As global markets navigate a landscape of geopolitical tensions and economic uncertainties, smaller-cap indexes have shown resilience, outperforming their larger counterparts amid fluctuating conditions. In Asia, this environment presents unique opportunities for investors to explore lesser-known stocks that demonstrate strong fundamentals and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | NA | 22.16% | 22.91% | ★★★★★★ |

| Jih Lin Technology | 54.08% | 1.96% | 1.22% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| Triocean Industrial Corporation | 21.89% | 47.09% | 77.47% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Guangdong Transtek Medical Electronics | 18.14% | -7.58% | -3.26% | ★★★★★☆ |

| Kondotec | 13.45% | 7.00% | 9.12% | ★★★★★☆ |

| Uniplus Electronics | 32.17% | 46.30% | 75.33% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Sanxiang Advanced Materials (SHSE:603663)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanxiang Advanced Materials Co., Ltd. specializes in the production and distribution of fused zirconia, cast modified materials, and single crystal fused aluminum materials, with a market capitalization of CN¥11.25 billion.

Operations: Sanxiang generates revenue primarily from its Specialty Chemicals segment, amounting to CN¥1.03 billion.

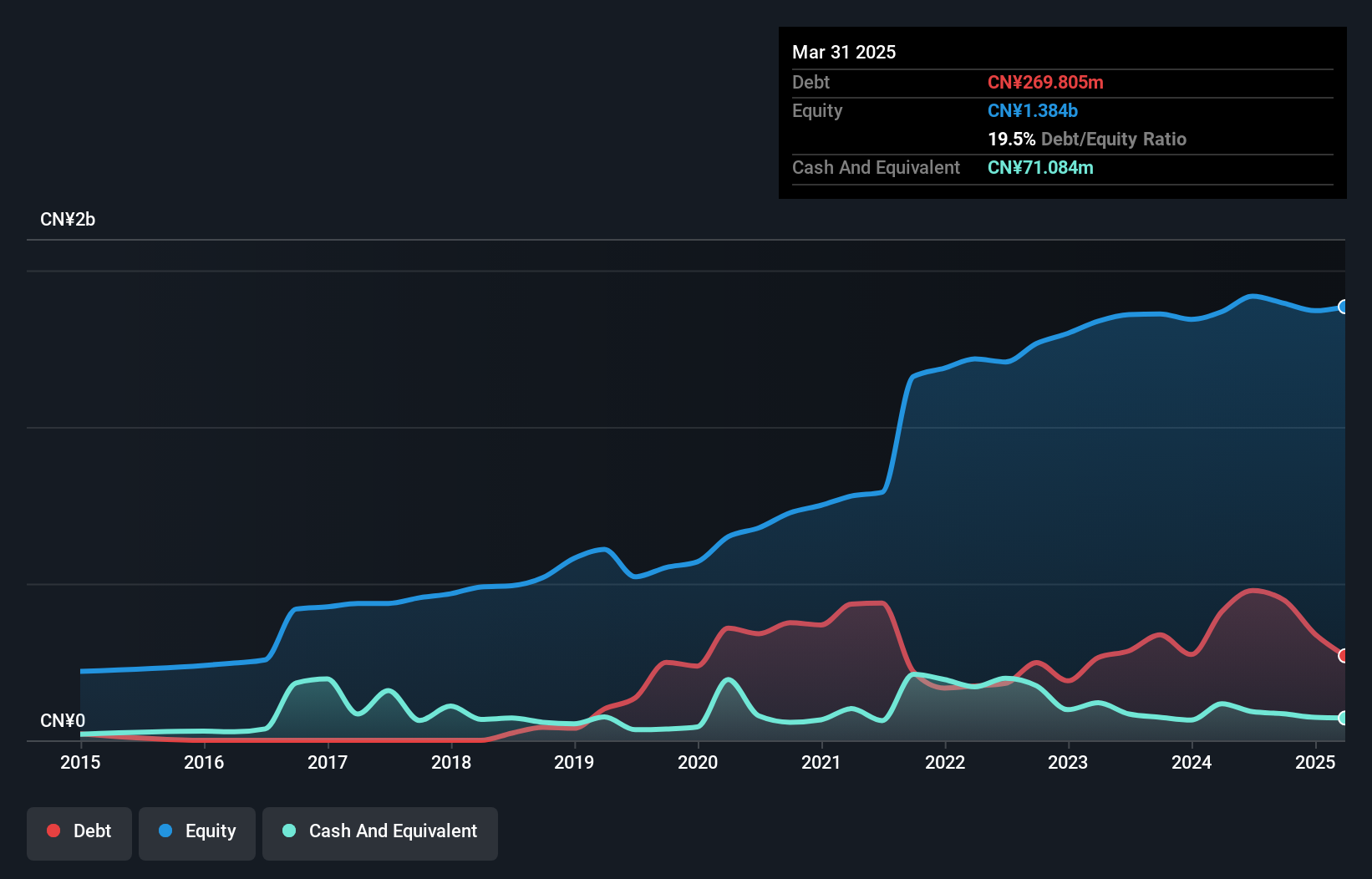

Sanxiang Advanced Materials, a promising player in the chemicals sector, has shown robust financial health with its net debt to equity ratio at 14.4%, comfortably below the industry benchmark. The company’s earnings growth of 12% outpaced the broader chemicals industry’s 4%, highlighting its competitive edge. Despite a dip in Q1 revenue to CNY 230.82 million from CNY 255.76 million last year, Sanxiang remains profitable with high-quality earnings and solid interest coverage at 8.1 times EBIT. Its debt reduction over five years from 55% to just under 20% further underscores prudent financial management amidst challenging market conditions.

- Take a closer look at Sanxiang Advanced Materials' potential here in our health report.

Gain insights into Sanxiang Advanced Materials' past trends and performance with our Past report.

Bozhon Precision Industry TechnologyLtd (SHSE:688097)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bozhon Precision Industry Technology Co., Ltd. specializes in industrial automation and control solutions, with a market cap of CN¥12.02 billion.

Operations: The company generates revenue primarily from its Industrial Automation & Controls segment, amounting to CN¥4.95 billion.

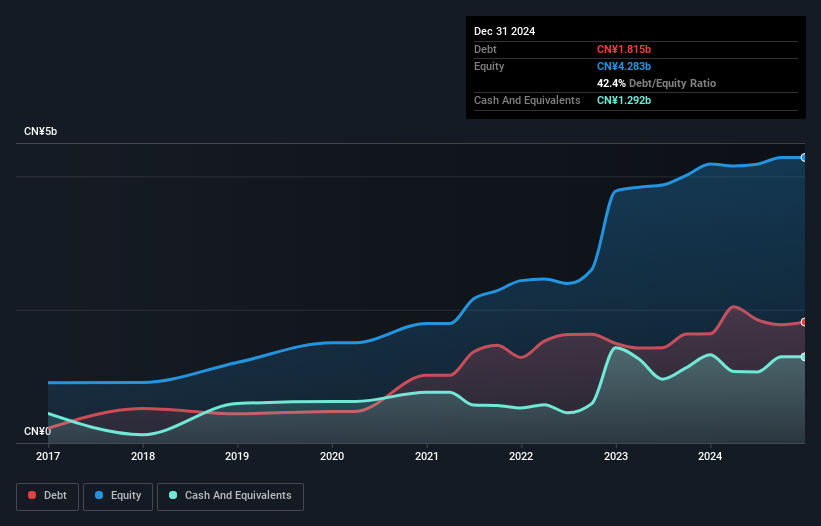

Bozhon Precision Industry Technology, a smaller player in the machinery sector, showcases a satisfactory net debt to equity ratio of 10.9%, indicating prudent financial management. Despite reporting a net loss of CNY 30.98 million for Q1 2025, the company remains free cash flow positive and its interest payments are well-covered by EBIT at 9.2x coverage. Earnings grew by 22.6% last year, outpacing the industry's growth rate of just 1%. However, recent volatility in share price and large one-off items impacting earnings suggest potential challenges ahead despite trading at a significant discount to estimated fair value.

- Click here and access our complete health analysis report to understand the dynamics of Bozhon Precision Industry TechnologyLtd.

Learn about Bozhon Precision Industry TechnologyLtd's historical performance.

Mesnac (SZSE:002073)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mesnac Co., Ltd. focuses on the research, development, and innovation of application software and information equipment for the rubber industry both in China and internationally, with a market cap of CN¥9.01 billion.

Operations: Mesnac generates revenue primarily from its application software and information equipment for the rubber industry. The company's market cap stands at CN¥9.01 billion.

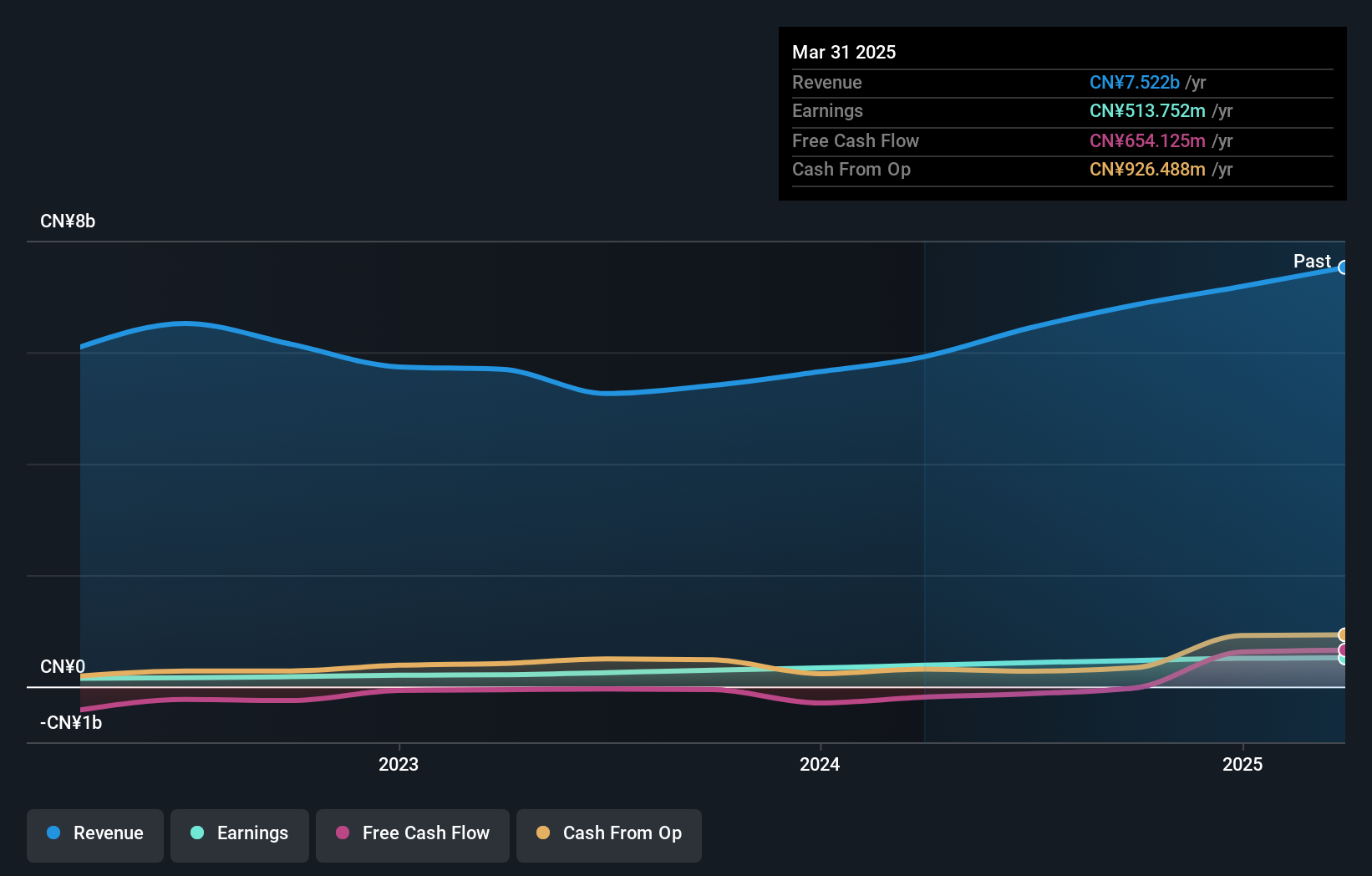

Mesnac, a notable player in the machinery sector, has demonstrated robust financial health with earnings growth of 34% over the past year, surpassing industry averages. Trading at 79% below its estimated fair value, Mesnac offers significant potential upside. The company reported net income of CNY 506 million for 2024, up from CNY 333 million in the previous year. Despite an increased debt to equity ratio from 16.5% to 35.4% over five years, Mesnac's interest coverage remains strong and it continues to generate positive free cash flow. Recent dividend affirmations further underscore its commitment to shareholder returns.

- Get an in-depth perspective on Mesnac's performance by reading our health report here.

Explore historical data to track Mesnac's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 2626 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bozhon Precision Industry TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688097

Bozhon Precision Industry TechnologyLtd

Bozhon Precision Industry Technology Co.,Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives