Is Guangzhou Sanfu New Materials TechnologyLtd (SHSE:688359) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Guangzhou Sanfu New Materials Technology Co.,Ltd (SHSE:688359) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Guangzhou Sanfu New Materials TechnologyLtd

What Is Guangzhou Sanfu New Materials TechnologyLtd's Net Debt?

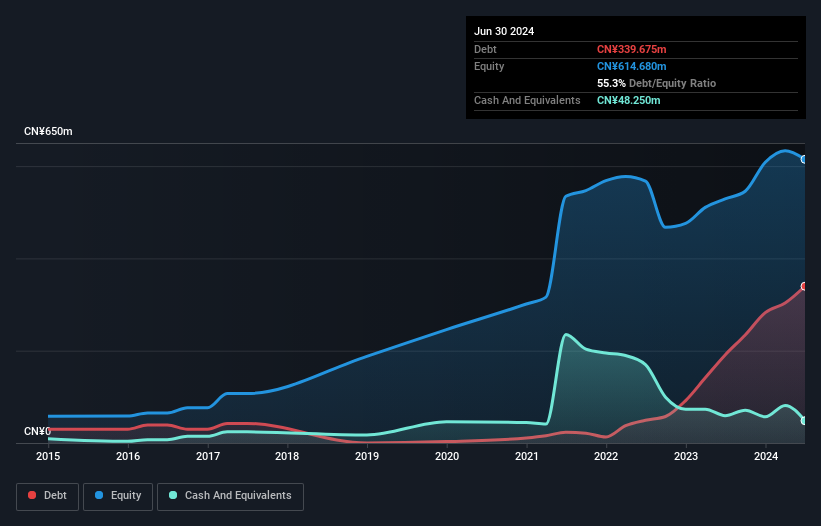

As you can see below, at the end of June 2024, Guangzhou Sanfu New Materials TechnologyLtd had CN¥339.7m of debt, up from CN¥190.8m a year ago. Click the image for more detail. However, it also had CN¥48.3m in cash, and so its net debt is CN¥291.4m.

How Healthy Is Guangzhou Sanfu New Materials TechnologyLtd's Balance Sheet?

According to the last reported balance sheet, Guangzhou Sanfu New Materials TechnologyLtd had liabilities of CN¥470.0m due within 12 months, and liabilities of CN¥139.1m due beyond 12 months. On the other hand, it had cash of CN¥48.3m and CN¥415.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥145.5m.

Of course, Guangzhou Sanfu New Materials TechnologyLtd has a market capitalization of CN¥3.81b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. There's no doubt that we learn most about debt from the balance sheet. But it is Guangzhou Sanfu New Materials TechnologyLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Guangzhou Sanfu New Materials TechnologyLtd wasn't profitable at an EBIT level, but managed to grow its revenue by 47%, to CN¥580m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Guangzhou Sanfu New Materials TechnologyLtd managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost CN¥21m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through CN¥97m of cash over the last year. So to be blunt we think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Guangzhou Sanfu New Materials TechnologyLtd that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688359

Guangzhou Sanfu New Materials TechnologyLtd

Engages in the research and development, production, and sale of new environmentally friendly surface engineering special chemicals in China.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026