A Piece Of The Puzzle Missing From Jiangsu Lopal Tech. Co., Ltd.'s (SHSE:603906) Share Price

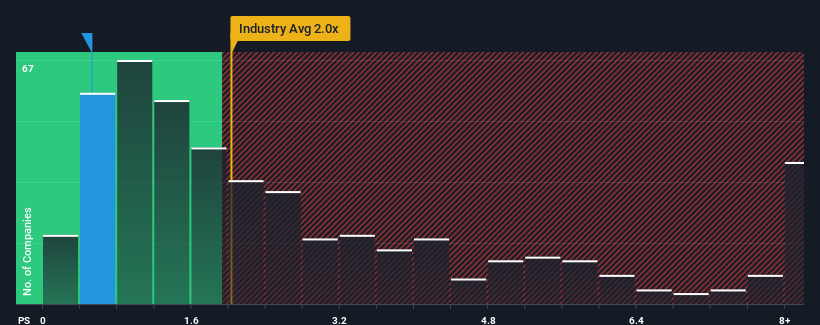

With a price-to-sales (or "P/S") ratio of 0.5x Jiangsu Lopal Tech. Co., Ltd. (SHSE:603906) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jiangsu Lopal Tech

What Does Jiangsu Lopal Tech's Recent Performance Look Like?

Jiangsu Lopal Tech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Jiangsu Lopal Tech's future stacks up against the industry? In that case, our free report is a great place to start.How Is Jiangsu Lopal Tech's Revenue Growth Trending?

Jiangsu Lopal Tech's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 9.0% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 72% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

In light of this, it's peculiar that Jiangsu Lopal Tech's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Jiangsu Lopal Tech's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Jiangsu Lopal Tech currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Jiangsu Lopal Tech that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603906

Jiangsu Lopal Tech. Group

Engages in the research and development, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles in China and internationally.

High growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success