Yongyue Science&Technology Co.,Ltd's (SHSE:603879) Popularity With Investors Under Threat As Stock Sinks 26%

To the annoyance of some shareholders, Yongyue Science&Technology Co.,Ltd (SHSE:603879) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

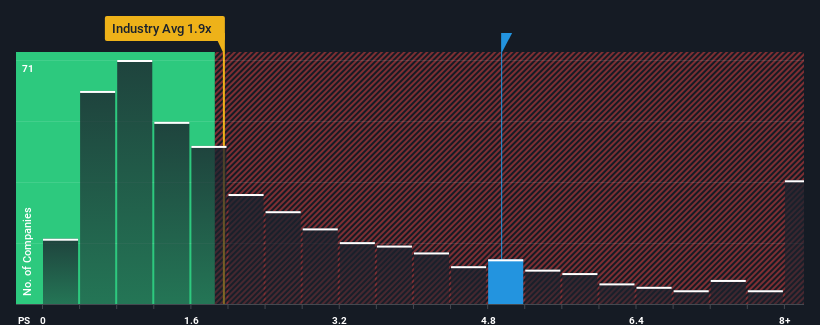

Even after such a large drop in price, you could still be forgiven for thinking Yongyue Science&TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.9x, considering almost half the companies in China's Chemicals industry have P/S ratios below 1.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Yongyue Science&TechnologyLtd

What Does Yongyue Science&TechnologyLtd's P/S Mean For Shareholders?

The recent revenue growth at Yongyue Science&TechnologyLtd would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Yongyue Science&TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Yongyue Science&TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Yongyue Science&TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 5.1% gain to the company's revenues. Still, lamentably revenue has fallen 15% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Yongyue Science&TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Yongyue Science&TechnologyLtd's P/S?

Yongyue Science&TechnologyLtd's shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Yongyue Science&TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Yongyue Science&TechnologyLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on Yongyue Science&TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603879

Yongyue Science&TechnologyLtd

Engages in the research and development, production, and sale of synthetic resins in China.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives