- China

- /

- Metals and Mining

- /

- SHSE:688355

Revenues Tell The Story For Suzhou Mingzhi Technology Co., Ltd. (SHSE:688355) As Its Stock Soars 28%

Suzhou Mingzhi Technology Co., Ltd. (SHSE:688355) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 54% share price decline over the last year.

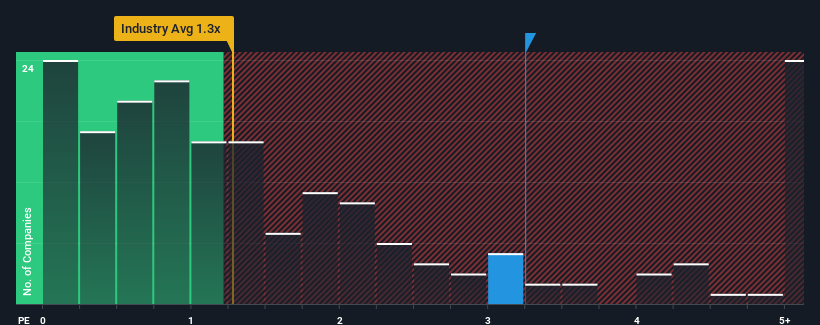

After such a large jump in price, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Suzhou Mingzhi Technology as a stock probably not worth researching with its 3.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Suzhou Mingzhi Technology

What Does Suzhou Mingzhi Technology's P/S Mean For Shareholders?

Suzhou Mingzhi Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Suzhou Mingzhi Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Suzhou Mingzhi Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 86% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Suzhou Mingzhi Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Suzhou Mingzhi Technology's P/S Mean For Investors?

Suzhou Mingzhi Technology's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Suzhou Mingzhi Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Suzhou Mingzhi Technology (1 makes us a bit uncomfortable) you should be aware of.

If these risks are making you reconsider your opinion on Suzhou Mingzhi Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688355

Suzhou Mingzhi Technology

Engages in the research and development, manufacture, and sale of casting equipment in the People’s Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives