- China

- /

- Metals and Mining

- /

- SHSE:603979

JCHX Mining Management Co.,Ltd. (SHSE:603979) Screens Well But There Might Be A Catch

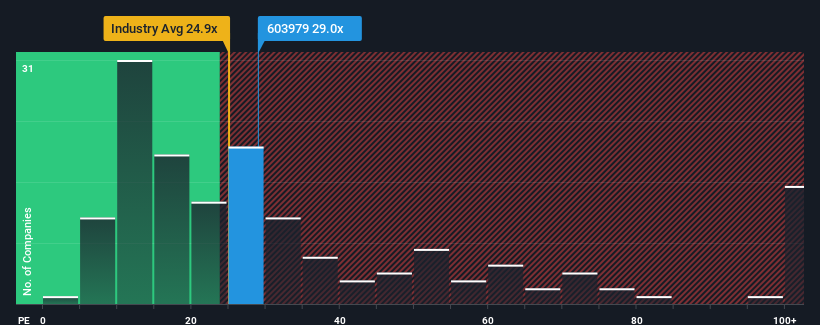

It's not a stretch to say that JCHX Mining Management Co.,Ltd.'s (SHSE:603979) price-to-earnings (or "P/E") ratio of 29x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 28x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

JCHX Mining ManagementLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for JCHX Mining ManagementLtd

What Are Growth Metrics Telling Us About The P/E?

JCHX Mining ManagementLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 74%. The strong recent performance means it was also able to grow EPS by 166% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 32% per annum during the coming three years according to the eight analysts following the company. With the market only predicted to deliver 24% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that JCHX Mining ManagementLtd's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From JCHX Mining ManagementLtd's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of JCHX Mining ManagementLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for JCHX Mining ManagementLtd that you should be aware of.

If these risks are making you reconsider your opinion on JCHX Mining ManagementLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603979

JCHX Mining ManagementLtd

Engages in mine engineering, development, and construction activities in the People’s Republic of China and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives