- China

- /

- Basic Materials

- /

- SHSE:605122

Investors Appear Satisfied With Chongqing Sifang New Material Co., Ltd.'s (SHSE:605122) Prospects As Shares Rocket 25%

Chongqing Sifang New Material Co., Ltd. (SHSE:605122) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

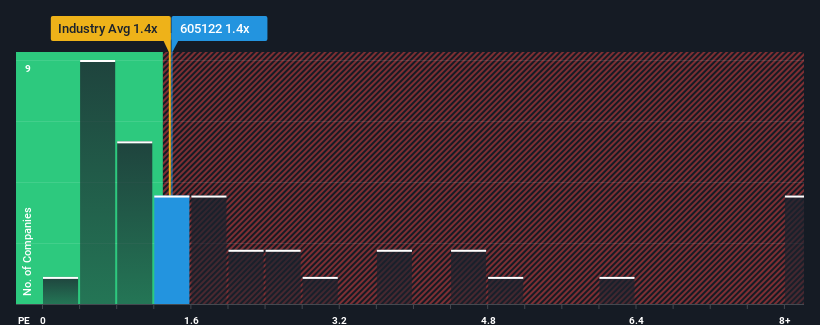

In spite of the firm bounce in price, it's still not a stretch to say that Chongqing Sifang New Material's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Basic Materials industry in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Chongqing Sifang New Material

How Chongqing Sifang New Material Has Been Performing

As an illustration, revenue has deteriorated at Chongqing Sifang New Material over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chongqing Sifang New Material's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Chongqing Sifang New Material?

The only time you'd be comfortable seeing a P/S like Chongqing Sifang New Material's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. Still, the latest three year period has seen an excellent 37% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Chongqing Sifang New Material's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Chongqing Sifang New Material's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Chongqing Sifang New Material maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 2 warning signs for Chongqing Sifang New Material (1 is a bit unpleasant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605122

Chongqing Sifang New Material

Engages in the research, development, production, and sale of commercial concrete in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives