- China

- /

- Real Estate

- /

- SHSE:600638

Undiscovered Gems with Strong Potential for November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of mixed economic signals and cautious investor sentiment, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amid a busy earnings season. In this environment, identifying undiscovered gems requires a keen focus on companies with solid fundamentals and the ability to adapt to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 20.47% | -3.86% | -2.71% | ★★★★★☆ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai New Huang Pu Industrial Group (SHSE:600638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai New Huang Pu Industrial Group Co., Ltd. operates in various sectors, primarily focusing on real estate development and management, with a market cap of approximately CN¥3.66 billion.

Operations: The company derives its revenue primarily from real estate development and management. It has a market capitalization of approximately CN¥3.66 billion.

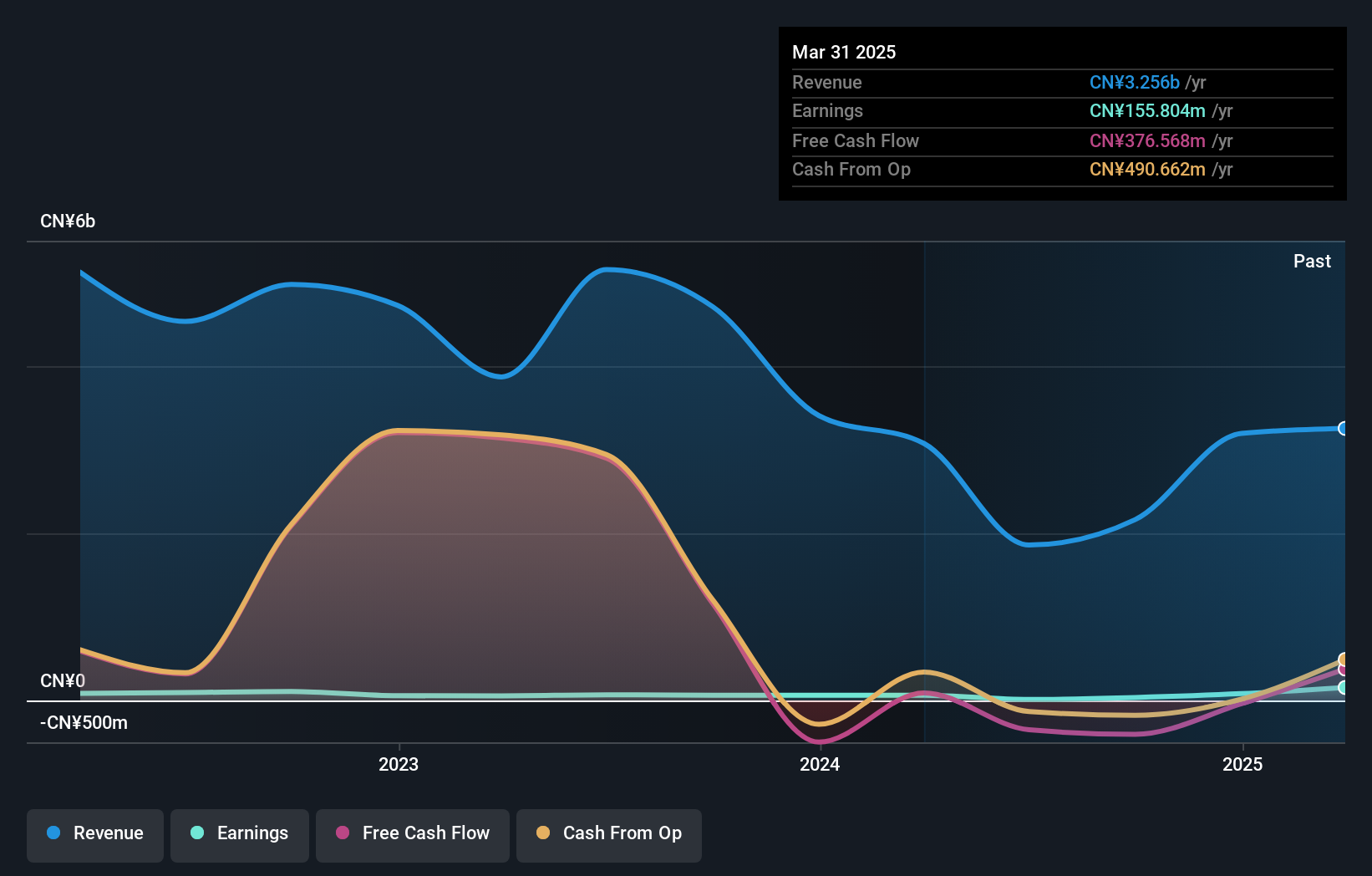

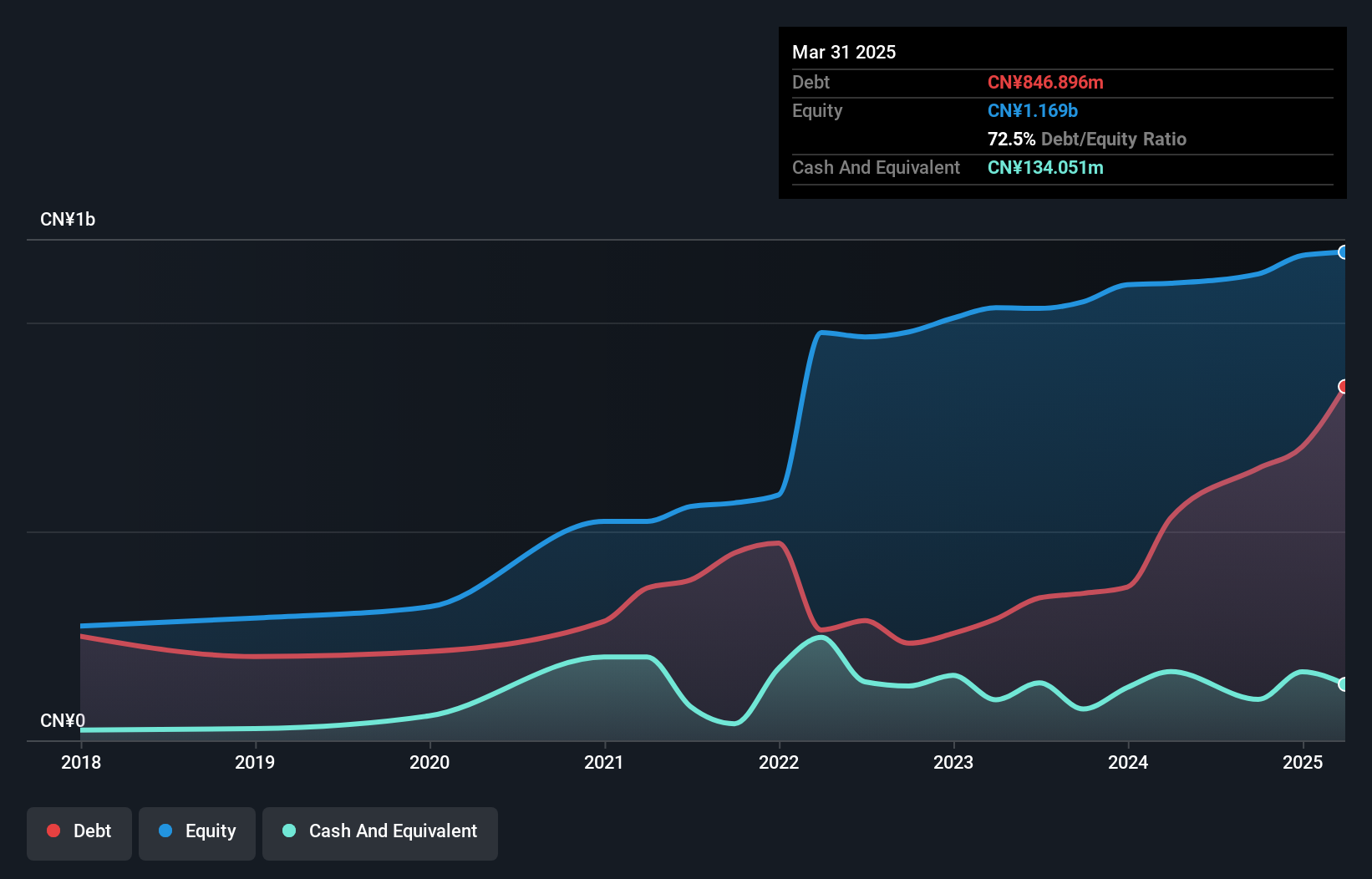

Shanghai New Huang Pu Industrial Group, a player in the real estate sector, has faced challenges with its earnings growth lagging behind industry averages. Over the past year, earnings dropped by 43.5%, while revenue for the nine months ending September 2024 was CNY 1.46 billion compared to CNY 2.70 billion a year ago. Despite high-quality past earnings and more cash than total debt, net income also fell to CNY 55.88 million from CNY 82 million previously. The company's debt-to-equity ratio improved from 69.9% to 60.6% over five years, indicating better financial management amidst these hurdles.

- Get an in-depth perspective on Shanghai New Huang Pu Industrial Group's performance by reading our health report here.

Learn about Shanghai New Huang Pu Industrial Group's historical performance.

Shaanxi Sirui Advanced Materials (SHSE:688102)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shaanxi Sirui Advanced Materials Co., Ltd. operates in the advanced materials sector and has a market capitalization of approximately CN¥7.06 billion.

Operations: Shaanxi Sirui Advanced Materials generates its revenue primarily from the advanced materials sector. The company's financial performance is highlighted by its market capitalization of approximately CN¥7.06 billion.

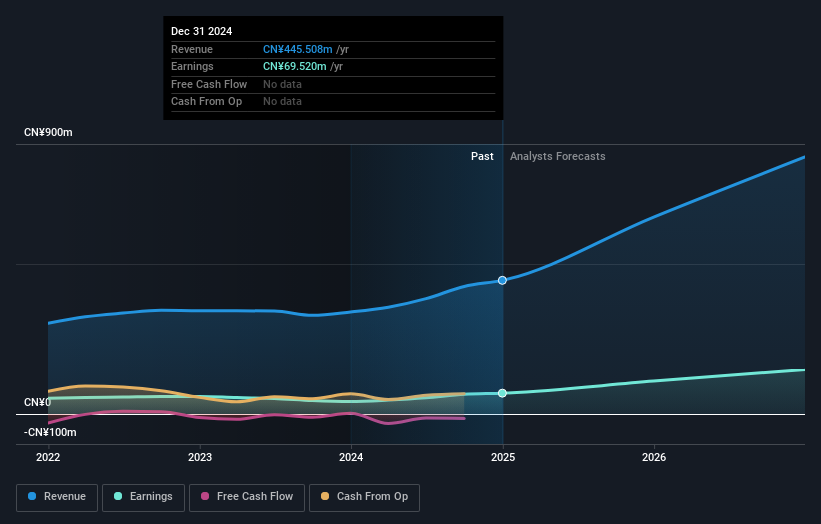

Shaanxi Sirui Advanced Materials, a relatively small player in its field, has shown promising financial performance with sales reaching CNY 964.31 million for the nine months ending September 2024, up from CNY 868.88 million last year. Net income also improved to CNY 78.27 million compared to the previous year's CNY 68.44 million, reflecting a solid earnings trajectory. The company's debt management appears prudent as its debt-to-equity ratio has decreased from 67% to 58.3% over five years, although it remains high at a net level of 49.6%. Despite not being free cash flow positive recently, interest payments are well covered by EBIT at an impressive rate of 47 times coverage, indicating strong operational efficiency and resilience in managing financial obligations amidst industry challenges.

Optowide Technologies (SHSE:688195)

Simply Wall St Value Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. specializes in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market capitalization of CN¥4.76 billion.

Operations: Optowide Technologies generates revenue primarily from its precision optics and fiber components business. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Optowide Technologies, a promising player in the electronics sector, has shown impressive earnings growth of 47% over the past year, outpacing the industry average. The company's net income for the first nine months of 2024 reached CNY 55.48 million, up from CNY 31.19 million a year ago, with basic earnings per share rising to CNY 0.43 from CNY 0.24. Despite its volatile share price recently, Optowide's financial health seems robust with more cash than total debt and interest payments well-covered by profits. A recent announcement of a CNY 20 million share repurchase program underscores confidence in future performance prospects.

- Unlock comprehensive insights into our analysis of Optowide Technologies stock in this health report.

Assess Optowide Technologies' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4733 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600638

Shanghai New Huang Pu Industrial Group

Shanghai New Huang Pu Industrial Group Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives