Crown Advanced Material Co.,Ltd.'s (SHSE:688560) Shares Climb 25% But Its Business Is Yet to Catch Up

Crown Advanced Material Co.,Ltd. (SHSE:688560) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

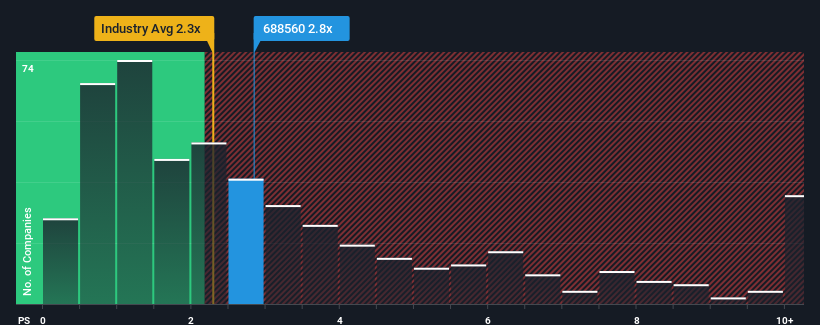

After such a large jump in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Crown Advanced MaterialLtd as a stock to potentially avoid with its 2.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Crown Advanced MaterialLtd

How Crown Advanced MaterialLtd Has Been Performing

As an illustration, revenue has deteriorated at Crown Advanced MaterialLtd over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Crown Advanced MaterialLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Crown Advanced MaterialLtd?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Crown Advanced MaterialLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 36%. As a result, revenue from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Crown Advanced MaterialLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Crown Advanced MaterialLtd's P/S Mean For Investors?

Crown Advanced MaterialLtd's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Crown Advanced MaterialLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

You should always think about risks. Case in point, we've spotted 1 warning sign for Crown Advanced MaterialLtd you should be aware of.

If you're unsure about the strength of Crown Advanced MaterialLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688560

Crown Advanced MaterialLtd

Engages in the research and development, production, and sale of composite membrane materials in the field of new energy in China and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.