As global markets navigate geopolitical tensions and consumer spending concerns, the recent volatility has underscored the importance of strategic investment choices. In such an environment, stocks with high insider ownership can be particularly appealing, as they often indicate strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's review some notable picks from our screened stocks.

Jiangxi Chenguang New Materials (SHSE:605399)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Chenguang New Materials Company Limited is a special chemical company that develops, produces, and sells functional silane raw materials and products both in China and internationally, with a market cap of CN¥3.58 billion.

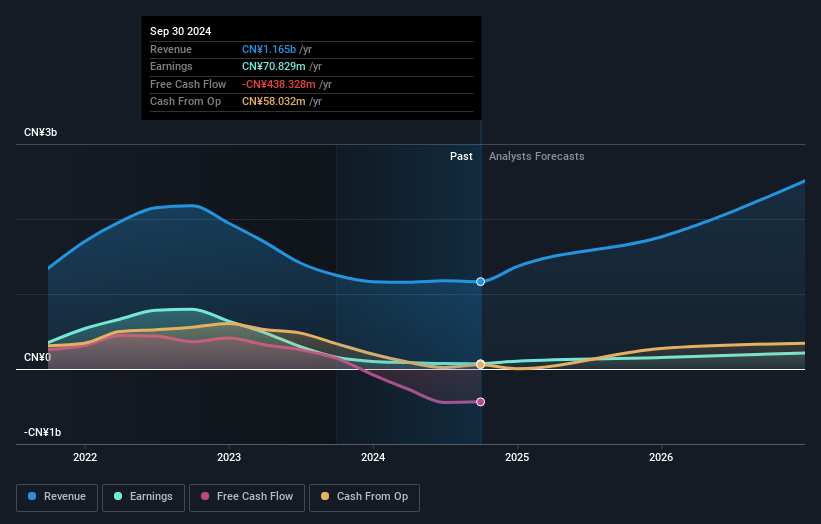

Operations: The company generates revenue primarily from the sale of functional silane, amounting to CN¥1.16 billion.

Insider Ownership: 35%

Earnings Growth Forecast: 44.1% p.a.

Jiangxi Chenguang New Materials is poised for substantial growth, with forecasted revenue and earnings expected to grow significantly at 33.6% and 44.1% per year, respectively, outpacing the broader Chinese market. Despite a decline in profit margins from 12.5% to 6.1%, the company's long-term prospects remain strong due to high projected earnings growth. Recent removal from the S&P Global BMI Index may warrant attention but doesn't overshadow its growth trajectory.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangxi Chenguang New Materials.

- Our valuation report here indicates Jiangxi Chenguang New Materials may be overvalued.

Bangyan Technology (SHSE:688132)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bangyan Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of information communication and security equipment for China's military industry, with a market cap of CN¥2.94 billion.

Operations: The company's revenue segment is Aerospace & Defense, generating CN¥356.97 million.

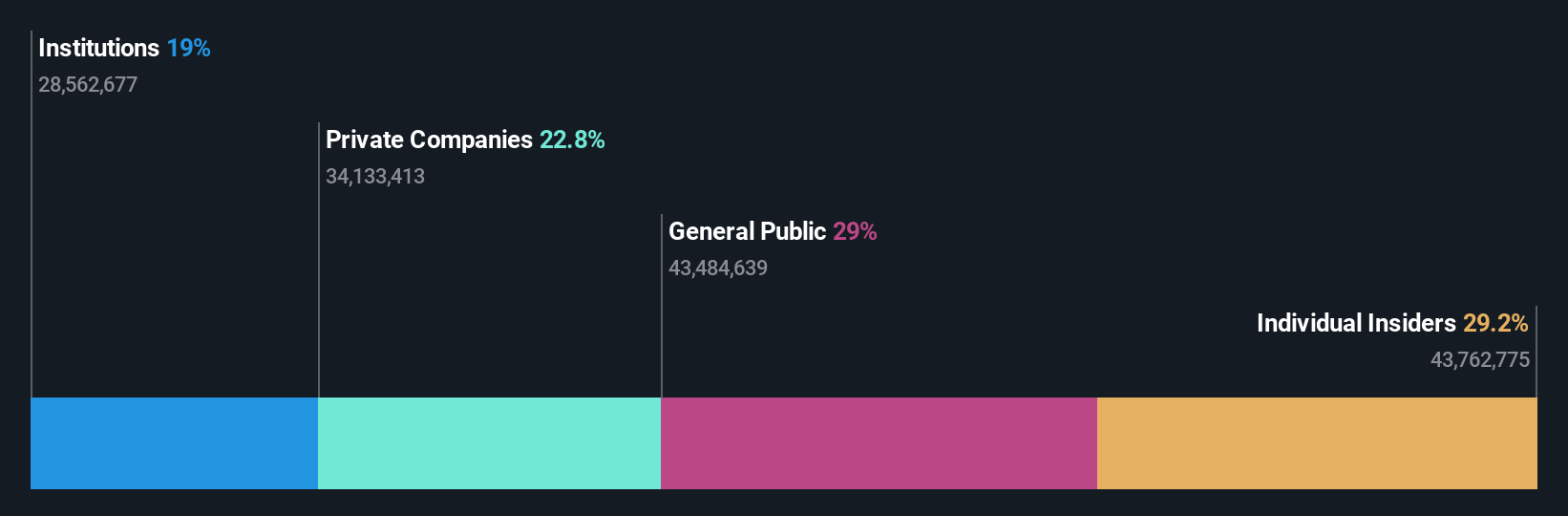

Insider Ownership: 29.2%

Earnings Growth Forecast: 95.3% p.a.

Bangyan Technology is positioned for significant expansion, with revenue projected to grow at 41.5% annually, surpassing the broader Chinese market's growth rate. The company reported a substantial increase in sales to CNY 356.97 million for 2024, although it remains unprofitable with a net loss of CNY 37.94 million. Recent private placement plans could bolster capital but may introduce volatility due to share issuance constraints and regulatory approvals needed for completion.

- Dive into the specifics of Bangyan Technology here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Bangyan Technology shares in the market.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. offers geographic information system and spatial intelligence software products and services both in China and internationally, with a market cap of CN¥9.28 billion.

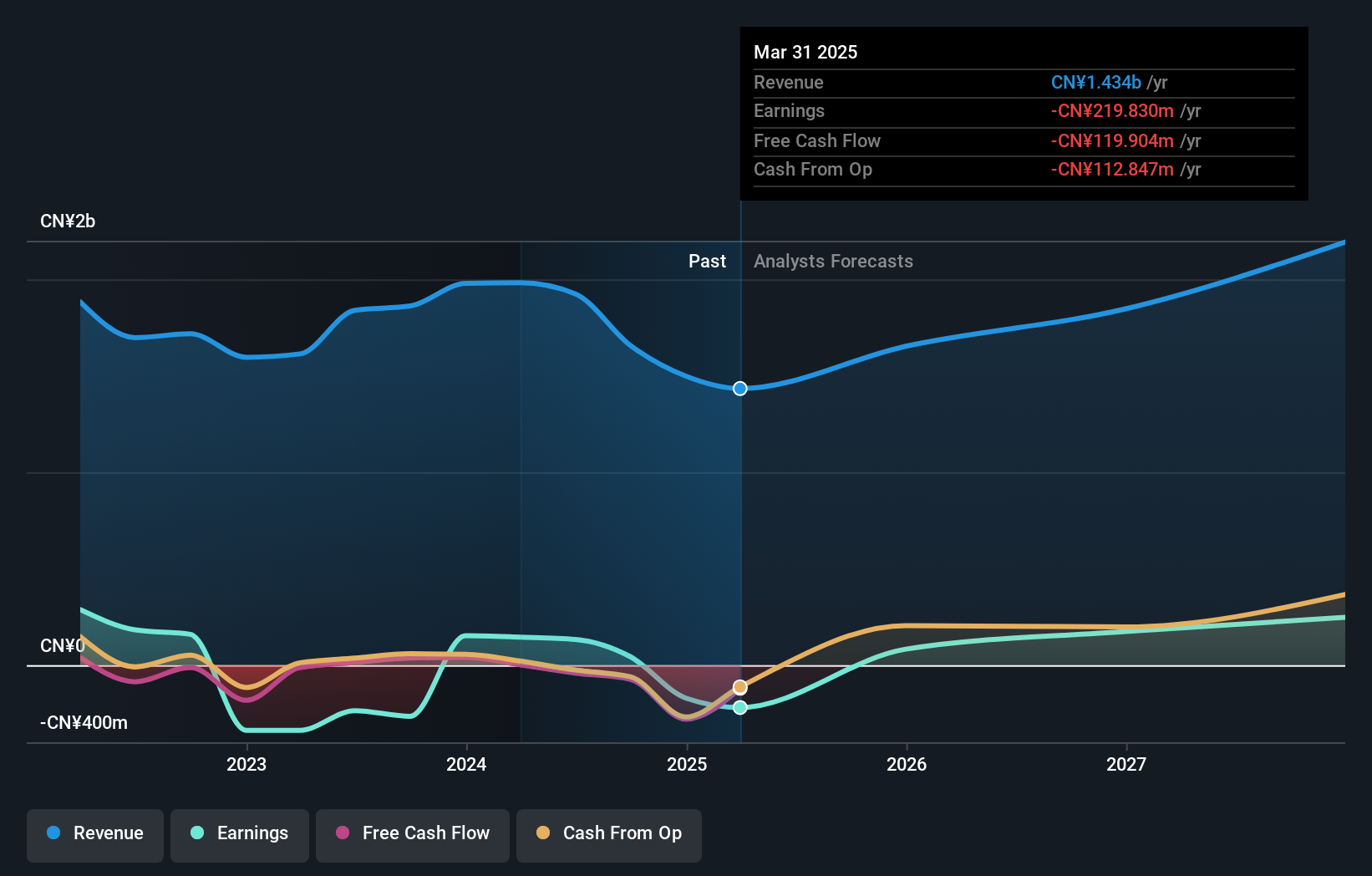

Operations: Beijing SuperMap Software Co., Ltd. generates revenue through its geographic information system and spatial intelligence software products and services offered domestically and abroad.

Insider Ownership: 17%

Earnings Growth Forecast: 54.2% p.a.

Beijing SuperMap Software is set for robust growth, with revenue projected to increase by 24.4% annually, outpacing the Chinese market. The company recently turned profitable and its earnings are expected to grow significantly at 54.21% per year, well above the market average of 25.3%. Despite trading at a good value relative to peers, its low forecasted Return on Equity of 7.5% in three years could be a concern for investors seeking high returns.

- Delve into the full analysis future growth report here for a deeper understanding of Beijing SuperMap Software.

- Our valuation report unveils the possibility Beijing SuperMap Software's shares may be trading at a discount.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1447 Fast Growing Companies With High Insider Ownership now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SuperMap Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300036

Beijing SuperMap Software

Provides geographic information system and spatial intelligence software products and services in China and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives