Fewer Investors Than Expected Jumping On Jiangsu Lopal Tech. Co., Ltd. (SHSE:603906)

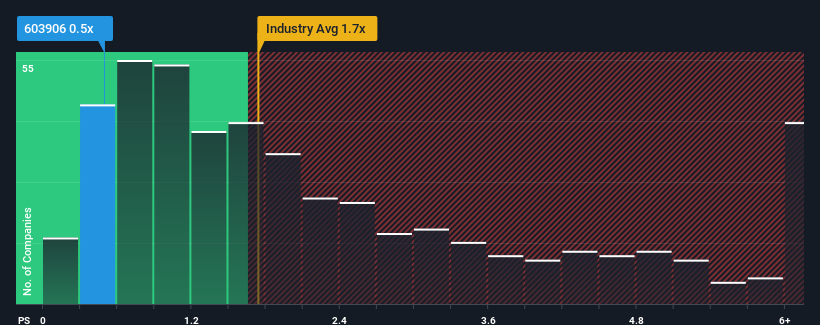

With a price-to-sales (or "P/S") ratio of 0.5x Jiangsu Lopal Tech. Co., Ltd. (SHSE:603906) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Jiangsu Lopal Tech

What Does Jiangsu Lopal Tech's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Jiangsu Lopal Tech's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Lopal Tech will help you uncover what's on the horizon.How Is Jiangsu Lopal Tech's Revenue Growth Trending?

Jiangsu Lopal Tech's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. Even so, admirably revenue has lifted 258% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 32% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 22%, which is noticeably less attractive.

In light of this, it's peculiar that Jiangsu Lopal Tech's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Jiangsu Lopal Tech currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jiangsu Lopal Tech you should know about.

If these risks are making you reconsider your opinion on Jiangsu Lopal Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603906

Jiangsu Lopal Tech. Group

Engages in the research and development, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles in China and internationally.

High growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026