- China

- /

- Electrical

- /

- SHSE:603799

Zhejiang Huayou Cobalt Co., Ltd (SHSE:603799) Screens Well But There Might Be A Catch

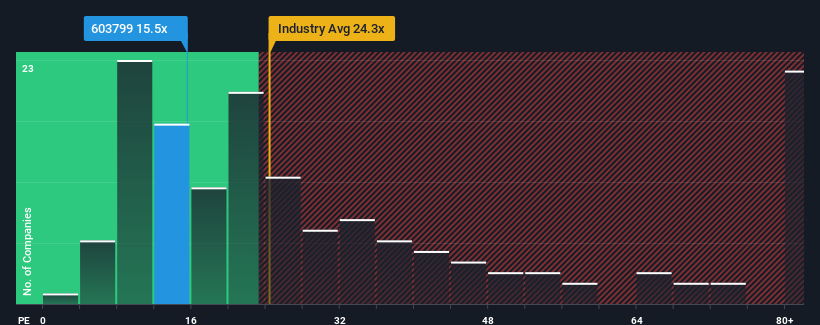

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Zhejiang Huayou Cobalt Co., Ltd (SHSE:603799) as an attractive investment with its 15.5x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Zhejiang Huayou Cobalt as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Zhejiang Huayou Cobalt

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Huayou Cobalt's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 14% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 18% each year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is not materially different.

With this information, we find it odd that Zhejiang Huayou Cobalt is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhejiang Huayou Cobalt's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for Zhejiang Huayou Cobalt (1 doesn't sit too well with us!) that you need to take into consideration.

You might be able to find a better investment than Zhejiang Huayou Cobalt. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huayou Cobalt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603799

Zhejiang Huayou Cobalt

Engages in the research, development, manufacture, and sale of lithium battery materials and diamond material products in China and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives