- China

- /

- Metals and Mining

- /

- SHSE:603315

Getting In Cheap On Liaoning Fu-An Heavy Industry Co.,Ltd (SHSE:603315) Is Unlikely

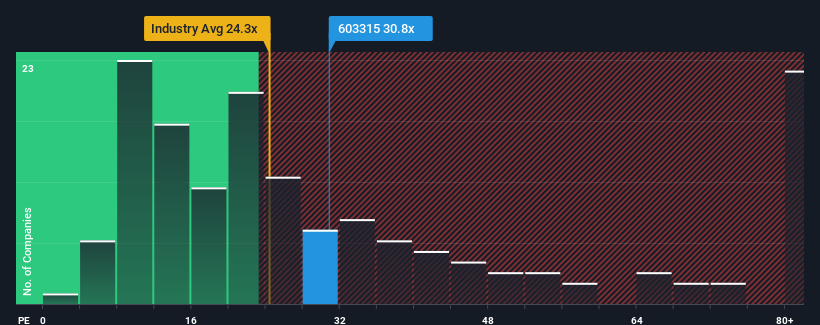

There wouldn't be many who think Liaoning Fu-An Heavy Industry Co.,Ltd's (SHSE:603315) price-to-earnings (or "P/E") ratio of 30.8x is worth a mention when the median P/E in China is similar at about 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Liaoning Fu-An Heavy IndustryLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Liaoning Fu-An Heavy IndustryLtd

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Liaoning Fu-An Heavy IndustryLtd's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 90% last year. As a result, it also grew EPS by 7.1% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Liaoning Fu-An Heavy IndustryLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Liaoning Fu-An Heavy IndustryLtd's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Liaoning Fu-An Heavy IndustryLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Liaoning Fu-An Heavy IndustryLtd has 3 warning signs (and 1 which is significant) we think you should know about.

If these risks are making you reconsider your opinion on Liaoning Fu-An Heavy IndustryLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603315

Liaoning Fu-An Heavy IndustryLtd

Produces and sells steel castings in China.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives