- China

- /

- Electrical

- /

- SZSE:001301

Global Growth Stocks Insiders Are Eager To Own

Reviewed by Simply Wall St

As global markets navigate a landscape of rising consumer inflation and mixed economic signals, investors are keenly observing the impact of robust corporate earnings on stock indices like the S&P 500 and Nasdaq Composite, which have recently reached new highs. In this environment, growth companies with substantial insider ownership often attract attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 61% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Pharma Mar (BME:PHM) | 11.8% | 43.3% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.6% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 25.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

Let's take a closer look at a couple of our picks from the screened companies.

Sunstone Development (SHSE:603612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunstone Development Co., Ltd. focuses on the R&D, production, and sales of prebaked carbon anodes for the aluminum industry both in China and globally, with a market cap of CN¥10.50 billion.

Operations: The company generates revenue primarily through the research, development, production, and sales of prebaked carbon anodes for the aluminum sector both domestically and internationally.

Insider Ownership: 36.1%

Earnings Growth Forecast: 25.7% p.a.

Sunstone Development has shown a turnaround, with net income of CNY 272.41 million for 2024 compared to a loss the previous year. Revenue and earnings are expected to grow faster than the Chinese market, at rates of 18.2% and 25.7% per year respectively. The company is trading at good value compared to peers, though debt coverage remains a concern. Insider ownership details over recent months are unavailable, which may affect investor confidence in management's alignment with shareholder interests.

- Dive into the specifics of Sunstone Development here with our thorough growth forecast report.

- Our expertly prepared valuation report Sunstone Development implies its share price may be lower than expected.

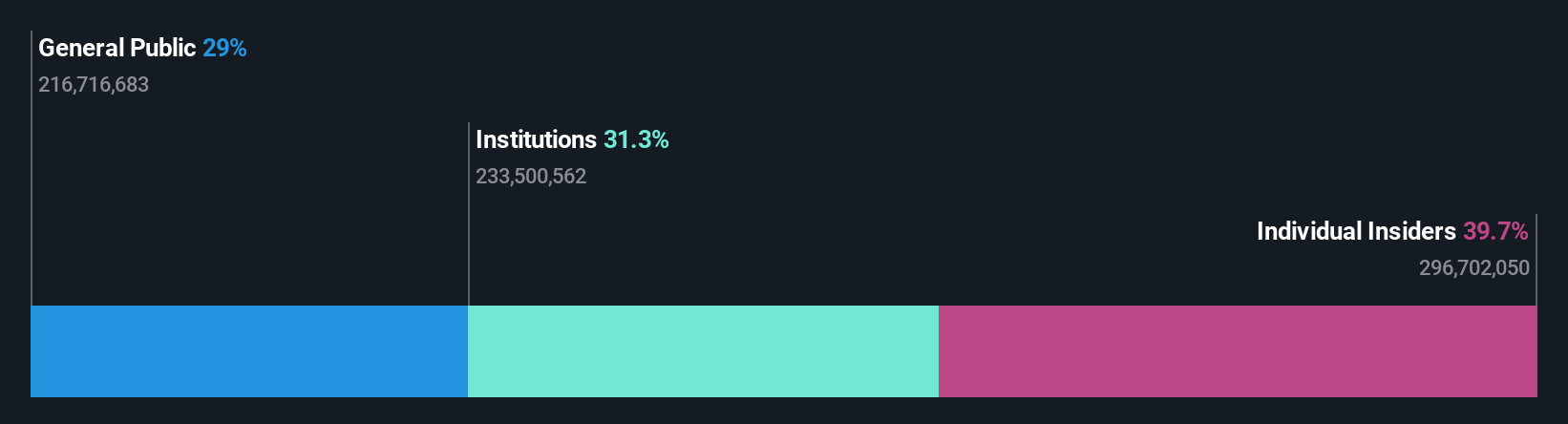

Shijiazhuang Shangtai Technology (SZSE:001301)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shijiazhuang Shangtai Technology Co., Ltd. operates in the technology sector and has a market cap of approximately CN¥13.54 billion.

Operations: Shijiazhuang Shangtai Technology Co., Ltd. operates in the technology sector with a market cap of approximately CN¥13.54 billion; however, specific revenue segments are not provided in the available data.

Insider Ownership: 39.5%

Earnings Growth Forecast: 20.7% p.a.

Shijiazhuang Shangtai Technology's recent performance highlights significant revenue growth, with sales reaching CNY 1.63 billion in Q1 2025, up from CNY 861.22 million a year prior. Earnings also rose to CNY 239.25 million, reflecting robust operational improvements. Despite a forecasted annual earnings growth of over 20%, this is slower than the broader Chinese market's expectations. The stock trades at an attractive P/E ratio of 15.6x compared to the market average and shows promising revenue expansion prospects exceeding market rates, although debt coverage issues persist.

- Click here and access our complete growth analysis report to understand the dynamics of Shijiazhuang Shangtai Technology.

- The valuation report we've compiled suggests that Shijiazhuang Shangtai Technology's current price could be quite moderate.

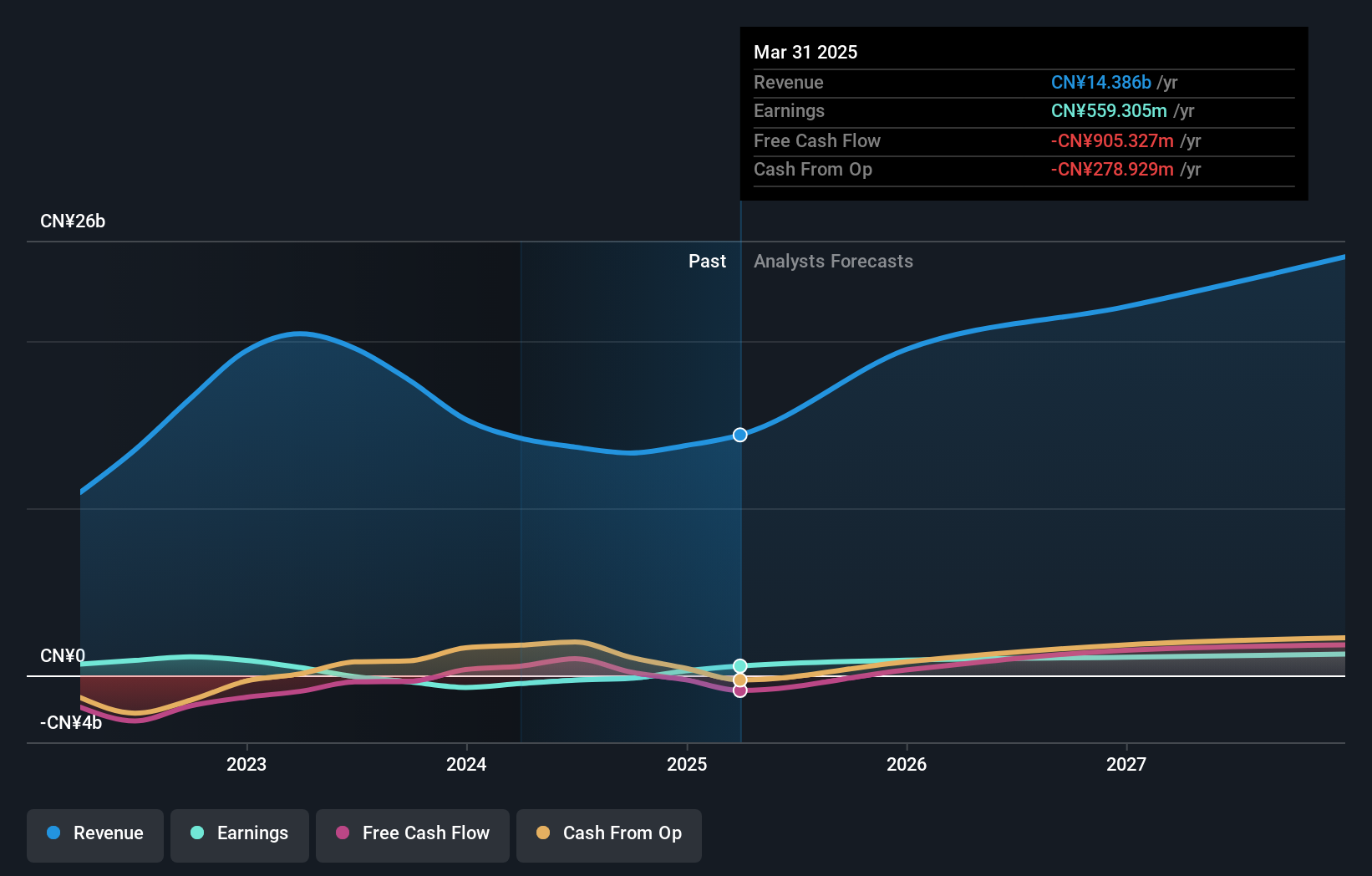

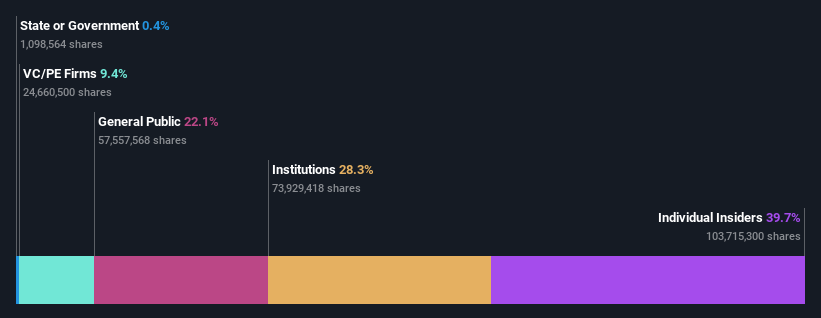

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials both in China and internationally with a market cap of CN¥25.07 billion.

Operations: Shenzhen Capchem Technology Co., Ltd. generates revenue through its activities in the electronic chemicals and functional materials sectors, serving both domestic and international markets.

Insider Ownership: 39.7%

Earnings Growth Forecast: 23.7% p.a.

Shenzhen Capchem Technology shows promising growth potential, with earnings forecasted to grow 23.68% annually, outpacing the Chinese market average. Despite a slower revenue growth rate of 19.4%, it remains above market expectations. The company's P/E ratio of 26x suggests good relative value compared to the broader CN market at 41.5x. Recent buybacks totaling CNY 199.95 million indicate strategic capital allocation, though its dividend yield is not well covered by free cash flows, presenting a potential risk factor.

- Click to explore a detailed breakdown of our findings in Shenzhen Capchem Technology's earnings growth report.

- The analysis detailed in our Shenzhen Capchem Technology valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Reveal the 814 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001301

Shijiazhuang Shangtai Technology

Shijiazhuang Shangtai Technology Co., Ltd.

Good value with reasonable growth potential.

Market Insights

Community Narratives