Revenues Not Telling The Story For GrandiT Co., Ltd. (SHSE:688549) After Shares Rise 45%

GrandiT Co., Ltd. (SHSE:688549) shares have continued their recent momentum with a 45% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

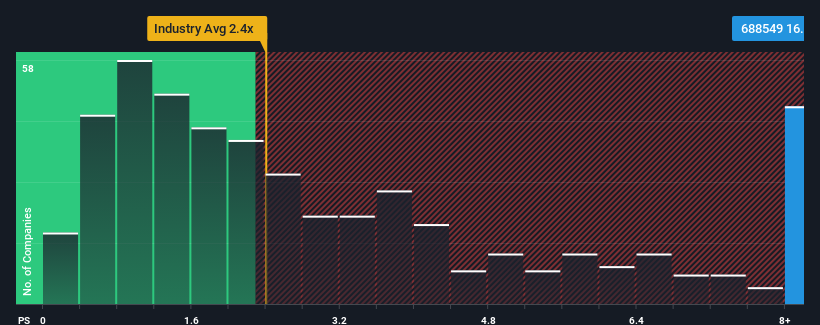

After such a large jump in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider GrandiT as a stock to avoid entirely with its 16.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GrandiT

What Does GrandiT's Recent Performance Look Like?

The revenue growth achieved at GrandiT over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GrandiT will help you shine a light on its historical performance.How Is GrandiT's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as GrandiT's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has also seen an excellent 76% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that GrandiT's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

GrandiT's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that GrandiT currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for GrandiT you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688549

GrandiT

Researches and develops, produces, and markets electronic chemical materials for the semiconductor industry in China and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026