- China

- /

- Metals and Mining

- /

- SHSE:603327

Investors Appear Satisfied With Sichuan Furong Technology Co., Ltd.'s (SHSE:603327) Prospects As Shares Rocket 35%

Sichuan Furong Technology Co., Ltd. (SHSE:603327) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

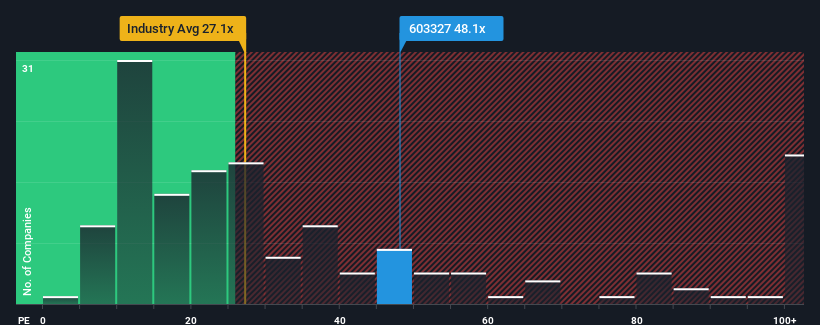

After such a large jump in price, Sichuan Furong Technology's price-to-earnings (or "P/E") ratio of 48.1x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 32x and even P/E's below 19x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings that are retreating more than the market's of late, Sichuan Furong Technology has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Sichuan Furong Technology

How Is Sichuan Furong Technology's Growth Trending?

In order to justify its P/E ratio, Sichuan Furong Technology would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. As a result, earnings from three years ago have also fallen 26% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 47% during the coming year according to the two analysts following the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Sichuan Furong Technology's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Sichuan Furong Technology's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Sichuan Furong Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sichuan Furong Technology (at least 2 which are significant), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Sichuan Furong Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603327

Sichuan Furong Technology

Engages in the research, development, production, and sale of aluminum structural parts for consumer electronics products.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026