- Japan

- /

- Healthcare Services

- /

- TSE:9729

Discovering Undiscovered Gems on None in December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape characterized by rate cuts from the ECB and SNB, while U.S. indices show mixed performance with small-cap stocks underperforming against their large-cap counterparts. With inflation pressures persisting and expectations rising for a Federal Reserve rate cut, investors are keenly observing how these economic conditions might impact smaller companies. In such an environment, discovering stocks that exhibit resilience and potential for growth becomes essential. Identifying companies with strong fundamentals and innovative strategies can offer promising opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Donglai Coating Technology(Shanghai)Co.Ltd (SHSE:688129)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Donglai Coating Technology (Shanghai) Co., Ltd. specializes in the development and production of coating materials, with a market capitalization of approximately CN¥2.03 billion.

Operations: Donglai Coating Technology's primary revenue stream is from its coating segment, generating CN¥598.33 million. The company has a market capitalization of approximately CN¥2.03 billion.

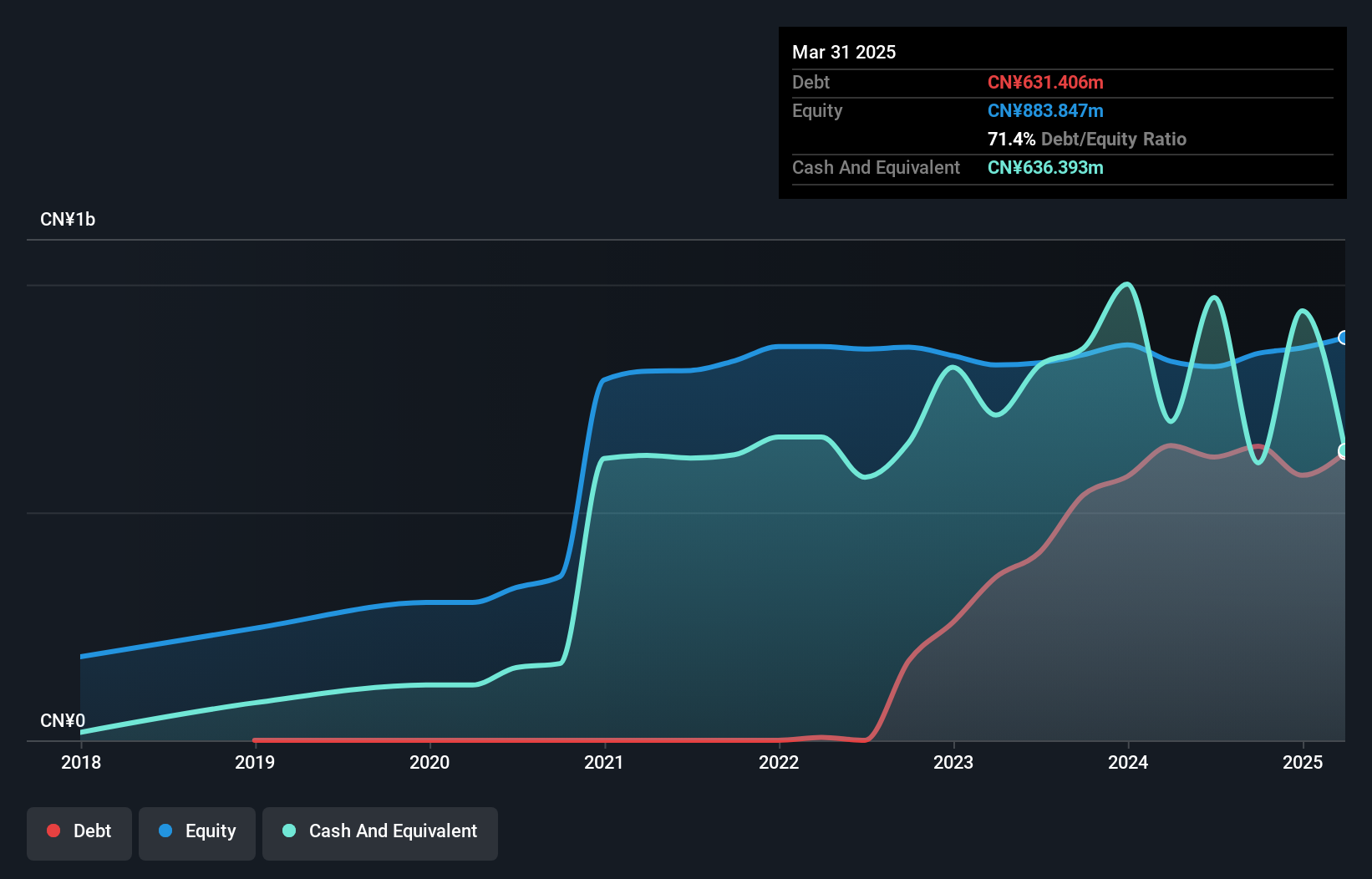

Donglai Coating Technology has shown impressive earnings growth, with a 207.6% increase over the past year, outpacing the Chemicals industry's -4.7%. The company's net income for the nine months ended September 2024 was ¥65.04 million, up from ¥28.58 million a year prior, reflecting strong operational performance despite an 11% annual decline in earnings over five years. A satisfactory net debt to equity ratio of 4.3% suggests prudent financial management, while a price-to-earnings ratio of 23x indicates potential value compared to the broader market's 36.3x average. One-off gains of ¥26.2 million have also influenced recent results significantly.

- Delve into the full analysis health report here for a deeper understanding of Donglai Coating Technology(Shanghai)Co.Ltd.

Understand Donglai Coating Technology(Shanghai)Co.Ltd's track record by examining our Past report.

Sporton International (TPEX:6146)

Simply Wall St Value Rating: ★★★★★★

Overview: Sporton International Inc. is a company that specializes in product testing and certification services both in Taiwan and globally, with a market cap of NT$21.19 billion.

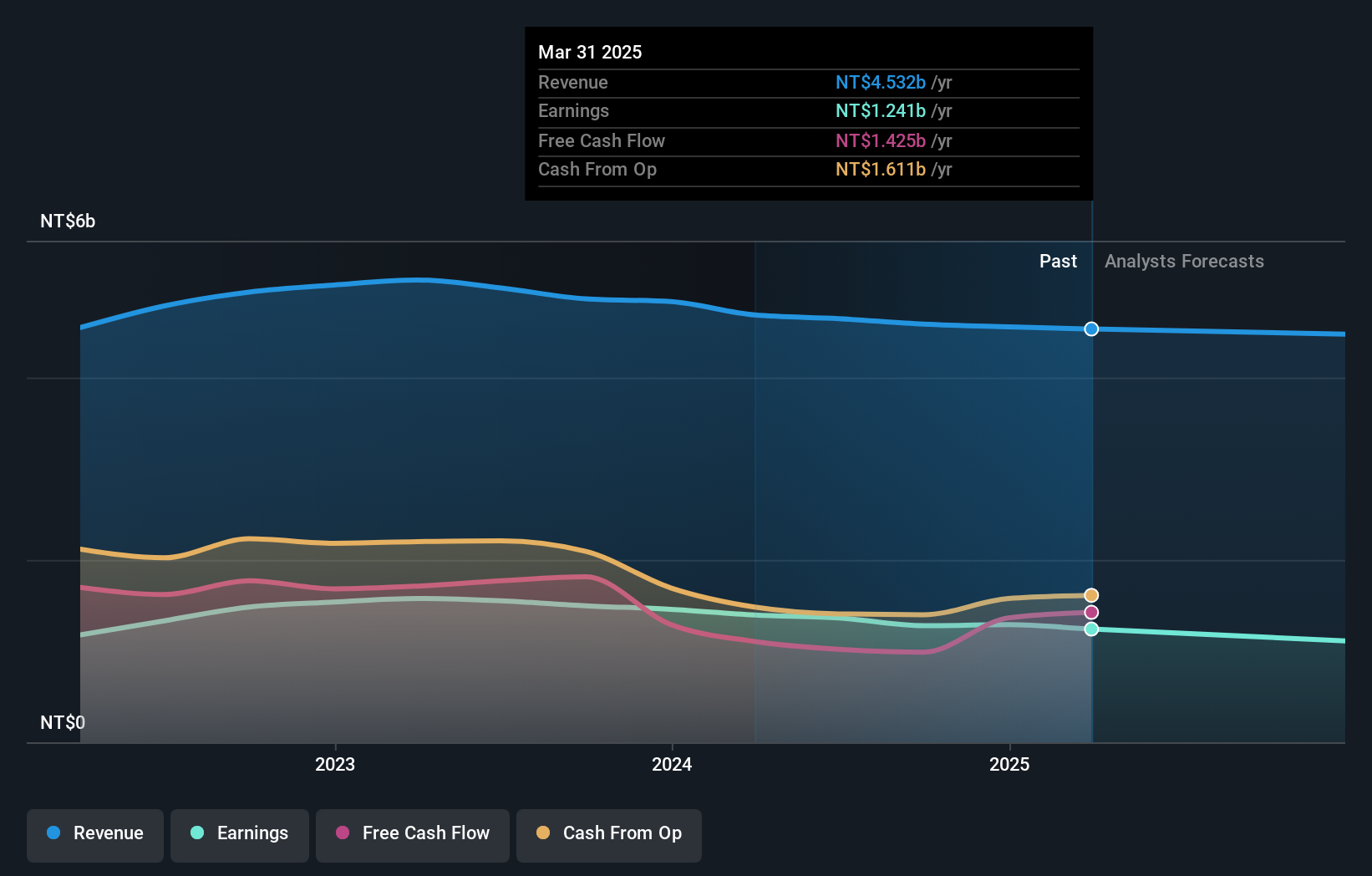

Operations: Sporton International generates revenue primarily from testing certification and verification services, contributing NT$4.15 billion, while the Parts Division adds NT$438.77 million. The company's net profit margin is a key financial indicator to consider when evaluating its profitability.

Sporton International, a smaller player in its field, showcases a mixed financial picture. Despite no debt over the past five years and maintaining high-quality earnings, recent performance indicates challenges. The company reported TWD 118.52 million in Q3 sales, up from TWD 89.1 million last year; however, revenue slipped to TWD 1,134.78 million from TWD 1,195.72 million previously. Net income also saw a drop to TWD 316.14 million compared to last year's TWD 401.63 million with basic earnings per share at TWD 3.1 down from TWD 3.94 last year indicating some hurdles ahead despite an attractive price-to-earnings ratio of 16x against the TW market's average of about 21x.

- Click here and access our complete health analysis report to understand the dynamics of Sporton International.

Assess Sporton International's past performance with our detailed historical performance reports.

TOKAI (TSE:9729)

Simply Wall St Value Rating: ★★★★★★

Overview: TOKAI Corp. operates in Japan, offering a range of healthy life services, with a market capitalization of approximately ¥80.49 billion.

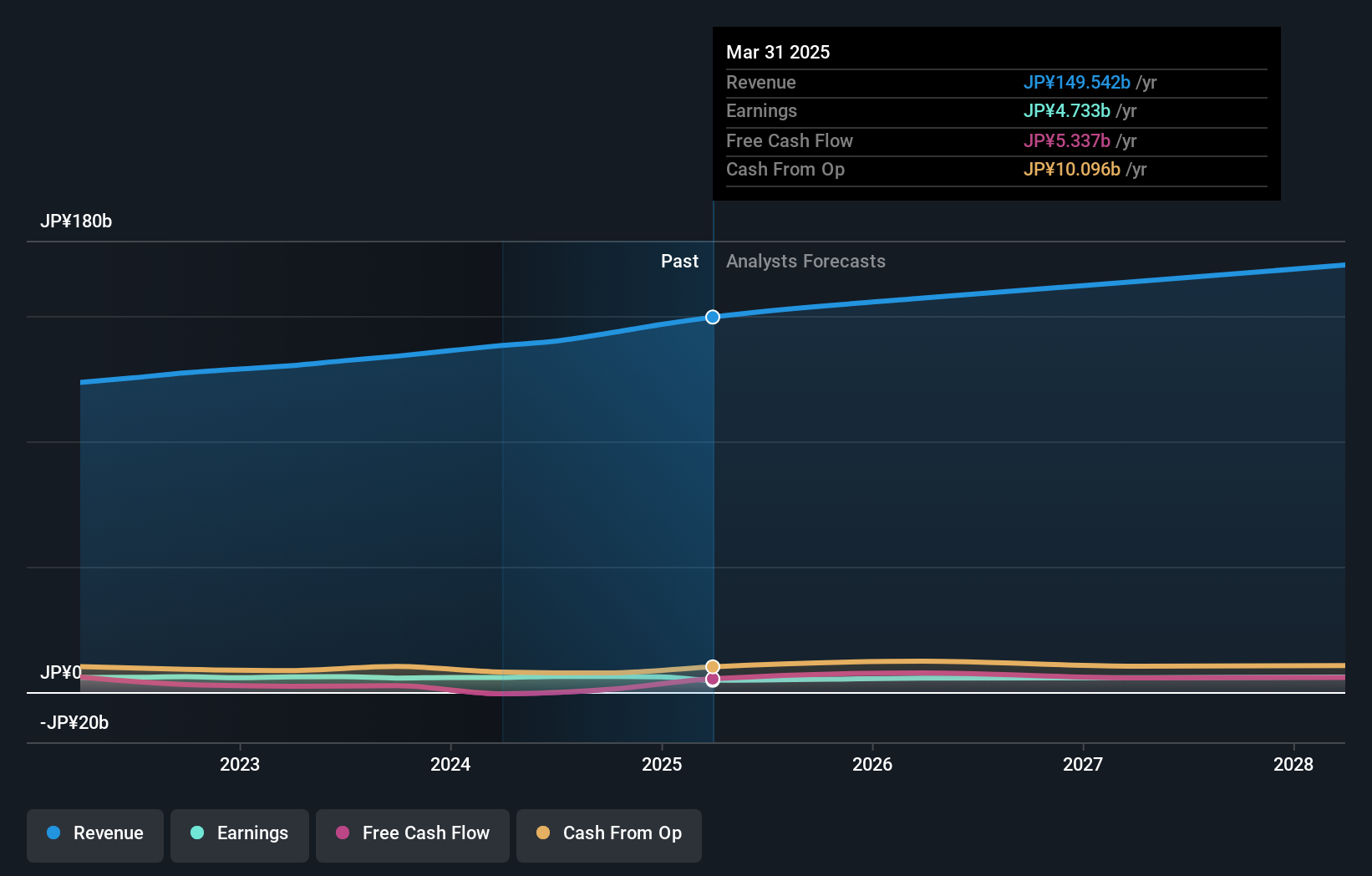

Operations: TOKAI Corp. generates revenue primarily from Healthy Life Services, which contributes ¥73.99 billion, and Pharmaceutical Services, adding ¥54.70 billion. Environmental Services provide an additional ¥14.74 billion in revenue.

TOKAI, a smaller player in the market, has been making strides with an 11% earnings growth over the past year, outpacing its industry peers. The company is trading at a good value, sitting 46.6% below its estimated fair value. Recently, TOKAI announced an increase in dividends to JPY 29 per share for Q2 of fiscal year ending March 2025, up from JPY 25 last year. With a debt-to-equity ratio decreasing from 4.3 to 1.7 over five years and more cash than total debt, TOKAI seems well-positioned financially while maintaining high-quality earnings coverage for interest payments.

- Unlock comprehensive insights into our analysis of TOKAI stock in this health report.

Evaluate TOKAI's historical performance by accessing our past performance report.

Make It Happen

- Gain an insight into the universe of 4615 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOKAI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9729

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives