- China

- /

- Paper and Forestry Products

- /

- SHSE:603607

Uncovering Three Asian Undiscovered Gems with Strong Financial Metrics

Reviewed by Simply Wall St

In the wake of a temporary de-escalation in U.S.-China trade tensions, Asian markets have shown resilience, with key indices such as China's CSI 300 Index and Japan's Nikkei 225 experiencing gains. As investors navigate these shifting dynamics, identifying stocks with robust financial metrics becomes crucial for capitalizing on potential opportunities in this evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Brillian Network & Automation Integrated System | NA | 22.16% | 22.91% | ★★★★★★ |

| Imuraya Group | 4.07% | 4.41% | 30.80% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Hunan Hansen Pharmaceutical | 3.84% | 4.16% | 10.80% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| CMC | 1.18% | 2.83% | 9.80% | ★★★★★☆ |

| Dura Tek | 4.98% | 42.18% | 94.37% | ★★★★★☆ |

| Zhe Jiang Dayang Biotech Group | 29.02% | 8.38% | -9.33% | ★★★★★☆ |

| Nippon Sharyo | 53.44% | -0.74% | -11.37% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Zhejiang Jinghua Laser TechnologyLtd (SHSE:603607)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Jinghua Laser Technology Co., Ltd specializes in the development, manufacturing, and sale of laser holographic molded products with a market capitalization of CN¥4.06 billion.

Operations: Zhejiang Jinghua Laser Technology's primary revenue stream is the sale of laser holographic molded products. The company has a market capitalization of CN¥4.06 billion.

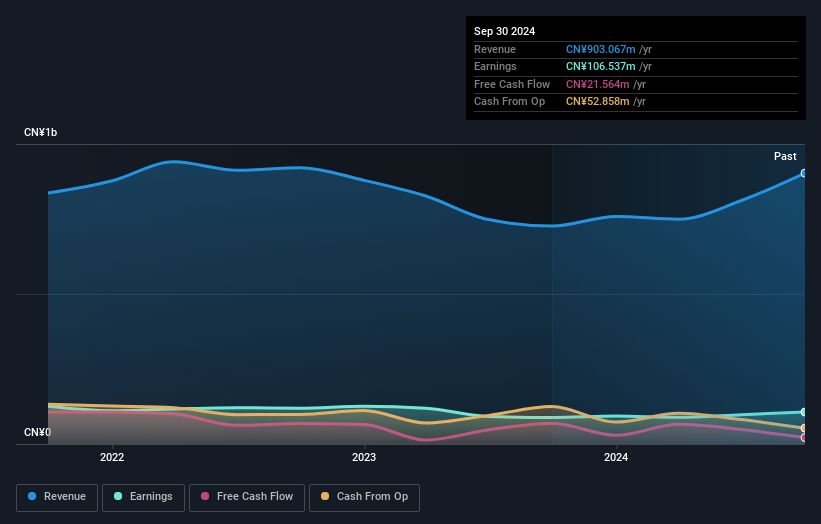

Zhejiang Jinghua Laser Technology, a nimble player in the tech sector, has shown promising growth with earnings climbing 21% over the past year, outpacing its industry peers. Despite a 1.7% annual decline in earnings over five years, recent performance is strong with Q1 sales reaching CNY 239.12 million from CNY 188.21 million last year and net income rising to CNY 25.41 million. The company boasts high-quality past earnings and maintains an appropriate debt level with more cash than total debt, suggesting robust financial health despite an increased debt-to-equity ratio of 31% over five years.

Tianjin Yiyi Hygiene ProductsLtd (SZSE:001206)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Yiyi Hygiene Products Co., Ltd focuses on the research, development, design, production, and sale of disposable pet and personal hygiene care products both in China and internationally, with a market cap of CN¥4.20 billion.

Operations: The company generates revenue primarily from the sale of disposable pet and personal hygiene care products. It operates both domestically in China and internationally. With a market cap of approximately CN¥4.20 billion, the business focuses on leveraging its research and development capabilities to enhance product offerings in these segments.

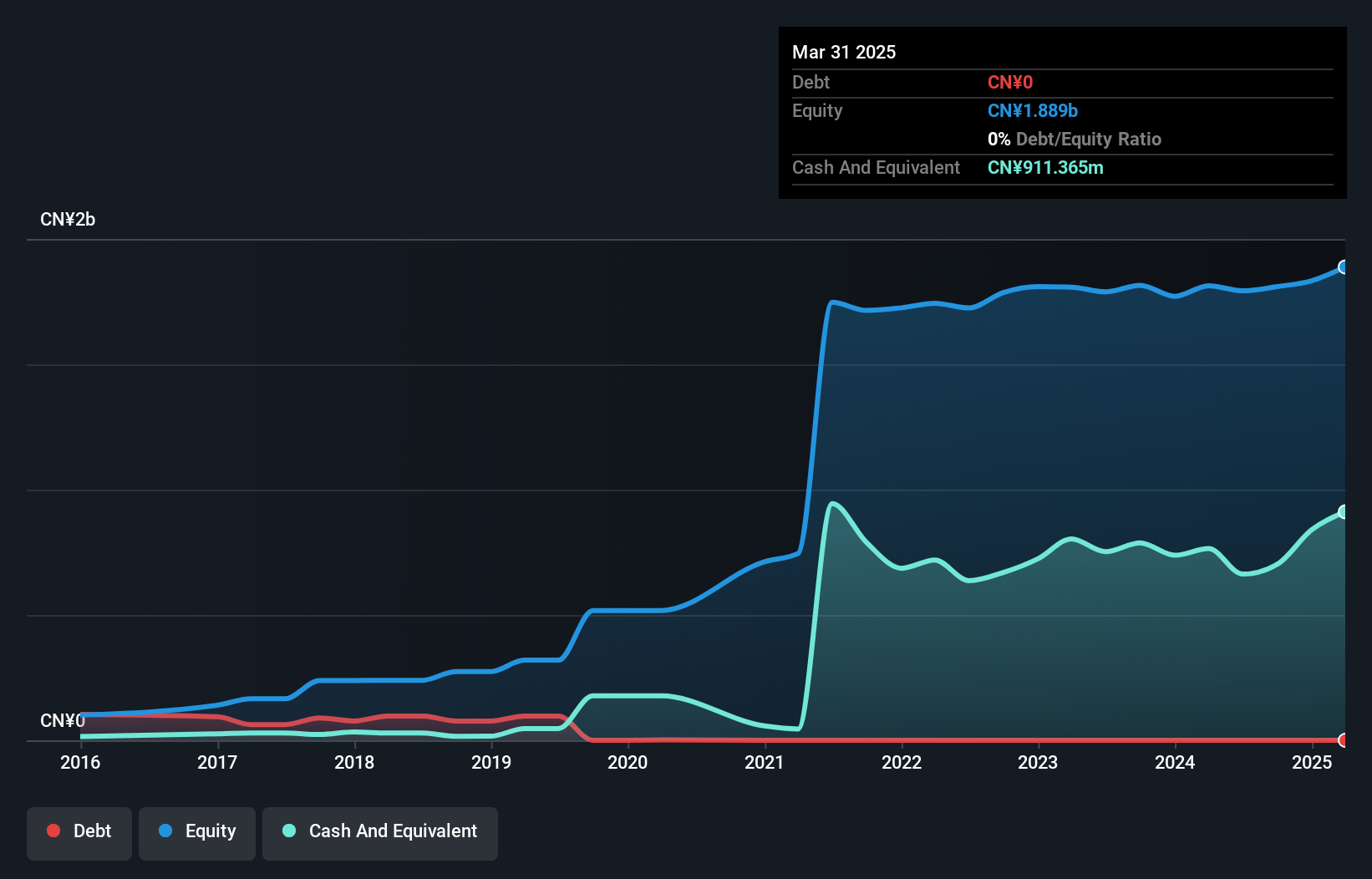

Tianjin Yiyi Hygiene Products, a nimble player in the hygiene sector, showcases impressive growth with earnings surging 53.6% over the past year, outpacing its industry peers. The company is debt-free now compared to a 0.4 debt-to-equity ratio five years ago, reflecting strong financial health. Trading at 25.6% below estimated fair value suggests potential undervaluation for investors eyeing opportunities in Asia's market landscape. Recent developments include a CNY 3.70 dividend per ten shares and an authorized share buyback program worth up to CNY 40 million, indicating confidence in future prospects and shareholder value enhancement strategies.

- Dive into the specifics of Tianjin Yiyi Hygiene ProductsLtd here with our thorough health report.

Learn about Tianjin Yiyi Hygiene ProductsLtd's historical performance.

GuangDong Suqun New MaterialLtd (SZSE:301489)

Simply Wall St Value Rating: ★★★★★☆

Overview: GuangDong Suqun New Material Co., Ltd. is involved in the research, development, production, and sale of functional materials in China with a market cap of CN¥4.69 billion.

Operations: The company generates revenue primarily from the sale of functional materials. It focuses on research and development to enhance its product offerings and market position. The cost structure includes expenses related to production, impacting profitability metrics such as net profit margin, which has shown varying trends over recent periods.

GuangDong Suqun New Material Ltd. has shown impressive sales growth, with first-quarter 2025 revenue reaching CNY 183.33 million compared to CNY 94.7 million a year earlier, while net income rose to CNY 17.72 million from CNY 9.87 million. Despite this, the company's full-year net profit for 2024 slightly dipped to CNY 52.46 million from the previous year's CNY 54.58 million, reflecting a decrease in profit margins from last year's figure of 12% to the current level of around 8%. The firm holds more cash than its total debt and has seen its debt-to-equity ratio increase over five years from about 7% to nearly10%.

Taking Advantage

- Click this link to deep-dive into the 2618 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Jinghua Laser TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603607

Zhejiang Jinghua Laser TechnologyLtd

Develops, manufactures, and sells laser holographic molded products.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion