- China

- /

- Electrical

- /

- SHSE:603633

Undiscovered Gems Three Promising Stocks To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating indices and mixed economic signals, investors are keenly observing the impact of AI competition and monetary policies on market sentiment. Amidst these dynamics, identifying promising small-cap stocks can offer unique opportunities for growth, especially those that demonstrate resilience and potential in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Laimu ElectronicsLtd (SHSE:603633)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Laimu Electronics Co., Ltd. is engaged in the research, development, production, and sale of precision electronic components in China with a market capitalization of CN¥3.67 billion.

Operations: Laimu Electronics generates revenue primarily from the sale of precision electronic components. The company's financial performance includes a focus on cost management and profit margins, with particular attention to trends in its gross profit margin.

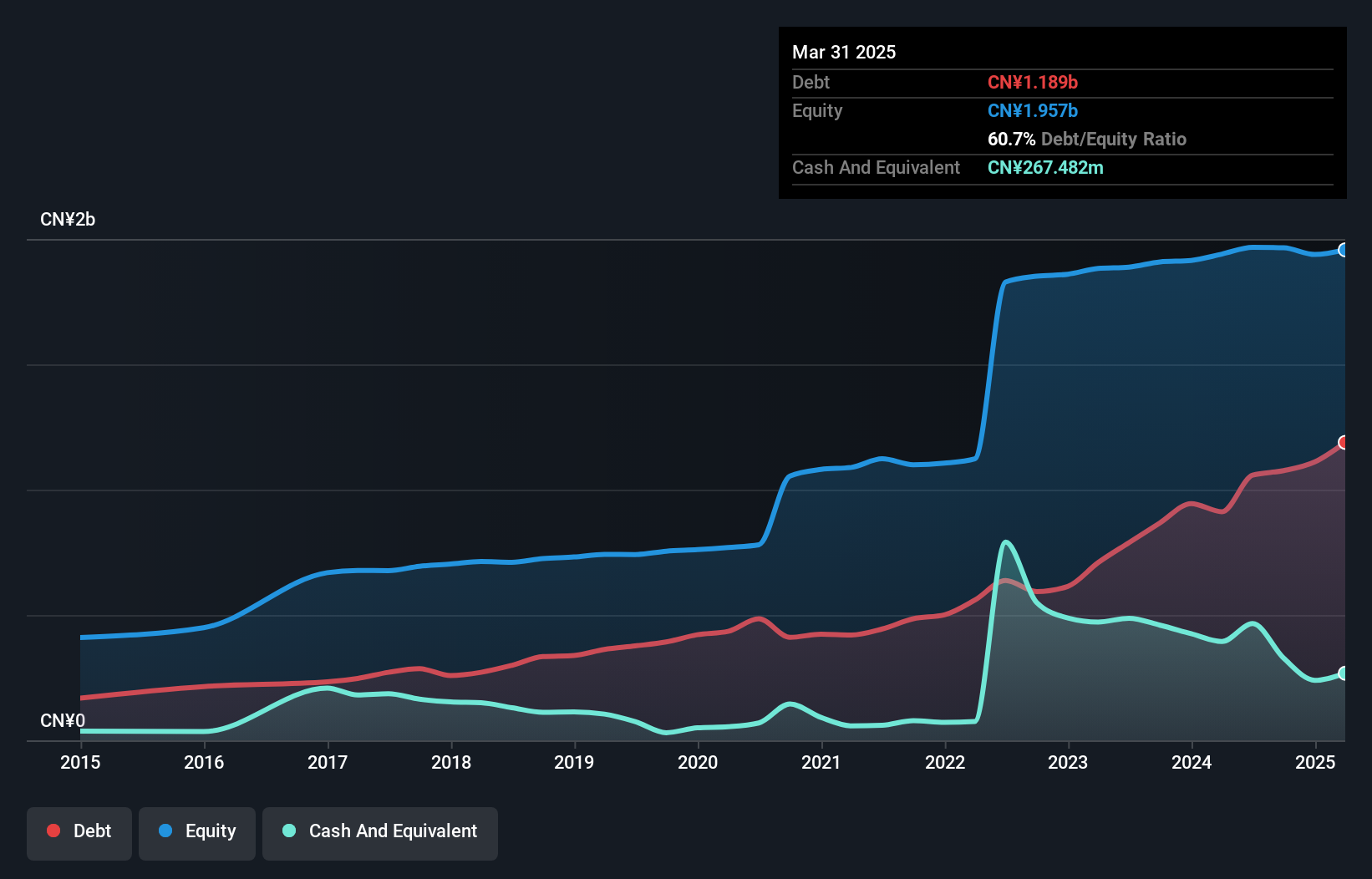

Laimu Electronics, a smaller player in the electronics sector, has shown resilience with its earnings growth of 1.1% over the past year, outpacing industry averages. The company's interest payments are comfortably covered by EBIT at 3.9 times, indicating robust financial health despite a net debt to equity ratio of 38.1%, which remains satisfactory. However, free cash flow is negative, suggesting potential challenges in liquidity management. In recent events, Laimu completed a share buyback totaling CNY 30 million for 0.88% of shares repurchased by December 2024—an effort likely aimed at boosting shareholder value amidst these dynamics.

Silvery Dragon Prestressed MaterialsLTD Tianjin (SHSE:603969)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Silvery Dragon Prestressed Materials Co., LTD Tianjin is engaged in the manufacturing and sale of prestressed steel products in China with a market capitalization of CN¥5.66 billion.

Operations: Silvery Dragon generates revenue primarily from its Metal Processors and Fabrication segment, amounting to CN¥2.93 billion.

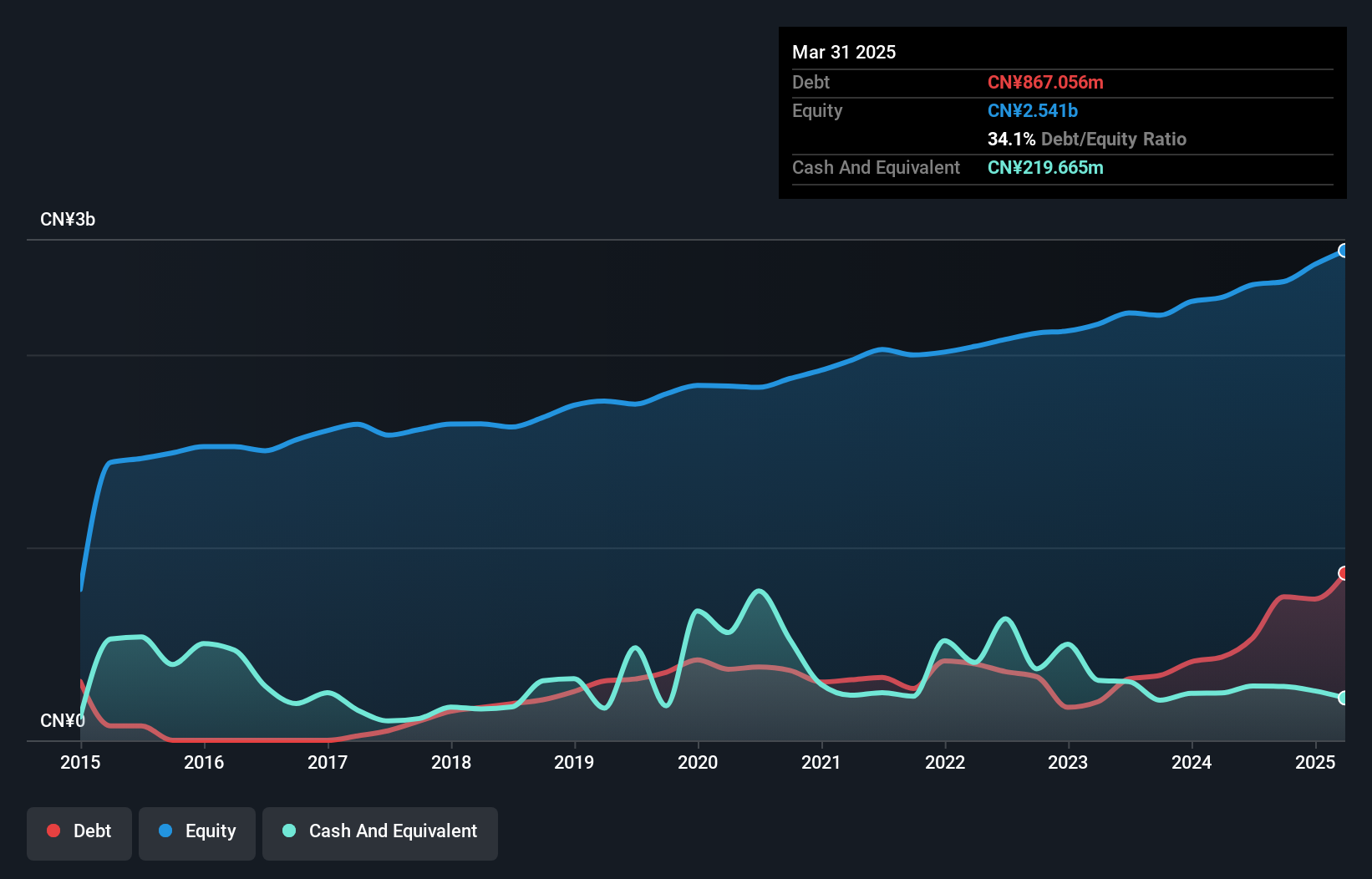

Silvery Dragon, a small player in the metals sector, shows promising financial health with a price-to-earnings ratio of 25.5x, which is more attractive than the broader CN market's 35.8x. The company's net debt to equity ratio stands at a satisfactory 19.5%, indicating manageable leverage levels over time despite an increase from 19.6% to 31.3% in five years. Its earnings surged by an impressive 76%, outpacing the industry's -2% performance, and interest payments are well-covered with EBIT at 30x coverage, suggesting robust operational efficiency and potential for continued profitability without liquidity concerns.

Baotek Industrial Materials (TPEX:5340)

Simply Wall St Value Rating: ★★★★★★

Overview: Baotek Industrial Materials Ltd. specializes in the manufacturing and sale of fiberglass fabrics used in copper clad laminates for electronic applications across Taiwan, China, Japan, America, and other international markets, with a market capitalization of approximately NT$8.50 billion.

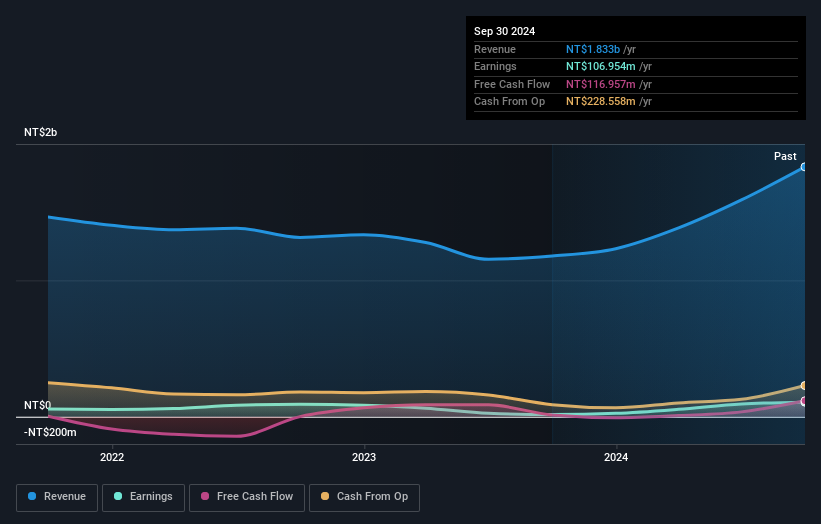

Operations: The company generates revenue primarily from the production and trading of electronic-grade fiberglass cloth, amounting to NT$1.83 billion.

Baotek Industrial Materials, a smaller player in its field, has shown impressive earnings growth of 589% over the past year, outpacing the electronics industry average. With no debt on its books compared to a 3.6 debt-to-equity ratio five years ago, Baotek seems financially stable and free cash flow positive. Recent earnings reports highlight significant improvements; for instance, third-quarter sales reached TWD 551.52 million from TWD 308.95 million last year and net income rose to TWD 24.98 million from TWD 12.12 million previously. However, high share price volatility might be a concern for potential investors seeking stability.

Taking Advantage

- Delve into our full catalog of 4724 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603633

Shanghai Laimu ElectronicsLtd

Researches and develops, produces, and sells precision electronic components in China.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives