- China

- /

- Metals and Mining

- /

- SHSE:688186

Earnings Tell The Story For Zhangjiagang Guangda Special Material Co., Ltd. (SHSE:688186) As Its Stock Soars 37%

Zhangjiagang Guangda Special Material Co., Ltd. (SHSE:688186) shareholders have had their patience rewarded with a 37% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

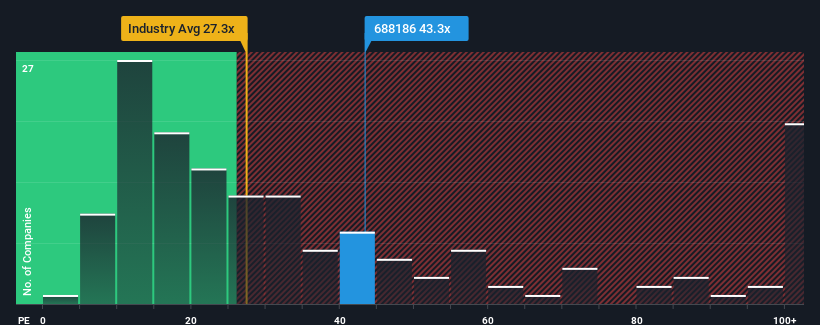

Since its price has surged higher, Zhangjiagang Guangda Special Material may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 43.3x, since almost half of all companies in China have P/E ratios under 33x and even P/E's lower than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Zhangjiagang Guangda Special Material has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Zhangjiagang Guangda Special Material

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Zhangjiagang Guangda Special Material would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 49%. The last three years don't look nice either as the company has shrunk EPS by 78% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 639% over the next year. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Zhangjiagang Guangda Special Material's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Zhangjiagang Guangda Special Material shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zhangjiagang Guangda Special Material maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Zhangjiagang Guangda Special Material has 4 warning signs (and 2 which are significant) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhangjiagang Guangda Special Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688186

Zhangjiagang Guangda Special Material

Zhangjiagang Guangda Special Material Co., Ltd.

Undervalued with proven track record.

Market Insights

Community Narratives