Market Participants Recognise Rayitek Hi-Tech Film Company Ltd., Shenzhen's (SHSE:688323) Revenues Pushing Shares 44% Higher

Despite an already strong run, Rayitek Hi-Tech Film Company Ltd., Shenzhen (SHSE:688323) shares have been powering on, with a gain of 44% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

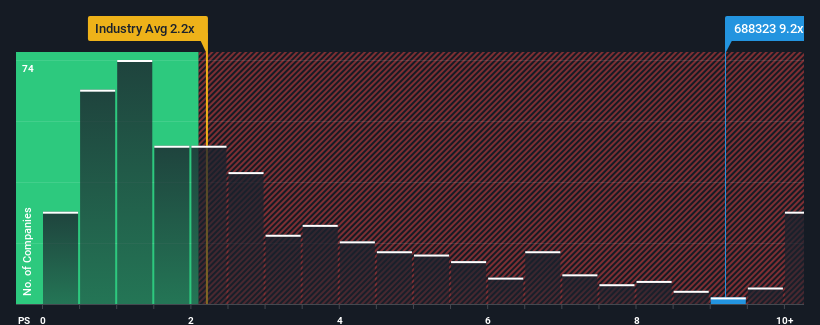

Since its price has surged higher, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Rayitek Hi-Tech Film Company Shenzhen as a stock to avoid entirely with its 9.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Rayitek Hi-Tech Film Company Shenzhen

What Does Rayitek Hi-Tech Film Company Shenzhen's P/S Mean For Shareholders?

Rayitek Hi-Tech Film Company Shenzhen certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rayitek Hi-Tech Film Company Shenzhen.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Rayitek Hi-Tech Film Company Shenzhen would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 9.3% gain to the company's revenues. Still, lamentably revenue has fallen 27% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 90% as estimated by the two analysts watching the company. With the industry only predicted to deliver 21%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Rayitek Hi-Tech Film Company Shenzhen's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Rayitek Hi-Tech Film Company Shenzhen's P/S Mean For Investors?

Rayitek Hi-Tech Film Company Shenzhen's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Rayitek Hi-Tech Film Company Shenzhen's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Rayitek Hi-Tech Film Company Shenzhen that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688323

Rayitek Hi-Tech Film Company Shenzhen

Engages in the research and development, manufacture, service, and sale of PI films in China.

High growth potential with minimal risk.

Market Insights

Community Narratives