- Hong Kong

- /

- Tech Hardware

- /

- SEHK:2889

3 Asian Growth Companies With High Insider Ownership Expecting Up To 109% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and economic uncertainties, Asia's growth potential remains a focal point for investors. In this environment, companies with high insider ownership often signal strong management confidence and alignment with shareholder interests, making them particularly attractive amidst fluctuating valuations and market shifts.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| PharmaResearch (KOSDAQ:A214450) | 34.9% | 31.1% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Here's a peek at a few of the choices from the screener.

PATEO CONNECT Technology (Shanghai) (SEHK:2889)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PATEO CONNECT Technology (Shanghai) Corporation specializes in developing smart cockpit solutions and vehicle connectivity support services for OEMs and Tier-1 suppliers in China and Hong Kong, with a market cap of HK$26.17 billion.

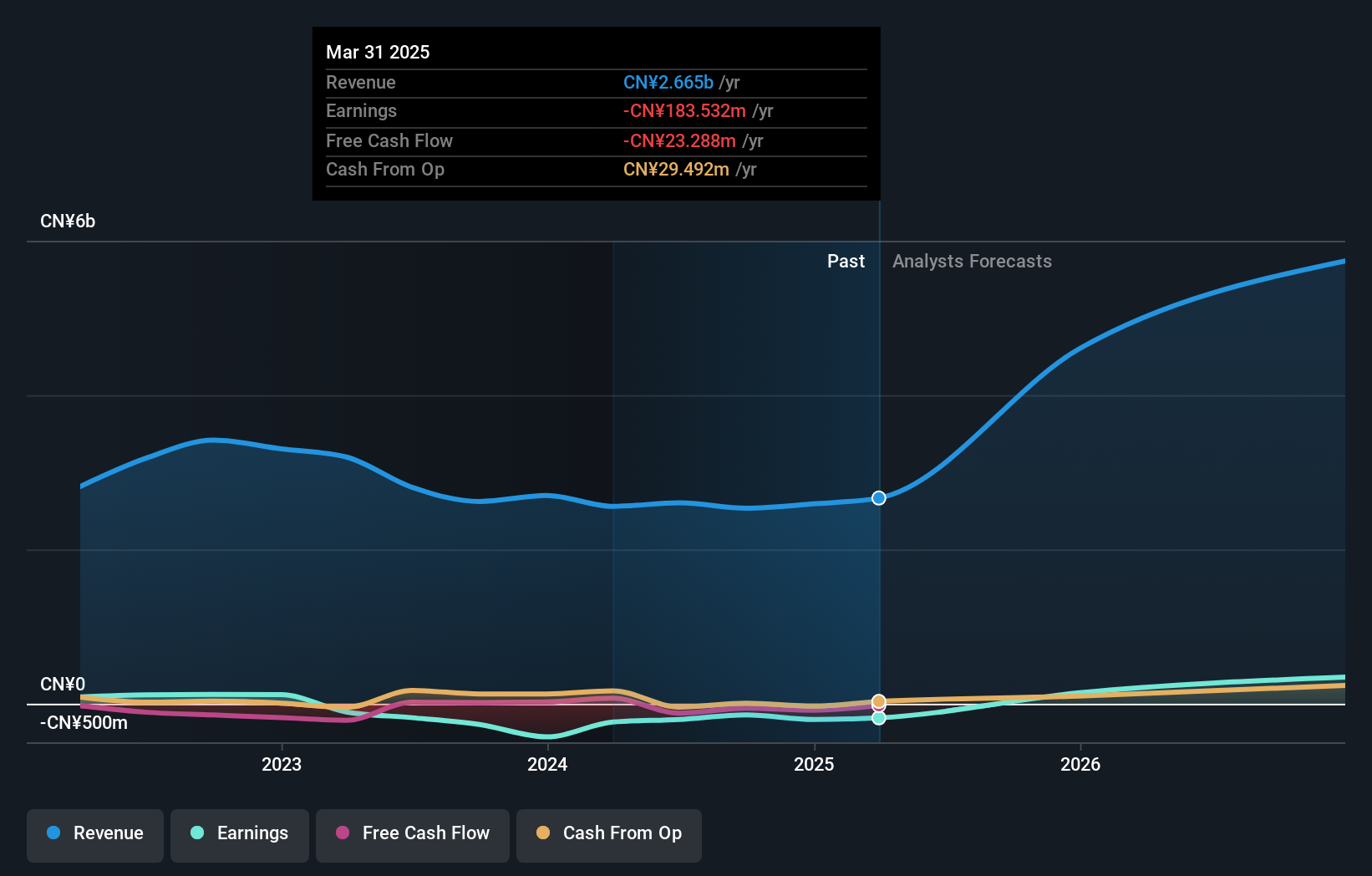

Operations: The company's revenue primarily comes from smart cockpit solutions, generating CN¥2.66 billion, and vehicle connectivity support services, contributing CN¥122.39 million.

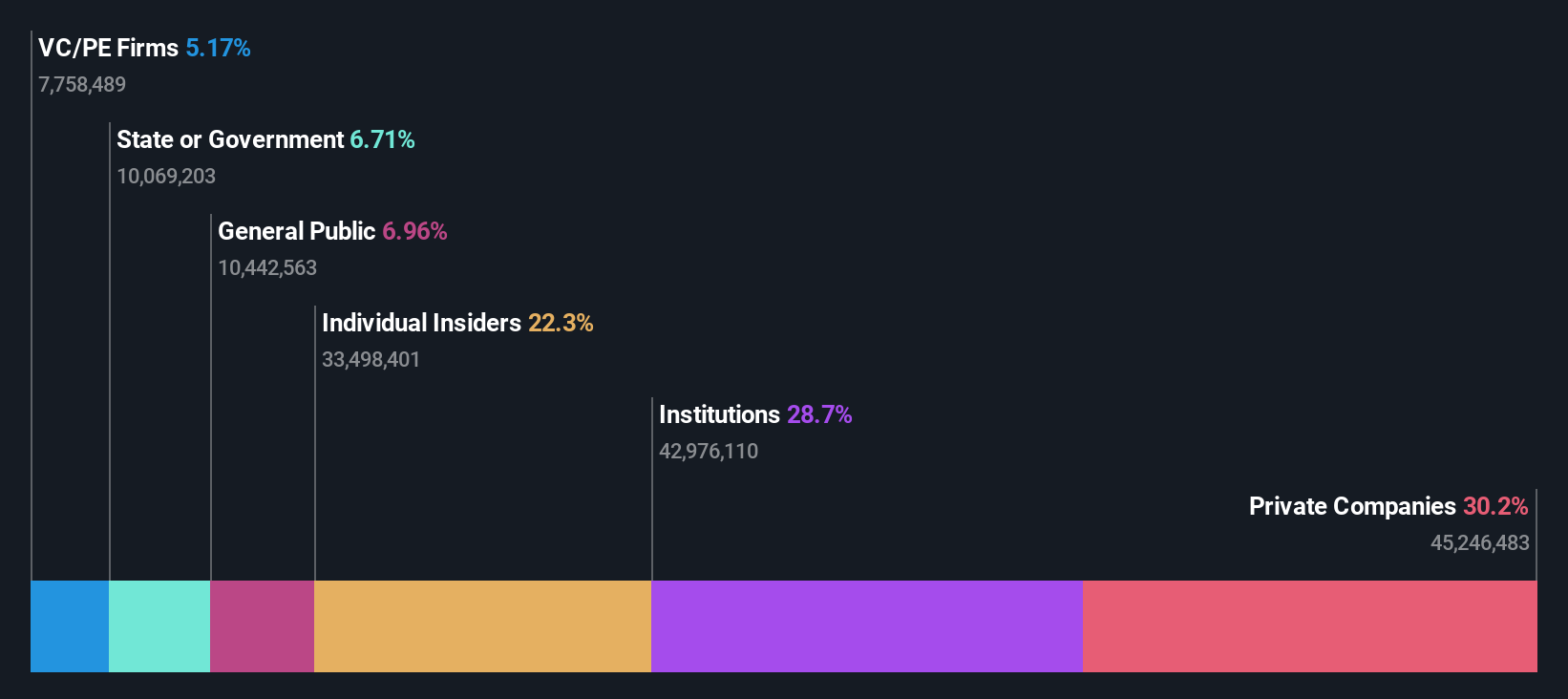

Insider Ownership: 22.3%

Earnings Growth Forecast: 109.6% p.a.

PATEO CONNECT Technology (Shanghai) is experiencing rapid growth, with revenue forecasted to increase by 36.4% annually, surpassing the Hong Kong market's average growth rate. Despite a volatile share price recently, the company completed an IPO raising HKD 1.07 billion, indicating strong investor interest. While still reporting net losses, PATEO is expected to become profitable within three years and achieve significant earnings growth of over 100% annually during this period.

- Click to explore a detailed breakdown of our findings in PATEO CONNECT Technology (Shanghai)'s earnings growth report.

- Our comprehensive valuation report raises the possibility that PATEO CONNECT Technology (Shanghai) is priced higher than what may be justified by its financials.

Jiangsu Cnano Technology (SHSE:688116)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Cnano Technology Co., Ltd. is engaged in the research, development, production, and sale of carbon nanotube materials and related products in China, with a market cap of CN¥21.42 billion.

Operations: The company's revenue segments include the research, development, production, and sale of carbon nanotube materials and related products in China.

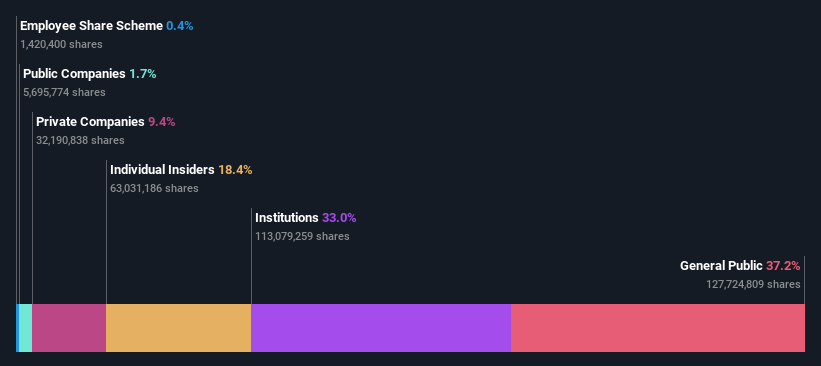

Insider Ownership: 10.8%

Earnings Growth Forecast: 48.3% p.a.

Jiangsu Cnano Technology is poised for substantial growth, with earnings projected to rise significantly at 48.3% annually, outpacing the Chinese market average. Revenue is also expected to grow robustly by 41.4% per year. Despite recent share price volatility and a modest buyback of shares worth CNY 54.15 million, the company reported increased net income for the first nine months of 2025 compared to last year, reflecting improving profitability amidst high insider ownership dynamics.

- Delve into the full analysis future growth report here for a deeper understanding of Jiangsu Cnano Technology.

- Insights from our recent valuation report point to the potential overvaluation of Jiangsu Cnano Technology shares in the market.

Guangdong Guanghua Sci-Tech (SZSE:002741)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Guanghua Sci-Tech Co., Ltd. is engaged in the production and sale of electronic chemicals, chemical reagents, and new energy materials in China, with a market cap of CN¥11.10 billion.

Operations: The company's revenue primarily comes from its chemical industry segment, generating CN¥2.80 billion.

Insider Ownership: 38.1%

Earnings Growth Forecast: 91.4% p.a.

Guangdong Guanghua Sci-Tech is experiencing significant growth, with recent earnings showing a substantial increase in net income to CNY 90.39 million for the first nine months of 2025 compared to CNY 6.78 million last year. Revenue is forecasted to grow at a strong rate of 21.4% annually, surpassing the market average. Despite no significant insider trading activity recently, high insider ownership aligns with its robust performance and strategic leadership changes approved in September 2025.

- Click here to discover the nuances of Guangdong Guanghua Sci-Tech with our detailed analytical future growth report.

- The analysis detailed in our Guangdong Guanghua Sci-Tech valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Dive into all 622 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2889

PATEO CONNECT Technology (Shanghai)

Develops smart cockpit solutions, vehicle connectivity support services, and products for OEMs and Tier-1 suppliers in China and Hong Kong.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives