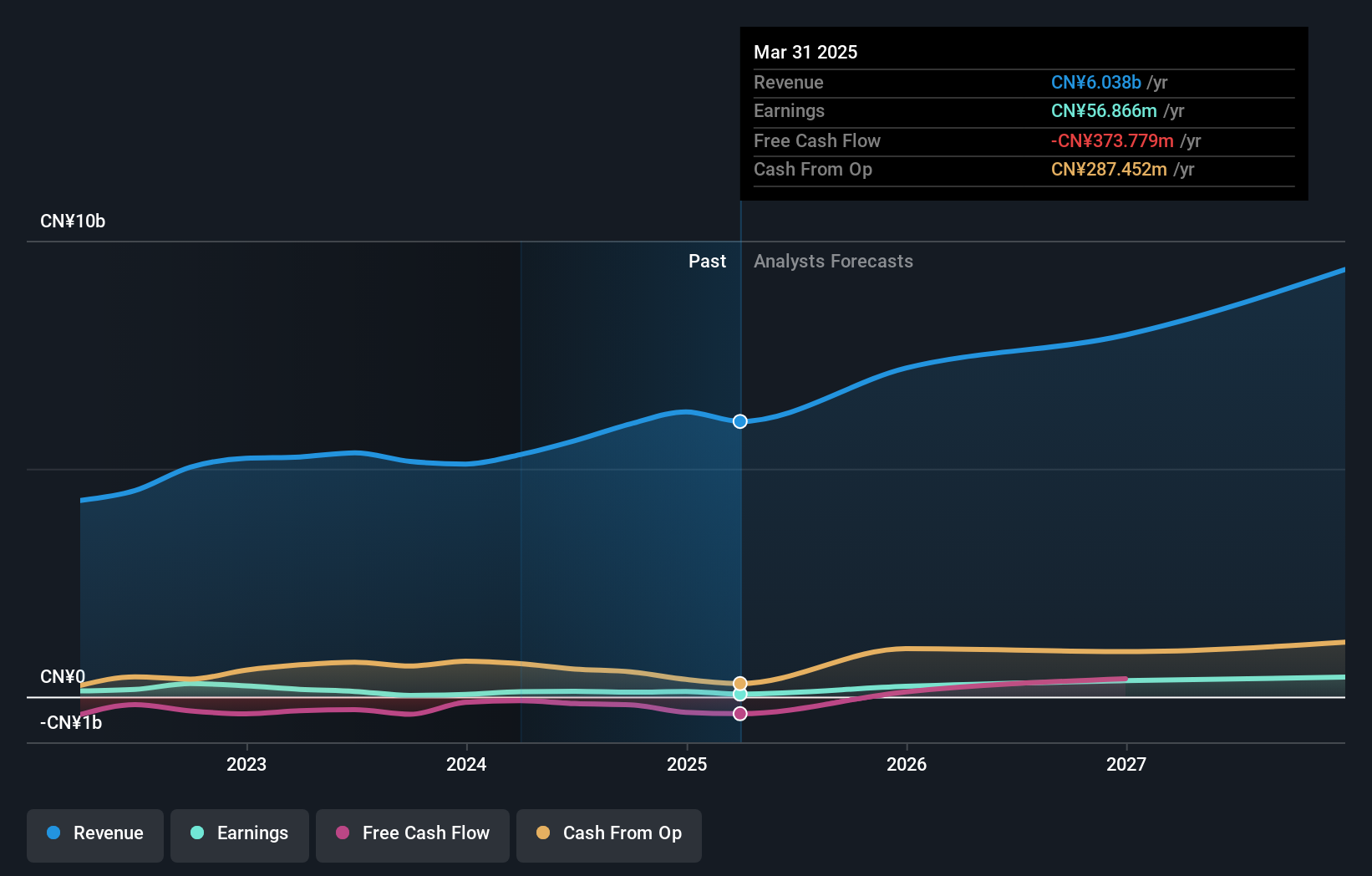

Wencan Group (SHSE:603348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wencan Group Co., Ltd. is involved in the research, development, production, and sale of automotive aluminum alloy precision die castings both in China and internationally, with a market cap of CN¥7.29 billion.

Operations: Wencan Group Co., Ltd. generates revenue through its focus on the research, development, production, and sale of precision die castings made from automotive aluminum alloy for both domestic and international markets.

Insider Ownership: 38.4%

Revenue Growth Forecast: 17.7% p.a.

Wencan Group's earnings are projected to grow significantly at 65.6% annually, outpacing the CN market's 25.1%. Despite a substantial past year's earnings increase of 242%, revenue growth is expected to be moderate at 17.7% per year, above the CN market average but below high-growth benchmarks. The stock trades significantly below fair value estimates, though shareholder dilution occurred in the past year and dividend coverage by free cash flow is weak.

- Unlock comprehensive insights into our analysis of Wencan Group stock in this growth report.

- Upon reviewing our latest valuation report, Wencan Group's share price might be too optimistic.

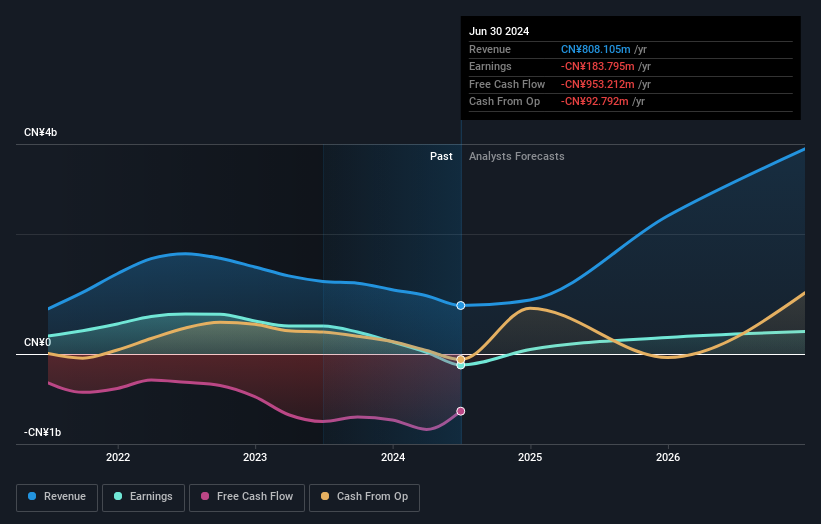

KBC Corporation (SHSE:688598)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KBC Corporation, Ltd. focuses on the research, development, production, and sale of carbon-based composite materials and products both in China and internationally with a market cap of CN¥4.05 billion.

Operations: KBC Corporation generates revenue from its activities in the research, development, production, and sale of carbon-based composite materials and products across domestic and international markets.

Insider Ownership: 15.3%

Revenue Growth Forecast: 63.2% p.a.

KBC Corporation is poised for significant growth, with revenue expected to increase by 63.2% annually, surpassing the CN market's average. Earnings are projected to grow at 82.63% per year, with profitability anticipated within three years—an above-average market growth rate. Analysts agree on a potential stock price rise of 26.8%. However, the forecasted return on equity remains low at 5%, and no substantial insider trading activity has been reported recently.

- Click here to discover the nuances of KBC Corporation with our detailed analytical future growth report.

- The analysis detailed in our KBC Corporation valuation report hints at an inflated share price compared to its estimated value.

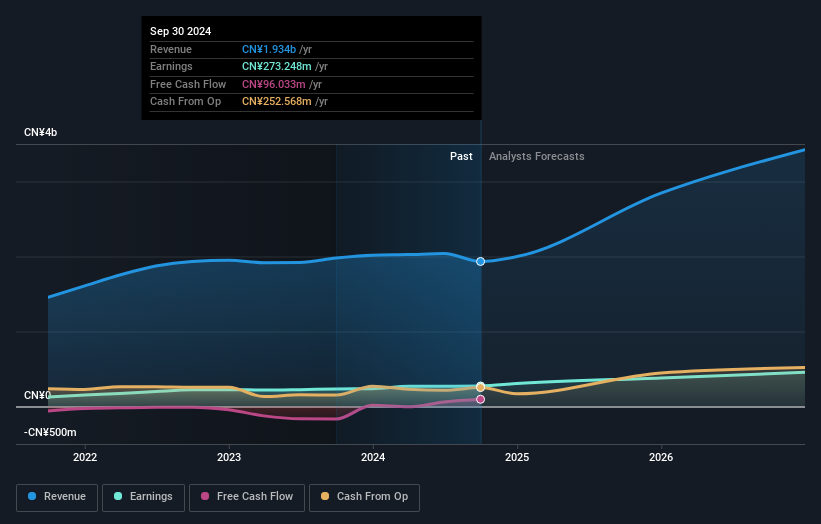

Fujian Yuanli Active CarbonLtd (SZSE:300174)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Yuanli Active Carbon Co., Ltd. manufactures and sells activated carbon in China, with a market cap of CN¥5.48 billion.

Operations: The company's revenue segments include the production and sale of activated carbon in China.

Insider Ownership: 22.8%

Revenue Growth Forecast: 27.1% p.a.

Fujian Yuanli Active Carbon Ltd. shows promising growth prospects, with earnings expected to increase by 22.46% annually over the next three years, though slightly below the broader CN market's growth rate of 25.1%. Revenue is forecasted to grow at a robust 27.1% per year, outpacing the market average of 13.5%. Despite these positive indicators, its return on equity is projected to remain modest at 10.9%, and dividend sustainability appears unstable.

- Delve into the full analysis future growth report here for a deeper understanding of Fujian Yuanli Active CarbonLtd.

- Our valuation report here indicates Fujian Yuanli Active CarbonLtd may be overvalued.

Make It Happen

- Access the full spectrum of 1479 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if KBC Corporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688598

KBC Corporation

Engages in the research and development, production, and sale of carbon-based composite materials and products in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives