As global markets navigate a complex landscape marked by mixed performances in major indices and shifting economic policies, Asia's small-cap stocks present intriguing opportunities for investors seeking growth amid broader market uncertainties. In this environment, identifying promising stocks often involves looking beyond immediate headlines to uncover companies with strong fundamentals, innovative business models, and potential resilience against macroeconomic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.58% | 38.70% | ★★★★★★ |

| Sinopower Semiconductor | NA | 0.64% | -7.63% | ★★★★★★ |

| Cresco | 5.50% | 9.09% | 11.32% | ★★★★★★ |

| Ohashi Technica | NA | 6.56% | -6.88% | ★★★★★★ |

| Advanced International Multitech | 30.42% | 1.80% | -3.87% | ★★★★★★ |

| Champion Building MaterialsLtd | 29.77% | -2.25% | 8.58% | ★★★★★★ |

| Chin Hsin Environ Engineering | 6.12% | 40.89% | 41.55% | ★★★★★☆ |

| Pacific Construction | 22.17% | -12.87% | 37.11% | ★★★★★☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Huangma TechnologyLtd (SHSE:603181)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Huangma Technology Co., Ltd is engaged in the research, development, production, and sale of surfactants both domestically in China and internationally with a market capitalization of CN¥10.75 billion.

Operations: Zhejiang Huangma Technology generates revenue primarily from its specialty chemicals segment, which contributed CN¥2.43 billion. The company's market capitalization stands at CN¥10.75 billion.

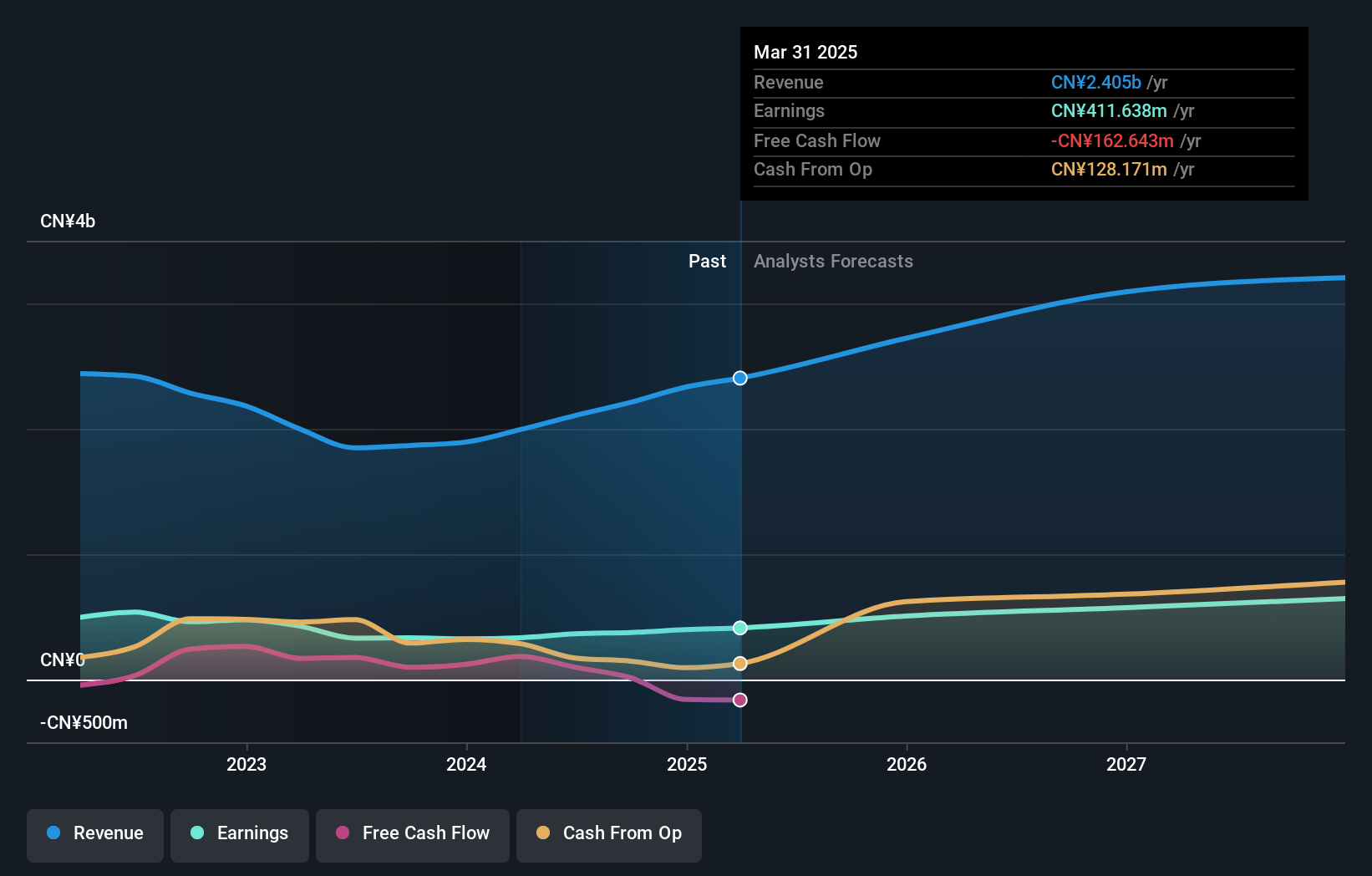

Zhejiang Huangma Technology, a nimble player in the chemicals sector, saw its earnings grow by 19.7% over the past year, outpacing the industry's 6.1% growth rate. The company reported sales of CNY 1.82 billion for the first nine months of 2025, up from CNY 1.72 billion a year ago, with net income rising to CNY 337 million from CNY 286 million. Despite a volatile share price recently, its price-to-earnings ratio at 23.9x remains attractive compared to the broader Chinese market's average of 45x and it holds more cash than total debt, indicating financial resilience and potential for future growth.

FSPG Hi-Tech (SZSE:000973)

Simply Wall St Value Rating: ★★★★★★

Overview: FSPG Hi-Tech Co., Ltd. is engaged in the manufacturing and sale of plastic materials in China, with a market capitalization of CN¥8.57 billion.

Operations: FSPG Hi-Tech generates revenue primarily from the sale of plastic materials. The company's net profit margin is a key financial indicator to consider when evaluating its profitability.

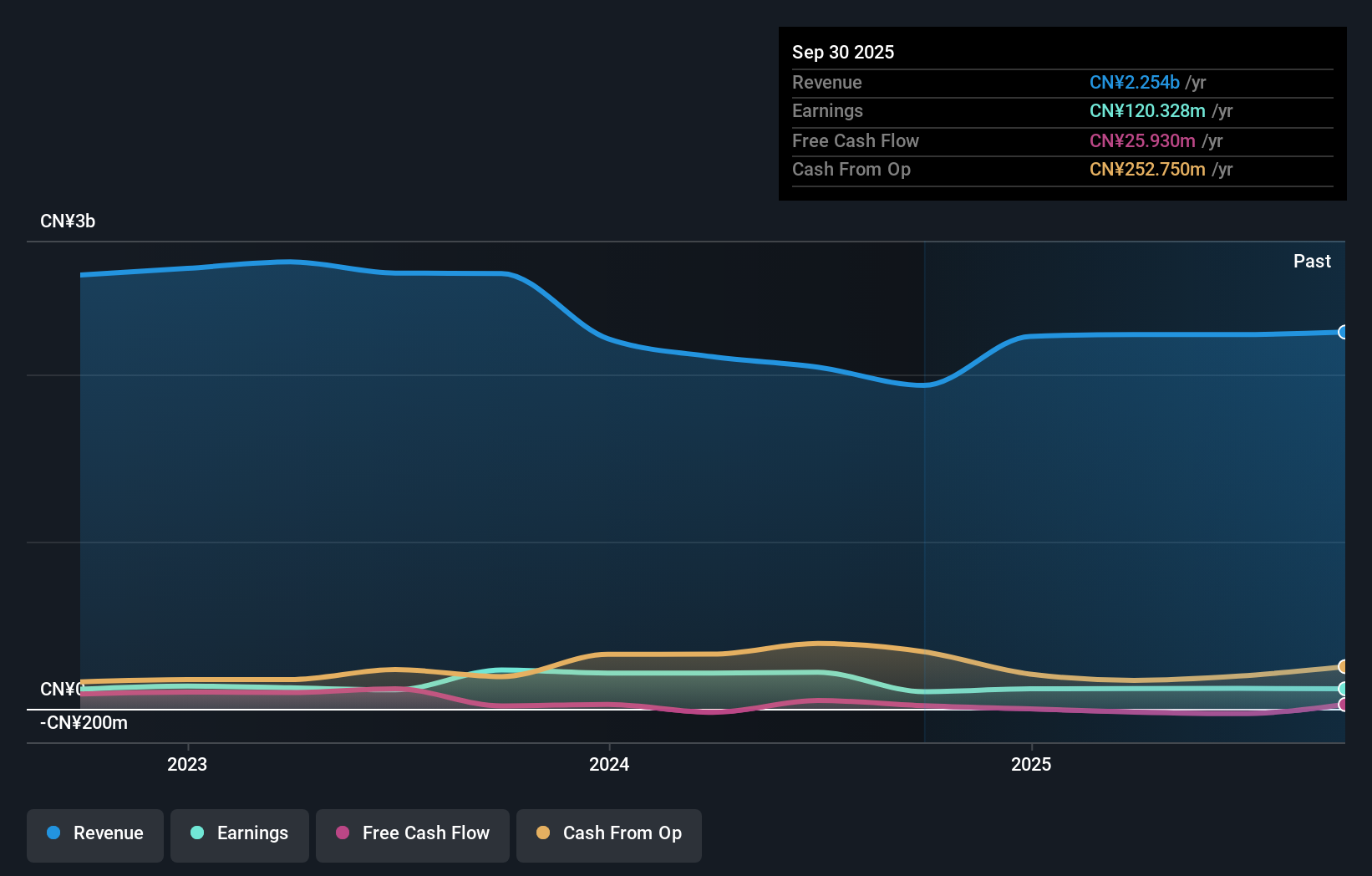

FSPG Hi-Tech, a promising player in the chemicals sector, has shown impressive earnings growth of 17.4% over the past year, outpacing the industry average of 6.1%. The company reported sales of CNY 1.66 billion for the nine months ending September 2025, with net income reaching CNY 83.92 million compared to CNY 83.23 million from last year. Its debt-to-equity ratio improved from 33.1% to a more favorable 24.2% over five years, indicating better financial health and stability in managing its obligations while maintaining high-quality earnings and positive free cash flow.

- Get an in-depth perspective on FSPG Hi-Tech's performance by reading our health report here.

Explore historical data to track FSPG Hi-Tech's performance over time in our Past section.

Shenzhen Jove Enterprise (SZSE:300814)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Jove Enterprise Limited operates in the research and development, production, and sales of printed circuit boards (PCB) both in China and internationally, with a market capitalization of CN¥12.40 billion.

Operations: The company generates revenue primarily through the production and sales of printed circuit boards (PCB) in China and international markets. Its financial performance is highlighted by a net profit margin that reflects its efficiency in managing production costs relative to its revenue.

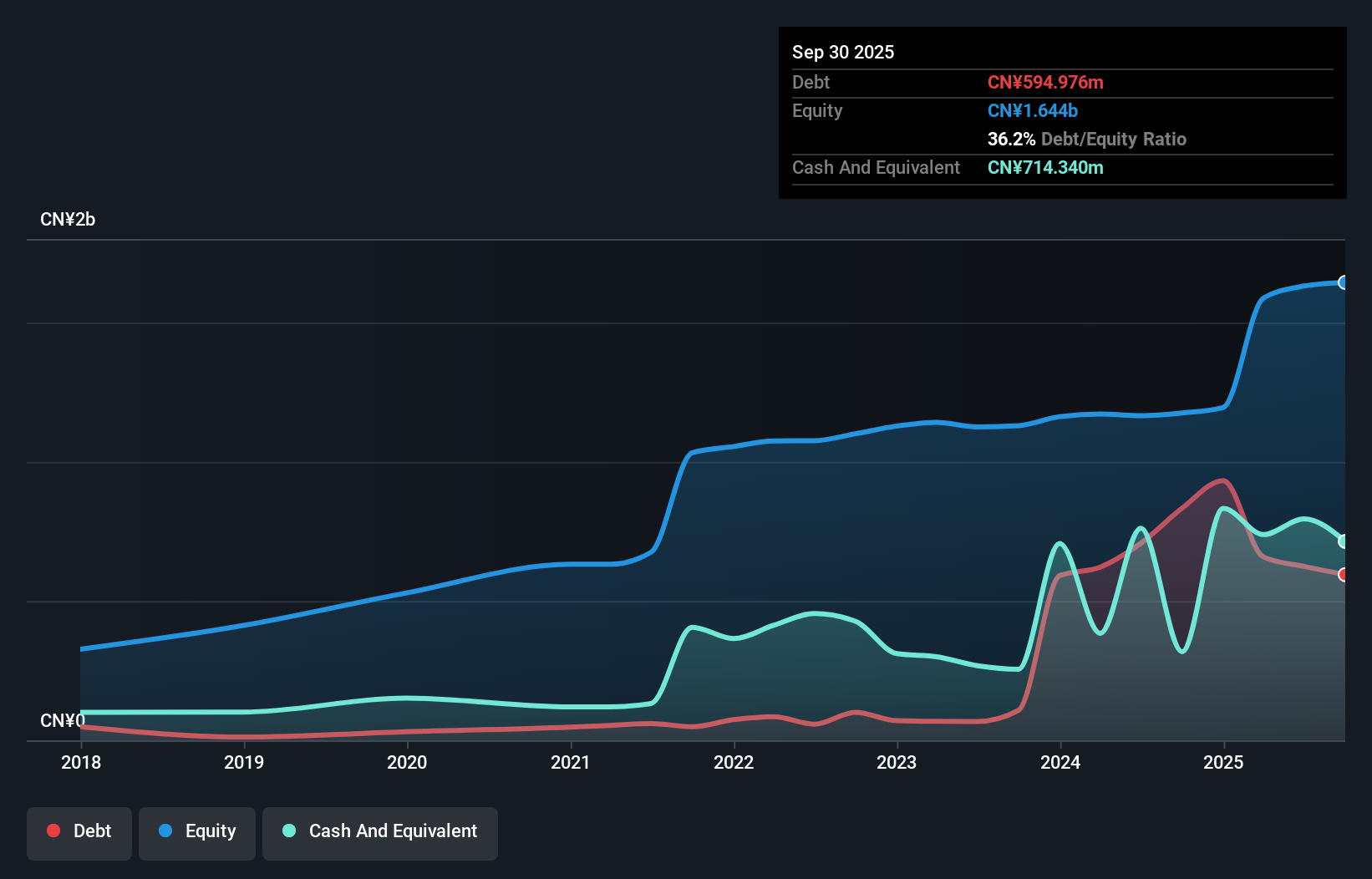

Shenzhen Jove Enterprise, a notable player in the electronics sector, has seen its earnings grow by 22.8% over the past year, outpacing the industry average of 8.7%. Despite this growth, earnings have decreased annually by 28.5% over five years. The company's debt to equity ratio has risen from 4.2% to 36.2%, yet it holds more cash than total debt, indicating financial stability despite volatility in share price recently observed over three months. Recent reports show sales reached CNY 1.35 billion for nine months ending September 2025, with net income at CNY 27.85 million compared to CNY 31.17 million previously.

Taking Advantage

- Access the full spectrum of 2406 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huangma TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603181

Zhejiang Huangma TechnologyLtd

Researches, develops, produces, and sells surfactants in China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives