- China

- /

- Metals and Mining

- /

- SHSE:688456

Undiscovered Gems Three Top Small Caps With Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and consumer spending concerns, major U.S. stock indexes experienced declines, reflecting broader market uncertainties. Despite these challenges, small-cap stocks present intriguing opportunities for investors seeking growth potential in under-the-radar companies that may benefit from shifting economic landscapes and evolving market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Top Union Electronics | 1.25% | 6.67% | 17.52% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Firich Enterprises | 34.24% | -2.31% | 25.41% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

GRIPM Advanced Materials (SHSE:688456)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GRIPM Advanced Materials Co., Ltd. is involved in the design, R&D, production, and sales of advanced non-ferrous metal powder materials both in China and globally, with a market cap of CN¥3.74 billion.

Operations: GRIPM Advanced Materials generates revenue primarily through the sale of advanced non-ferrous metal powder materials. The company has shown variability in its net profit margin, reflecting changes in cost management and pricing strategies.

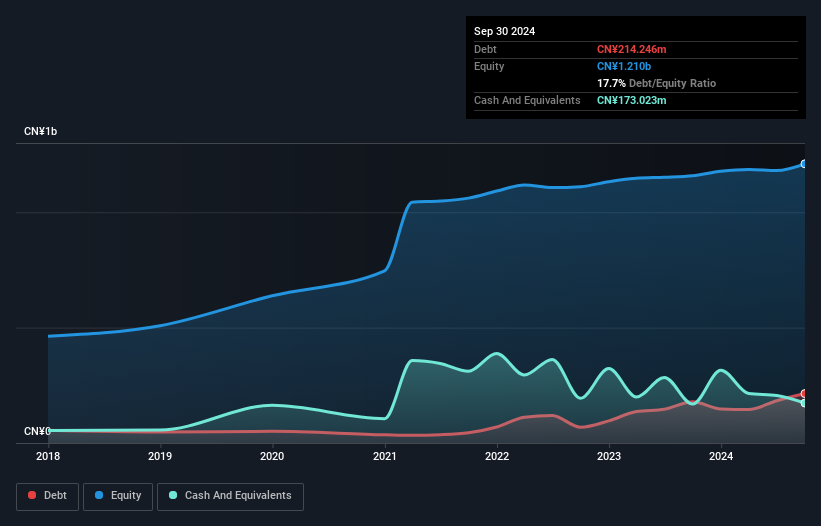

In the niche arena of advanced materials, GRIPM Advanced Materials stands out with its recent financial performance. The company reported a sales increase to CNY 3.23 billion from CNY 2.68 billion, alongside a net income rise to CNY 58.59 million from CNY 55.12 million last year, showcasing solid growth in earnings per share at CNY 0.57 from CNY 0.53 previously. While its debt-to-equity ratio has climbed to 17.7% over five years, the net debt-to-equity remains satisfactory at 3.4%. Despite not being free cash flow positive, GRIPM's high-quality earnings and robust interest coverage (13x EBIT) signal resilience and potential for future expansion in an industry lagging behind its pace of growth (6% vs -1%).

- Navigate through the intricacies of GRIPM Advanced Materials with our comprehensive health report here.

Gain insights into GRIPM Advanced Materials' past trends and performance with our Past report.

Jiujiang Shanshui TechnologyLtd (SZSE:301190)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiujiang Shanshui Technology Co., Ltd. is involved in the research, development, production, and sale of dye intermediates, pesticides, and pharmaceutical intermediates in China with a market capitalization of approximately CN¥3.31 billion.

Operations: The company generates revenue primarily from its specialty chemicals segment, which reported CN¥504.55 million.

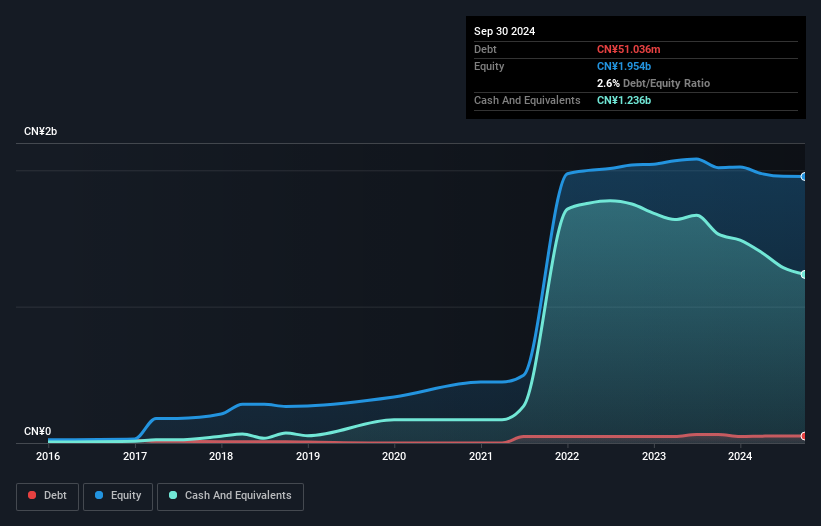

Jiujiang Shanshui Technology, a nimble player in its industry, has shown impressive earnings growth of 543% over the past year, outpacing the broader Chemicals sector's -5.4%. Despite this surge, its earnings have decreased by 27.9% annually over five years. The company's debt-to-equity ratio rose from 0.6% to 2.6%, yet it holds more cash than total debt, easing financial concerns. Recently, the company repurchased shares worth CNY 27 million under a buyback program initiated in July 2024, reflecting confidence in its valuation and future prospects amidst ongoing strategic adjustments discussed at their December shareholders meeting.

Zhonghang Shangda SuperalloysLtd (SZSE:301522)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhonghang Shangda Superalloys Co., Ltd. specializes in the research, development, production, and sale of high-temperature and high-performance alloys as well as ultra-high purity stainless steel in China, with a market cap of CN¥13.36 billion.

Operations: Zhonghang Shangda generates revenue primarily from the sale of high-temperature and high-performance alloys, along with ultra-high purity stainless steel. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency.

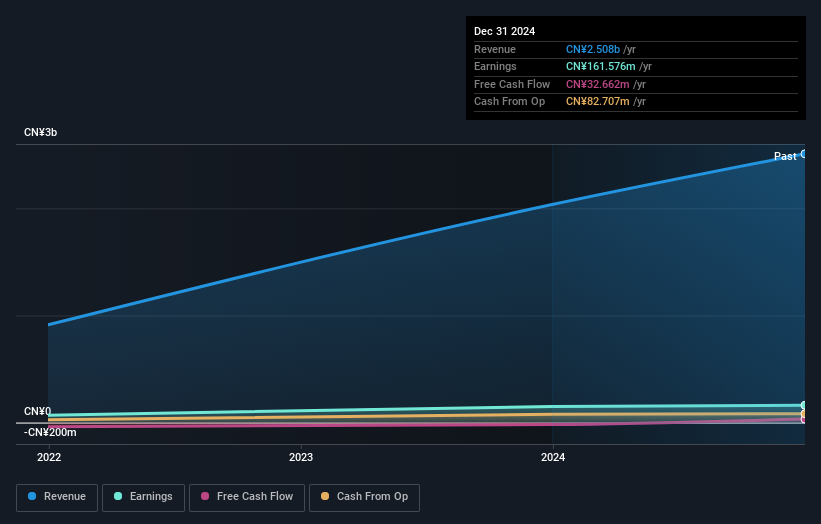

Zhonghang Shangda Superalloys seems to be making waves with its recent performance. Sales jumped to CNY 2.51 billion from CNY 2.03 billion, while net income rose to CNY 161.58 million from CNY 150.81 million, highlighting robust growth in the past year. The company’s debt-to-equity ratio improved significantly over five years, dropping from 42% to about 30%. With high-quality earnings and free cash flow turning positive at CNY 32.66 million, it appears well-positioned within the metals and mining sector despite industry challenges, showcasing potential for future value appreciation in this niche market segment.

- Click here to discover the nuances of Zhonghang Shangda SuperalloysLtd with our detailed analytical health report.

Understand Zhonghang Shangda SuperalloysLtd's track record by examining our Past report.

Seize The Opportunity

- Reveal the 4752 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688456

GRIPM Advanced Materials

Engages in the design, research and development, production, and sales of advanced non-ferrous metal powder materials in China and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives