There's Reason For Concern Over Cabio Biotech (Wuhan) Co., Ltd.'s (SHSE:688089) Massive 25% Price Jump

Those holding Cabio Biotech (Wuhan) Co., Ltd. (SHSE:688089) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

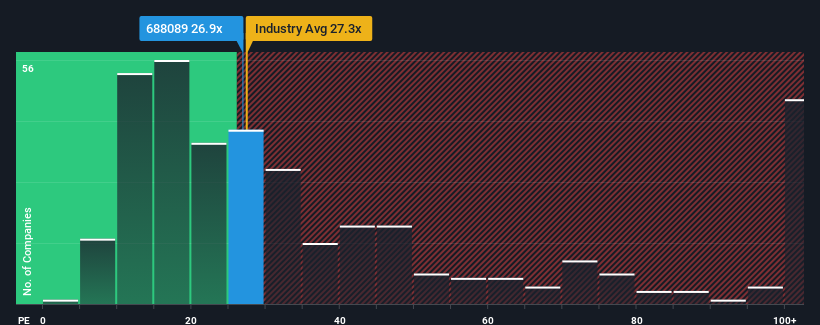

Although its price has surged higher, there still wouldn't be many who think Cabio Biotech (Wuhan)'s price-to-earnings (or "P/E") ratio of 26.9x is worth a mention when the median P/E in China is similar at about 28x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Cabio Biotech (Wuhan) certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Cabio Biotech (Wuhan)

Is There Some Growth For Cabio Biotech (Wuhan)?

There's an inherent assumption that a company should be matching the market for P/E ratios like Cabio Biotech (Wuhan)'s to be considered reasonable.

Retrospectively, the last year delivered an exceptional 76% gain to the company's bottom line. Still, incredibly EPS has fallen 27% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 20% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 24% per annum, which is noticeably more attractive.

With this information, we find it interesting that Cabio Biotech (Wuhan) is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Cabio Biotech (Wuhan)'s P/E

Its shares have lifted substantially and now Cabio Biotech (Wuhan)'s P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Cabio Biotech (Wuhan) currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Cabio Biotech (Wuhan) is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

You might be able to find a better investment than Cabio Biotech (Wuhan). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688089

Cabio Biotech (Wuhan)

Develops, produces, and markets arachidonic and docosahexaenoic acids, and beta-carotene for domestic and foreign infant formula, and healthy food manufacturers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives