- China

- /

- Auto Components

- /

- SZSE:300304

Discovering Hidden Stock Treasures In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing a mixed bag of economic signals, with U.S. consumer confidence dipping and key indices like the S&P 500 and Nasdaq Composite showing moderate gains despite some volatility. Amid these shifting dynamics, investors are increasingly on the lookout for small-cap opportunities that may be undervalued or overlooked by larger market trends. In such an environment, stocks that demonstrate resilience through strong fundamentals and potential for growth can stand out as hidden treasures worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Liaoning Fu-An Heavy IndustryLtd (SHSE:603315)

Simply Wall St Value Rating: ★★★★☆☆

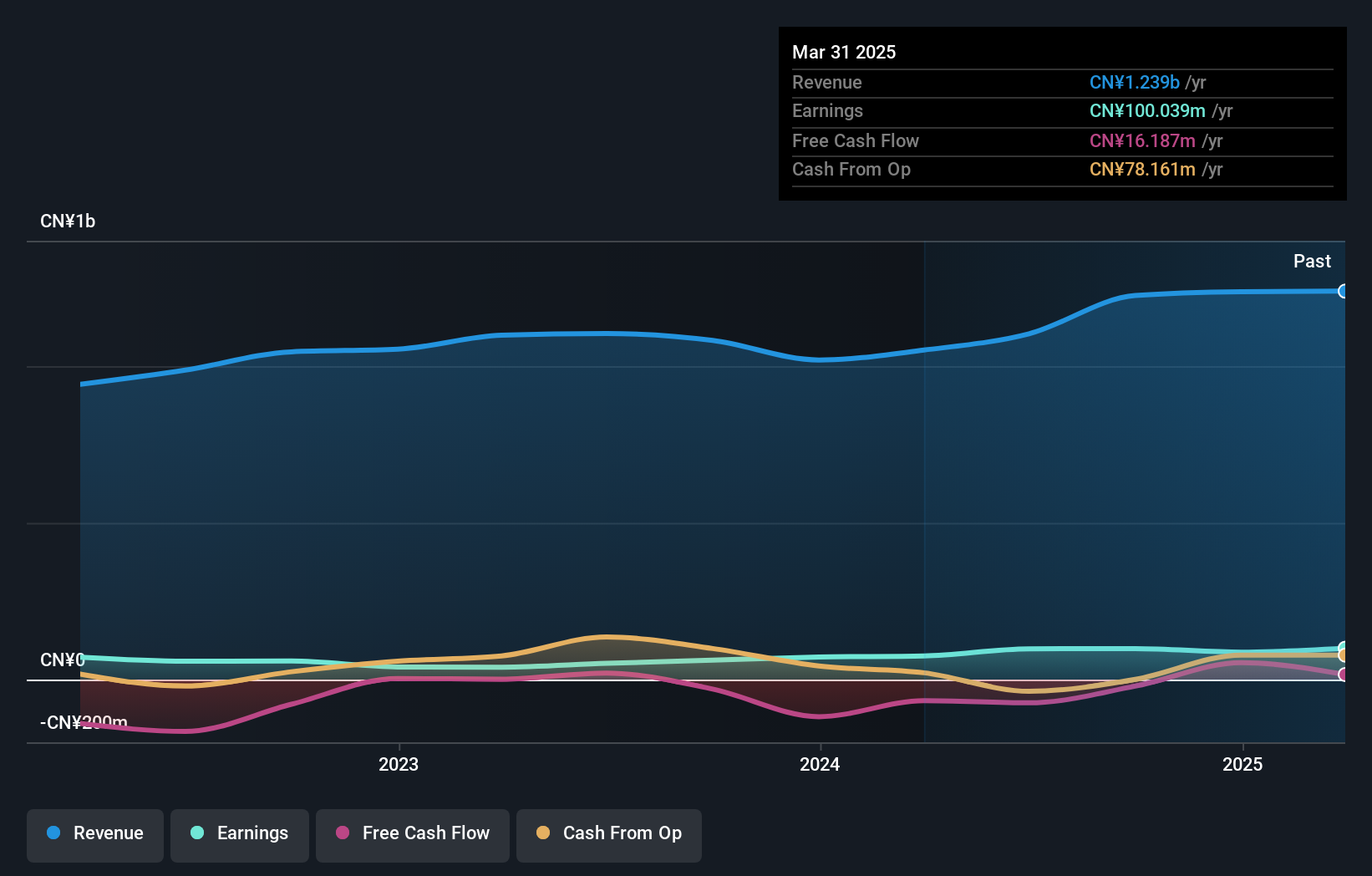

Overview: Liaoning Fu-An Heavy Industry Co., Ltd specializes in the production and sale of steel castings in China, with a market capitalization of CN¥3.51 billion.

Operations: Liaoning Fu-An Heavy Industry Co., Ltd generates revenue primarily from the production and sale of steel castings. The company's gross profit margin has shown fluctuations, reflecting changes in production efficiency or cost management.

Liaoning Fu-An Heavy Industry, a smaller player in the industry, has shown impressive growth with earnings surging by 59.5% over the past year, outpacing its sector's average. The company reported sales of ¥935.1 million for the first nine months of 2024, up from ¥729.5 million in the previous year. Net income also rose to ¥83.09 million from ¥56.05 million last year, highlighting its profitability despite a challenging environment where earnings have declined by 13.1% annually over five years. Its net debt to equity ratio stands at a satisfactory 22.6%, supporting financial stability amidst industry fluctuations.

Jiangsu Yunyi ElectricLtd (SZSE:300304)

Simply Wall St Value Rating: ★★★★★★

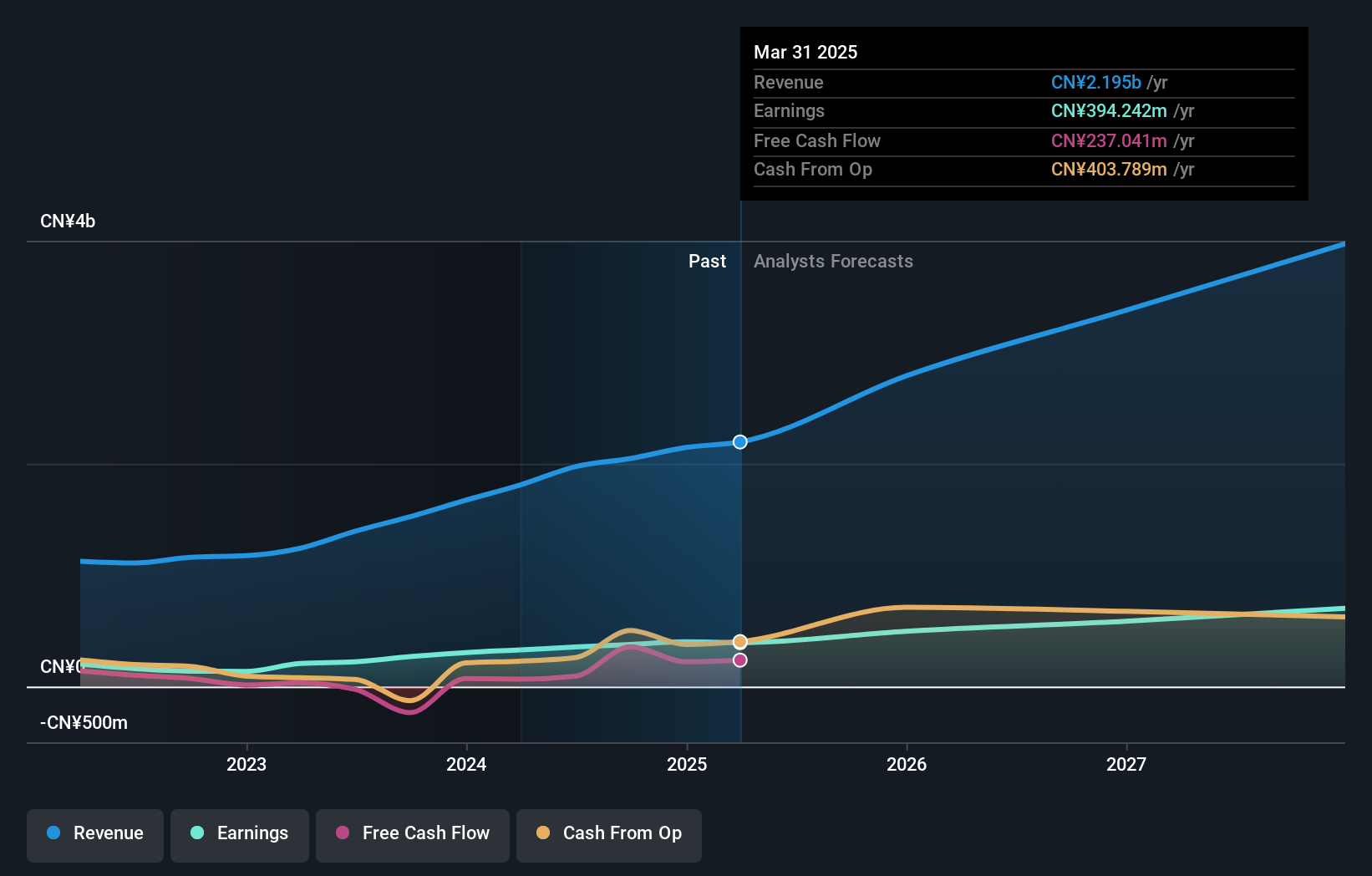

Overview: Jiangsu Yunyi Electric Co., Ltd. engages in the research, development, manufacturing, marketing, and sales of automotive electronic parts both in China and internationally, with a market capitalization of CN¥7.10 billion.

Operations: Yunyi Electric generates revenue primarily through the sale of automotive electronic parts. The company's financial performance is impacted by its cost structure, which includes expenses related to research, development, and manufacturing.

Jiangsu Yunyi Electric, a nimble player in the auto components sector, showcases a robust financial profile with earnings growth of 40.9% over the past year, outpacing the industry average of 10.5%. The company is trading at an attractive 63.1% below its estimated fair value and has reduced its debt to equity ratio from 13.8% to just 0.3% over five years, indicating strong financial health. Recent revenue for nine months ended September soared to CNY 1.56 billion from CNY 1.18 billion last year, while net income increased to CNY 307 million from CNY 234 million, reflecting solid operational performance and potential for continued growth in profitability.

- Navigate through the intricacies of Jiangsu Yunyi ElectricLtd with our comprehensive health report here.

Learn about Jiangsu Yunyi ElectricLtd's historical performance.

Asanuma (TSE:1852)

Simply Wall St Value Rating: ★★★★★☆

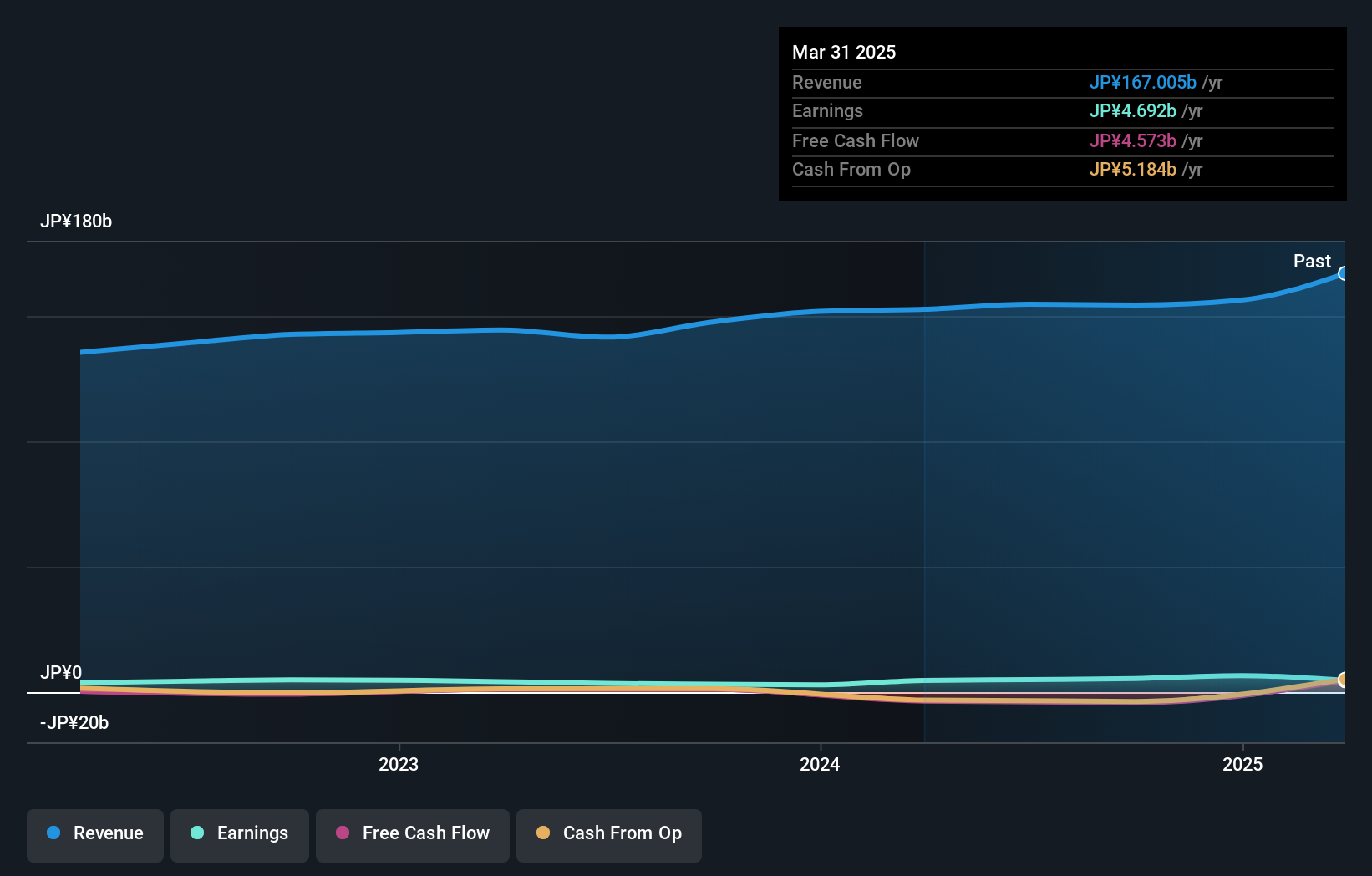

Overview: Asanuma Corporation is a general contractor that engages in construction and civil engineering projects both in Japan and internationally, with a market capitalization of approximately ¥53.85 billion.

Operations: Asanuma Corporation generates revenue primarily from its construction and civil engineering segments, with ¥79.97 billion from construction and ¥70.94 billion from civil engineering. The company's focus on these core areas highlights its strategic allocation of resources towards infrastructure development projects in both domestic and international markets.

Asanuma, a notable player in the construction sector, has shown impressive earnings growth of 71% over the past year, outpacing the industry average of 21%. The company's debt-to-equity ratio improved from 30% to 24% over five years, indicating prudent financial management. Despite a slight annual earnings decline of 0.7% over five years, Asanuma is trading at a value slightly below its estimated fair value by about 2%. With high-quality non-cash earnings and satisfactory interest coverage, Asanuma seems well-positioned for stable performance. Recently, it announced a dividend of ¥15 per share for shareholders as of September end.

- Take a closer look at Asanuma's potential here in our health report.

Understand Asanuma's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 4626 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300304

Jiangsu Yunyi ElectricLtd

Researches, develops, manufactures, markets, and sells automotive electronic parts in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives