- China

- /

- Electronic Equipment and Components

- /

- SZSE:301626

Exploring Three Undiscovered Gems In Asia With Strong Potential

Reviewed by Simply Wall St

As global markets navigate through a period of economic adjustments, with the U.S. labor market showing signs of cooling and trade tensions between major economies like the U.S. and China remaining a focal point, small-cap stocks have been leading gains, reflected in the Russell 2000 Index's recent performance. In this dynamic environment, identifying promising small-cap opportunities can be particularly rewarding for investors seeking growth potential; such stocks often exhibit strong fundamentals or unique market positions that may not yet be fully recognized by broader market participants.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Luyin Investment GroupLtd | 40.20% | 6.14% | 18.68% | ★★★★★★ |

| Tohoku Steel | NA | 5.34% | -2.26% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Togami Electric Mfg | 3.09% | 4.88% | 16.96% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 39.70% | 14.43% | 7.86% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| FCE | 7.92% | 26.91% | 26.05% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| Uniplus Electronics | 32.22% | 46.30% | 75.33% | ★★★★★☆ |

| Lungyen Life Service | 5.26% | 1.68% | -3.57% | ★★★★★☆ |

We'll examine a selection from our screener results.

Lily Group (SHSE:603823)

Simply Wall St Value Rating: ★★★★★★

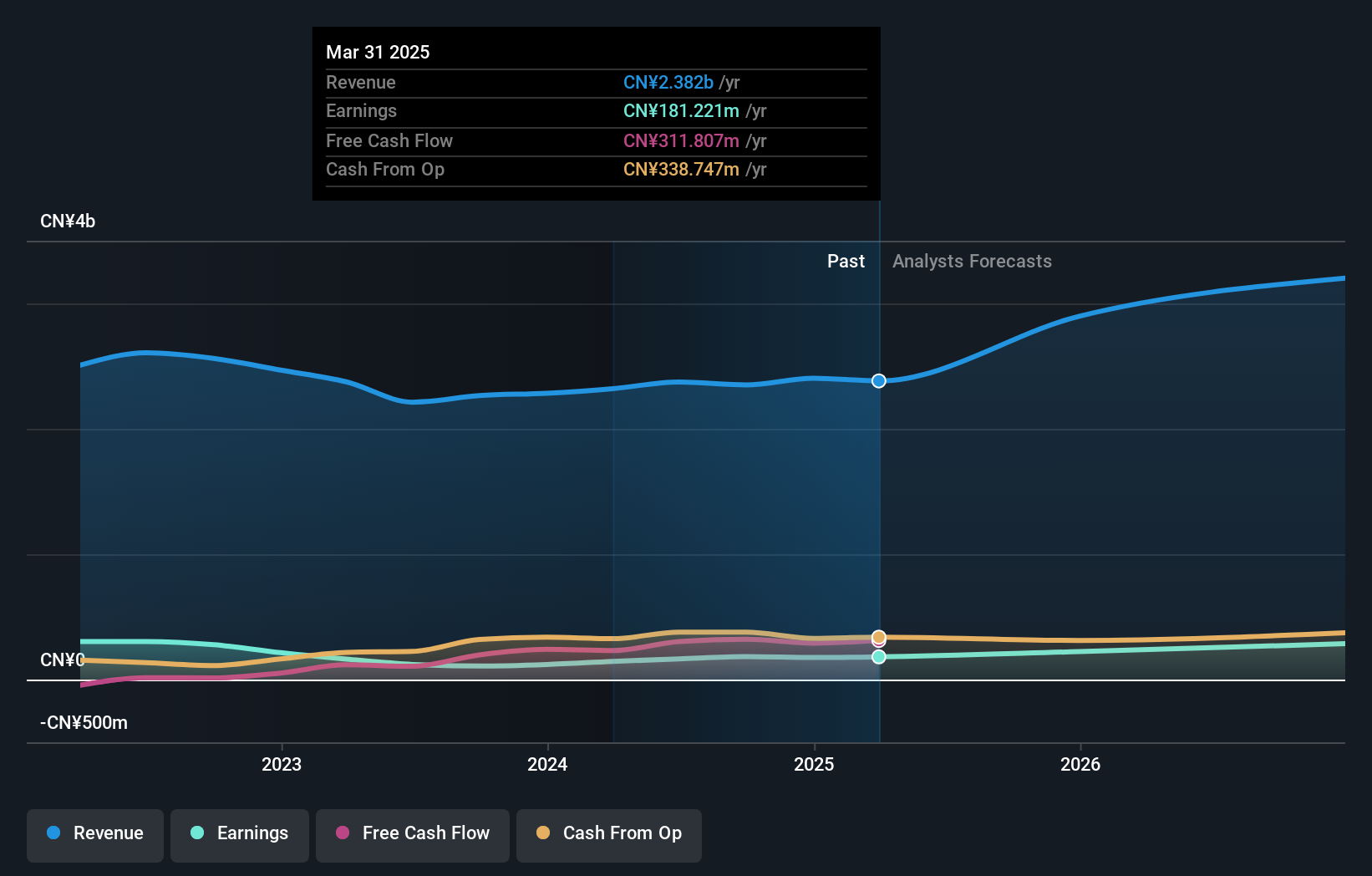

Overview: Lily Group Co., Ltd. is a company based in the People's Republic of China that specializes in the manufacturing and sale of organic pigments, with a market capitalization of approximately CN¥5.34 billion.

Operations: Lily Group generates revenue primarily from its chemicals segment, amounting to CN¥2.36 billion. The company's financial performance is influenced by the gross profit margin trends, which can provide insights into cost management and pricing strategies.

Lily Group, a promising player in the chemicals sector, has been trading at 7% below its estimated fair value. Over the past year, earnings surged by 24.8%, outpacing the industry average of 4%. The company reported CNY 568.68 million in revenue for Q1 2025, with net income rising to CNY 45.79 million from CNY 40.63 million last year. Their interest payments are comfortably covered with EBIT at an impressive 239 times coverage, and their debt-to-equity ratio improved from 6.6 to 5.3 over five years, indicating strong financial management and potential for future growth.

- Click here and access our complete health analysis report to understand the dynamics of Lily Group.

Assess Lily Group's past performance with our detailed historical performance reports.

Yongjin Technology Group (SHSE:603995)

Simply Wall St Value Rating: ★★★★☆☆

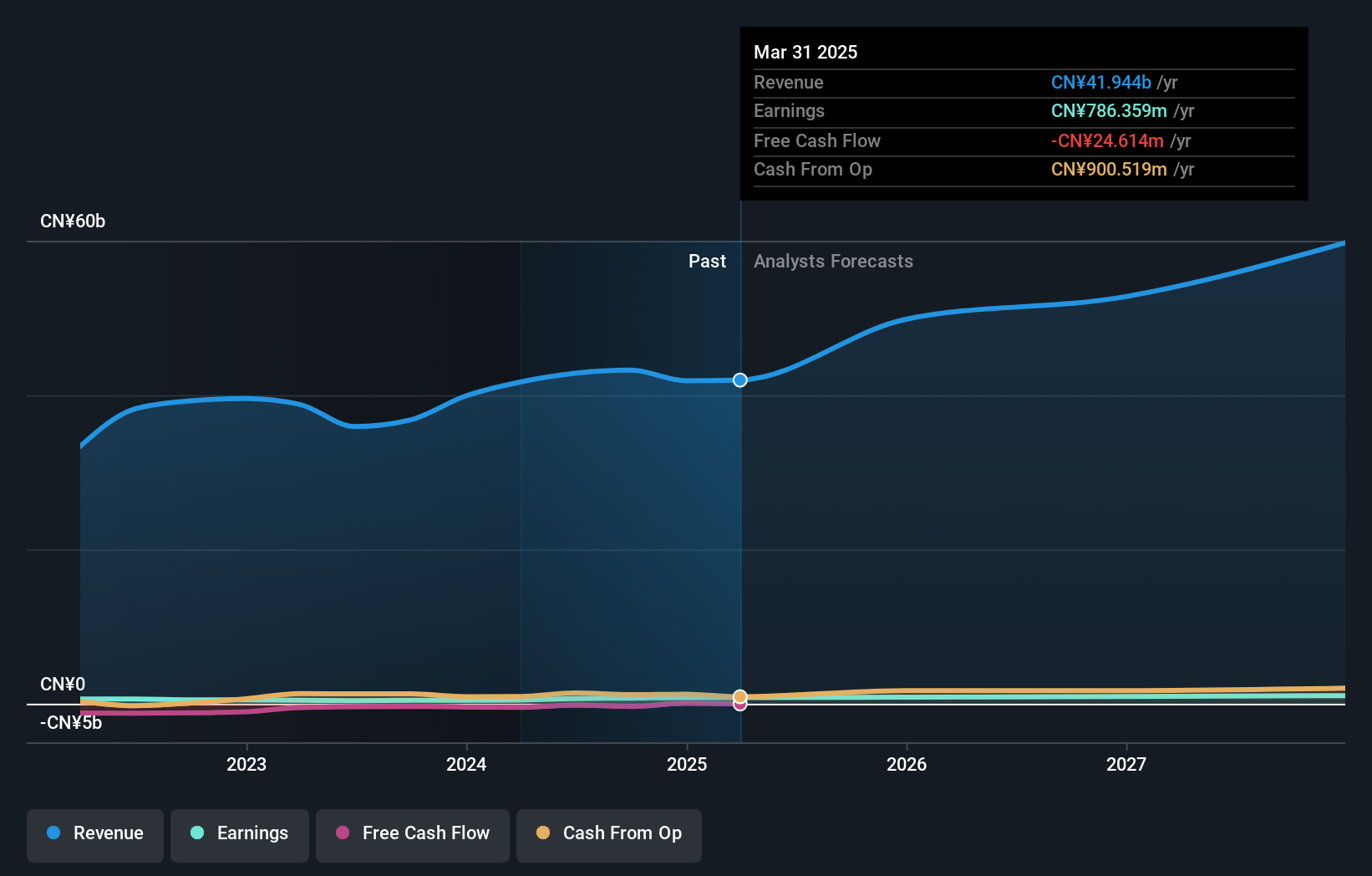

Overview: Yongjin Technology Group Co., Ltd. specializes in the research, development, production, and sale of cold-rolled stainless steel strips and has a market cap of approximately CN¥7.15 billion.

Operations: Yongjin Technology Group generates revenue primarily through the sale of cold-rolled stainless steel strips. The company's focus on this product line is reflected in its financial performance, with a notable trend observed in its gross profit margin.

Yongjin Technology Group, a small player in Asia's tech sector, showcases both promise and challenges. The company trades at a favorable P/E ratio of 9.1x compared to the CN market's 39x, indicating good value. Despite high debt with a net debt to equity ratio of 41%, its earnings growth last year was impressive at 63.3%, outpacing the industry average by far. However, free cash flow remains negative as it reported -CNY 437 million recently. In Q1 2025, sales rose slightly to CNY 9,389 million from CNY 9,305 million the previous year but net income dipped to CNY 104 million from CNY 122 million.

Suzhou Tianmai Thermal Technology (SZSE:301626)

Simply Wall St Value Rating: ★★★★★★

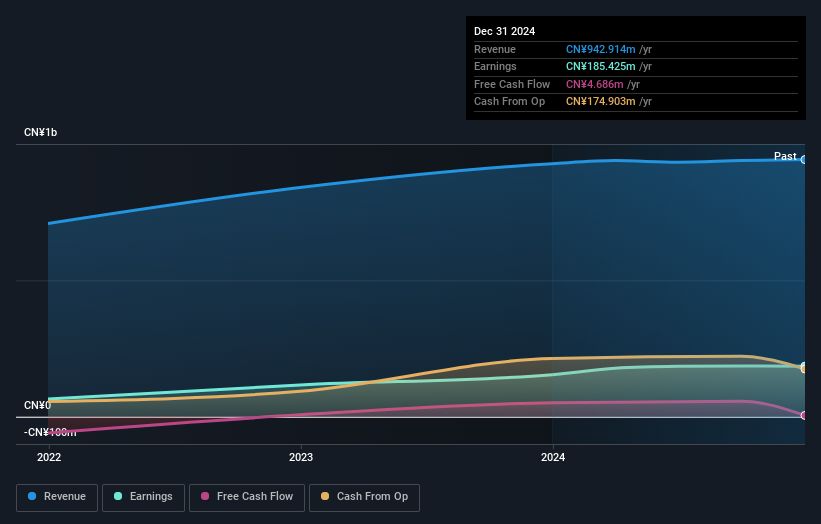

Overview: Suzhou Tianmai Thermal Technology Co., Ltd. specializes in the production of thermal management solutions and components, with a market capitalization of CN¥9.14 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, which amounts to CN¥956.46 million.

Suzhou Tianmai Thermal Technology, a promising player in the thermal technology sector, showcases robust financial health with earnings growth of 3.2% over the past year, outpacing the industry average of 2.7%. The company boasts high-quality earnings and maintains a debt-to-equity ratio that has impressively decreased from 21.7% to just 0.1% over five years, indicating effective debt management. Despite a volatile share price recently, it remains profitable with positive free cash flow and more cash than total debt, underscoring its solid fiscal position. A recent dividend announcement further highlights shareholder value focus with CNY 5.60 per ten shares for 2024 approved at their latest AGM.

Key Takeaways

- Click through to start exploring the rest of the 2611 Asian Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301626

Suzhou Tianmai Thermal Technology

Suzhou Tianmai Thermal Technology Co., Ltd.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives