Jiangxi Chenguang New Materials Company Limited's (SHSE:605399) P/S Is Still On The Mark Following 28% Share Price Bounce

Jiangxi Chenguang New Materials Company Limited (SHSE:605399) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 60% share price decline over the last year.

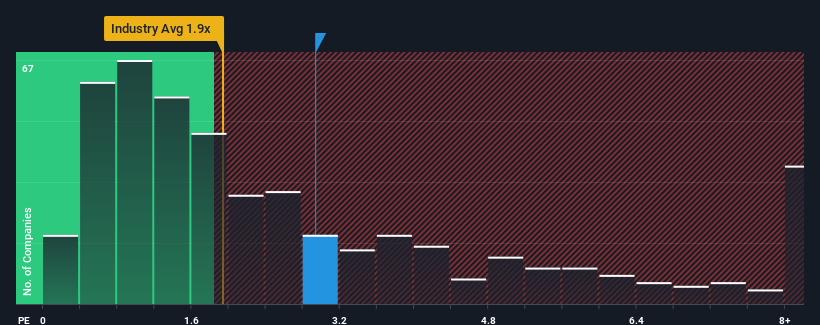

Since its price has surged higher, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Jiangxi Chenguang New Materials as a stock probably not worth researching with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Jiangxi Chenguang New Materials

How Jiangxi Chenguang New Materials Has Been Performing

Jiangxi Chenguang New Materials hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Jiangxi Chenguang New Materials will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Jiangxi Chenguang New Materials?

Jiangxi Chenguang New Materials' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 43% decrease to the company's top line. Even so, admirably revenue has lifted 77% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 83% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we can see why Jiangxi Chenguang New Materials is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Jiangxi Chenguang New Materials' P/S

Jiangxi Chenguang New Materials' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Jiangxi Chenguang New Materials' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Jiangxi Chenguang New Materials that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605399

Jiangxi Chenguang New Materials

A special chemical company, develops, produces, and sells functional silane basic raw materials, intermediates, and downstream products in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives