Discovering December 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts in Europe and expectations for further reductions by the Federal Reserve, small-cap stocks have faced headwinds, with the Russell 2000 Index underperforming its larger-cap counterparts. Amidst these dynamics, identifying promising small-cap opportunities requires a keen eye for companies that demonstrate resilience and potential growth in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Deyaar Development PJSC (DFM:DEYAAR)

Simply Wall St Value Rating: ★★★★★★

Overview: Deyaar Development PJSC operates in the United Arab Emirates and internationally, offering property investment, development, and management services through its subsidiaries, with a market capitalization of approximately AED4.17 billion.

Operations: Deyaar Development PJSC generates revenue primarily from property development activities, contributing AED1.09 billion, followed by properties and facilities management at AED157.25 million, and hospitality services at AED110.65 million.

Deyaar Development PJSC shines with its impressive earnings growth of 90.9% over the past year, outpacing the Real Estate industry's 46.8%. The company reported a net income of AED 139.8 million for Q3 2024, up from AED 119.03 million in the previous year, with basic earnings per share rising to AED 0.032 from AED 0.0272. Despite a significant one-off gain of AED108 million influencing recent results, Deyaar's financial health appears strong as it holds more cash than total debt and boasts an attractive price-to-earnings ratio of 7.8x compared to the AE market's average of 12.7x.

Zhejiang Oceanking Development (SHSE:603213)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Oceanking Development Co., Ltd. focuses on the research, development, production, and sale of chlor-alkali-related products with a market capitalization of CN¥4.30 billion.

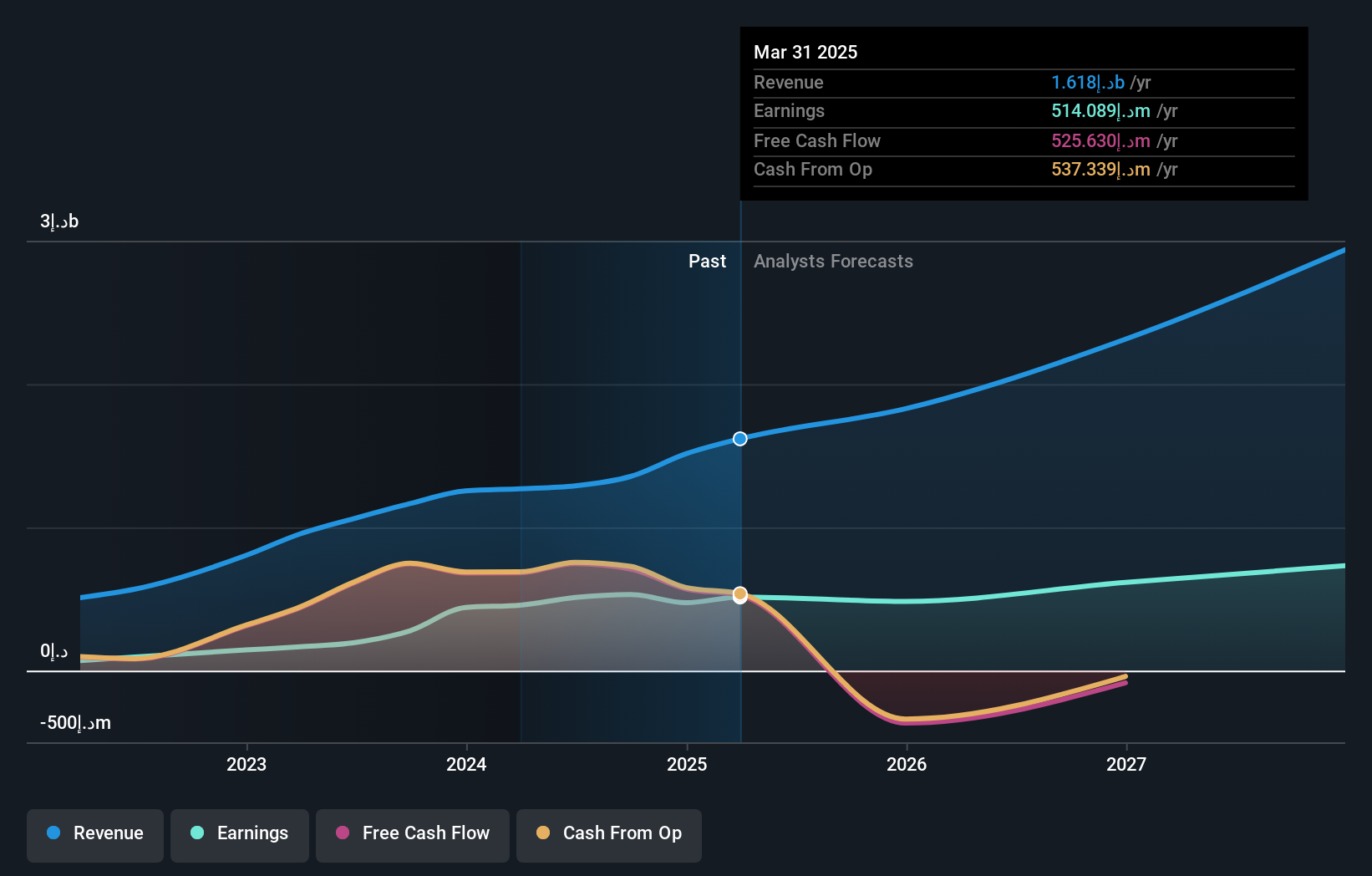

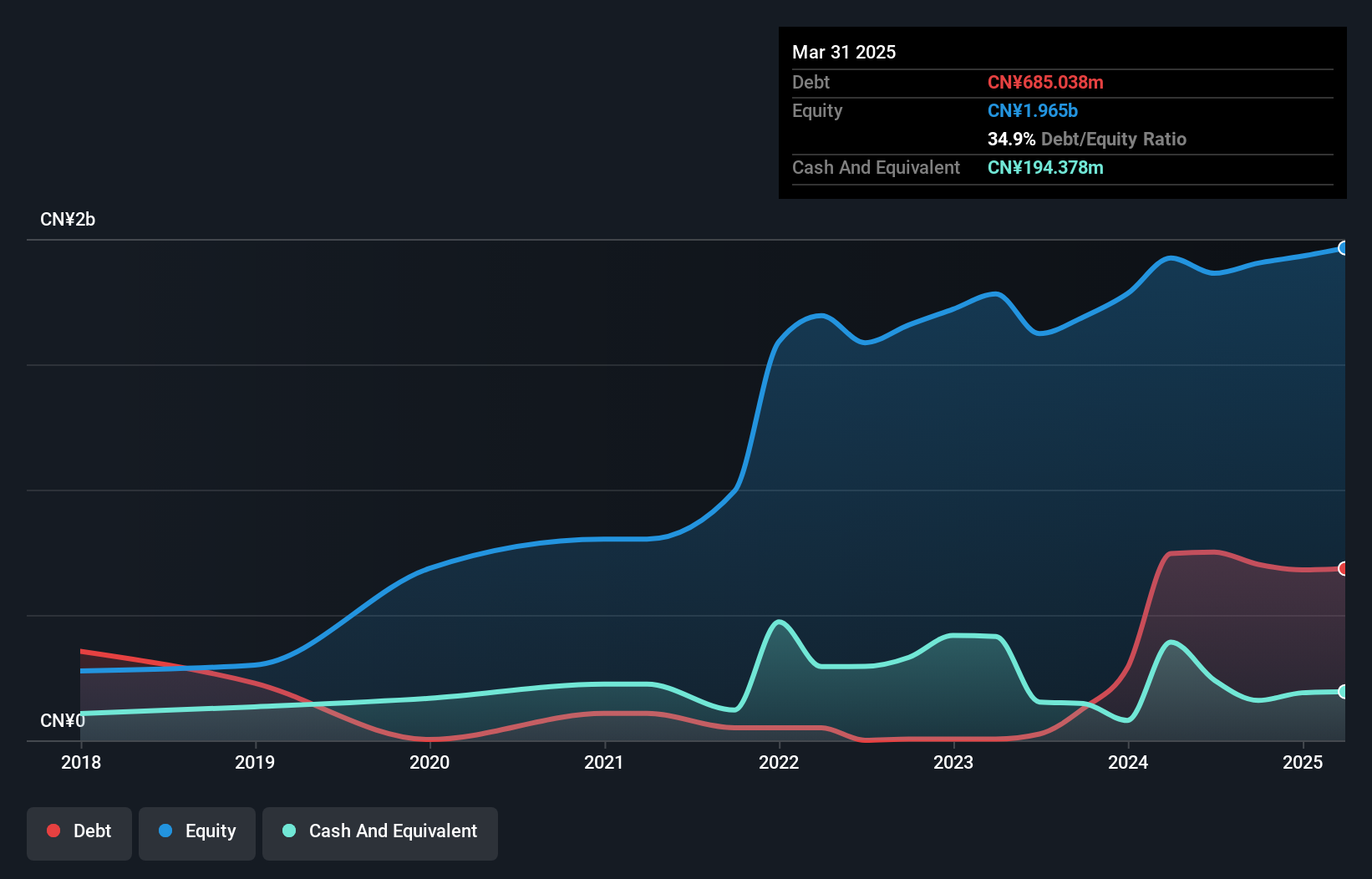

Operations: The company generates revenue primarily from the sale of chlor-alkali-related products. Its cost structure is influenced by raw material expenses and production costs, impacting its overall profitability. The net profit margin has shown variations over recent periods, reflecting changes in operational efficiency and market conditions.

Zhejiang Oceanking Development, a small player in its field, has shown resilience with a debt to equity ratio climbing from 10.2% to 36.9% over five years, yet maintaining satisfactory interest coverage at 39 times EBIT. Despite the challenges, earnings grew by 12.4%, outpacing the broader Chemicals industry which saw a -4.7% performance last year. The price-to-earnings ratio of 18.7x is appealing compared to the broader CN market's 37x average, suggesting potential value for investors seeking opportunities in smaller companies with robust fundamentals and growth prospects despite some fluctuations in net income recently reported at CNY149 million against CNY154 million previously.

Jiangsu Libert (SHSE:605167)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Libert INC. designs, manufactures, and sells industrial modules in China and internationally, with a market cap of CN¥4.54 billion.

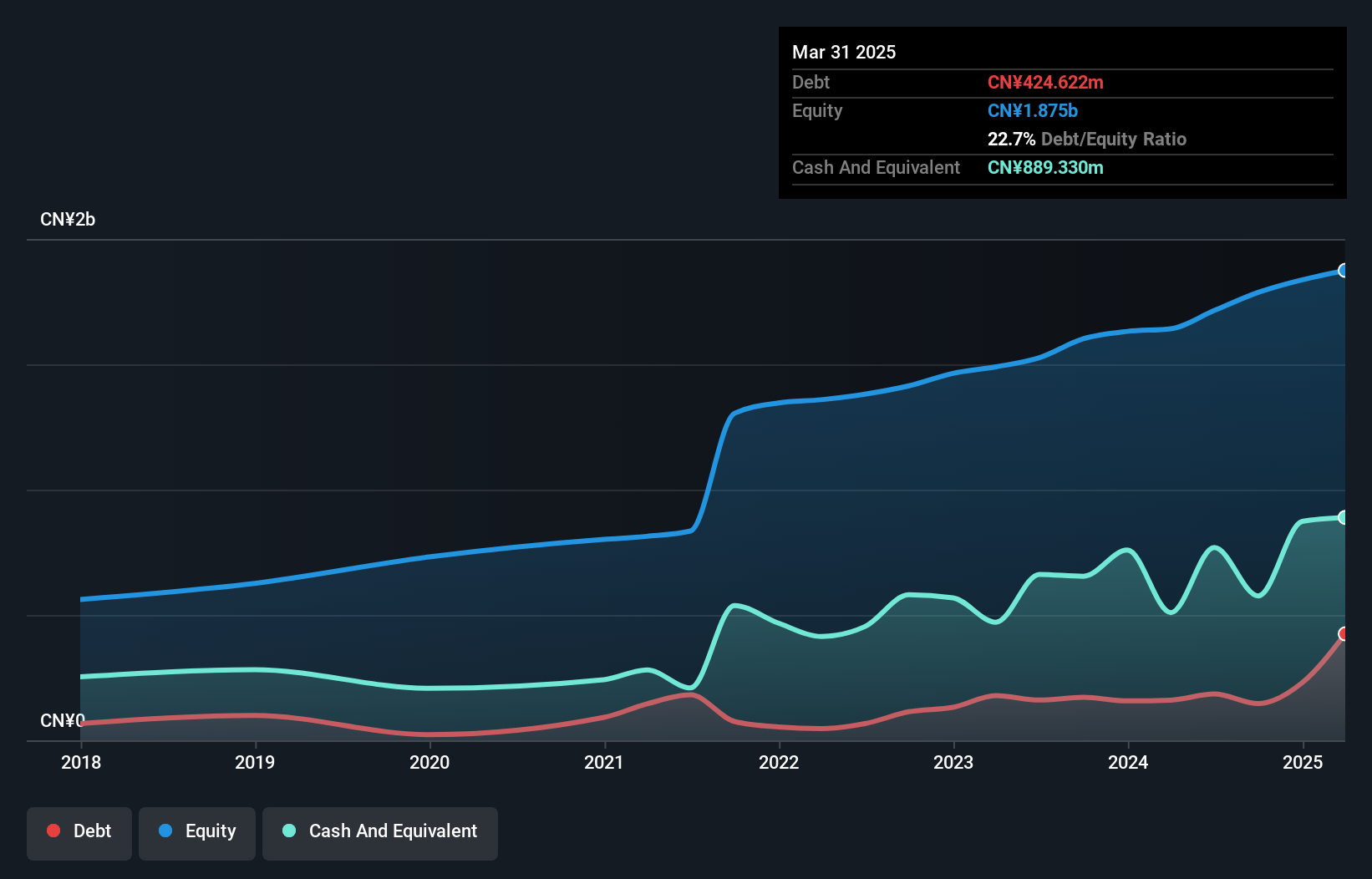

Operations: Jiangsu Libert generates revenue primarily from the sale of industrial modules. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its ability to convert sales into profit efficiently.

Jiangsu Libert, a promising player in its field, has shown notable growth with earnings increasing by 3.4% over the past year, surpassing the construction industry's -3.9%. The company seems to be on solid ground with its debt well covered by EBIT at 177.5 times interest payments and a price-to-earnings ratio of 19.4x, which is favorable compared to the CN market's 37.3x. Recent financials reveal sales of CNY 2.59 billion for nine months ending September 2024, up from CNY 2.38 billion last year, and net income rose to CNY 200 million from CNY 157 million previously, indicating strong operational performance and potential for future growth.

- Click to explore a detailed breakdown of our findings in Jiangsu Libert's health report.

Review our historical performance report to gain insights into Jiangsu Libert's's past performance.

Turning Ideas Into Actions

- Reveal the 4502 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Oceanking Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603213

Zhejiang Oceanking Development

Engages in the research, development, production, and sale of chlor-alkali-related products.

Excellent balance sheet with low risk.

Market Insights

Community Narratives