- China

- /

- Consumer Durables

- /

- SHSE:603610

Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by tariff uncertainty and mixed economic signals, global markets have experienced fluctuations, with U.S. indices like the S&P 500 seeing slight declines amid manufacturing growth and cooling labor market indicators. As investors navigate these turbulent waters, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential amidst broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NPR-Riken | 12.24% | 14.08% | 50.12% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| Uoriki | NA | 3.85% | 9.40% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.11% | 0.82% | 7.95% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hubei Zhenhua ChemicalLtd (SHSE:603067)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hubei Zhenhua Chemical Co., Ltd. focuses on the research, development, manufacture, and sale of chromium salt and related products mainly in China, with a market cap of CN¥6.47 billion.

Operations: Zhenhua Chemical generates revenue primarily through the sale of chromium salt products. The company has reported a net profit margin of 5%.

Hubei Zhenhua Chemical, a promising player in the chemicals sector, has seen its debt to equity ratio rise from 0% to 40.3% over five years, yet maintains a satisfactory net debt to equity ratio of 26.3%. The company boasts high-quality earnings and achieved a notable earnings growth of 15% last year, outpacing the industry average of -5.4%. With its price-to-earnings ratio at 16x—well below the Chinese market's average of 36.7x—it seems attractively valued compared to peers. Despite no recent share repurchases, it completed a buyback earlier for CNY 46.38 million underlining shareholder value focus.

Keeson Technology (SHSE:603610)

Simply Wall St Value Rating: ★★★★★☆

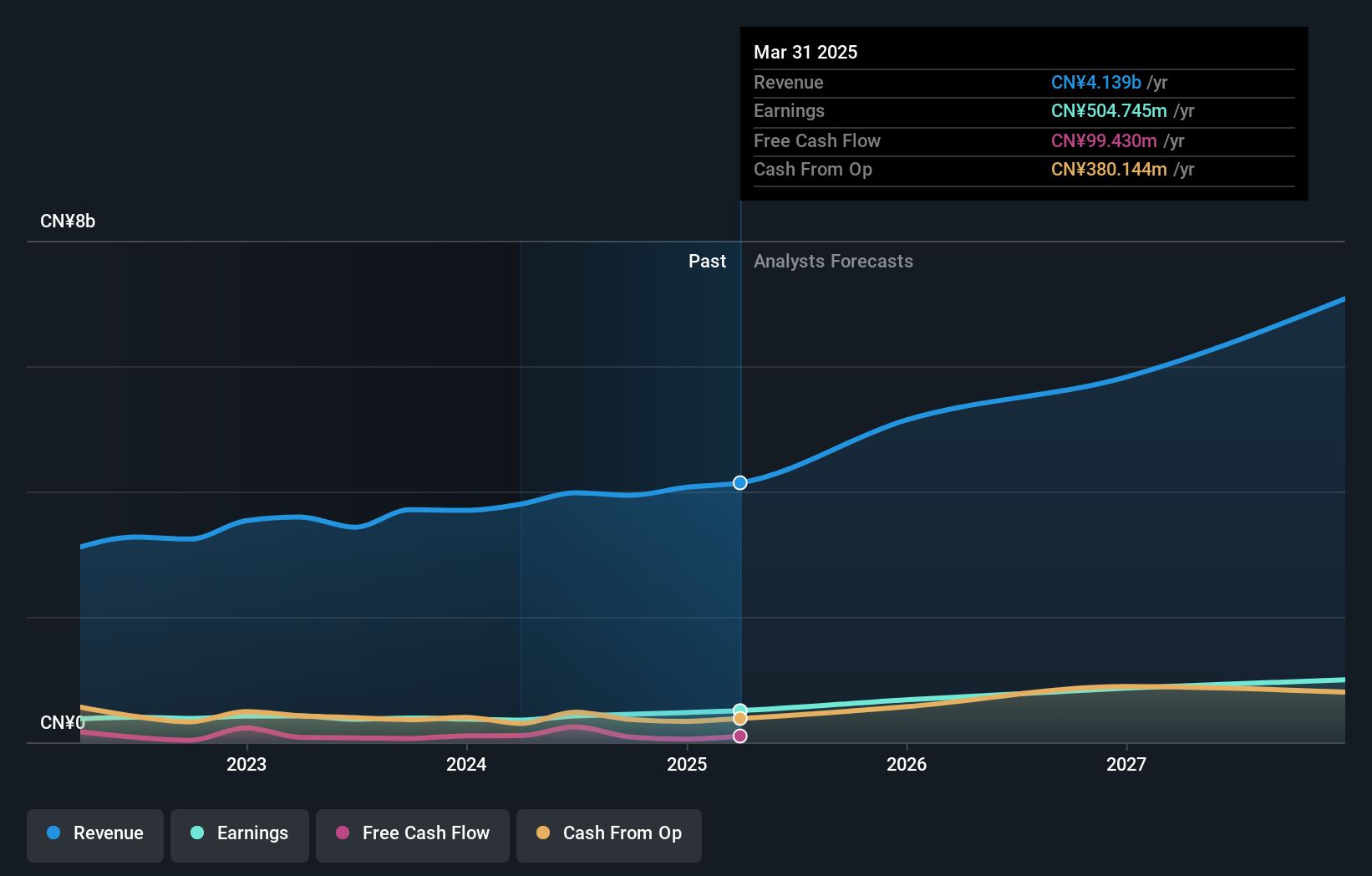

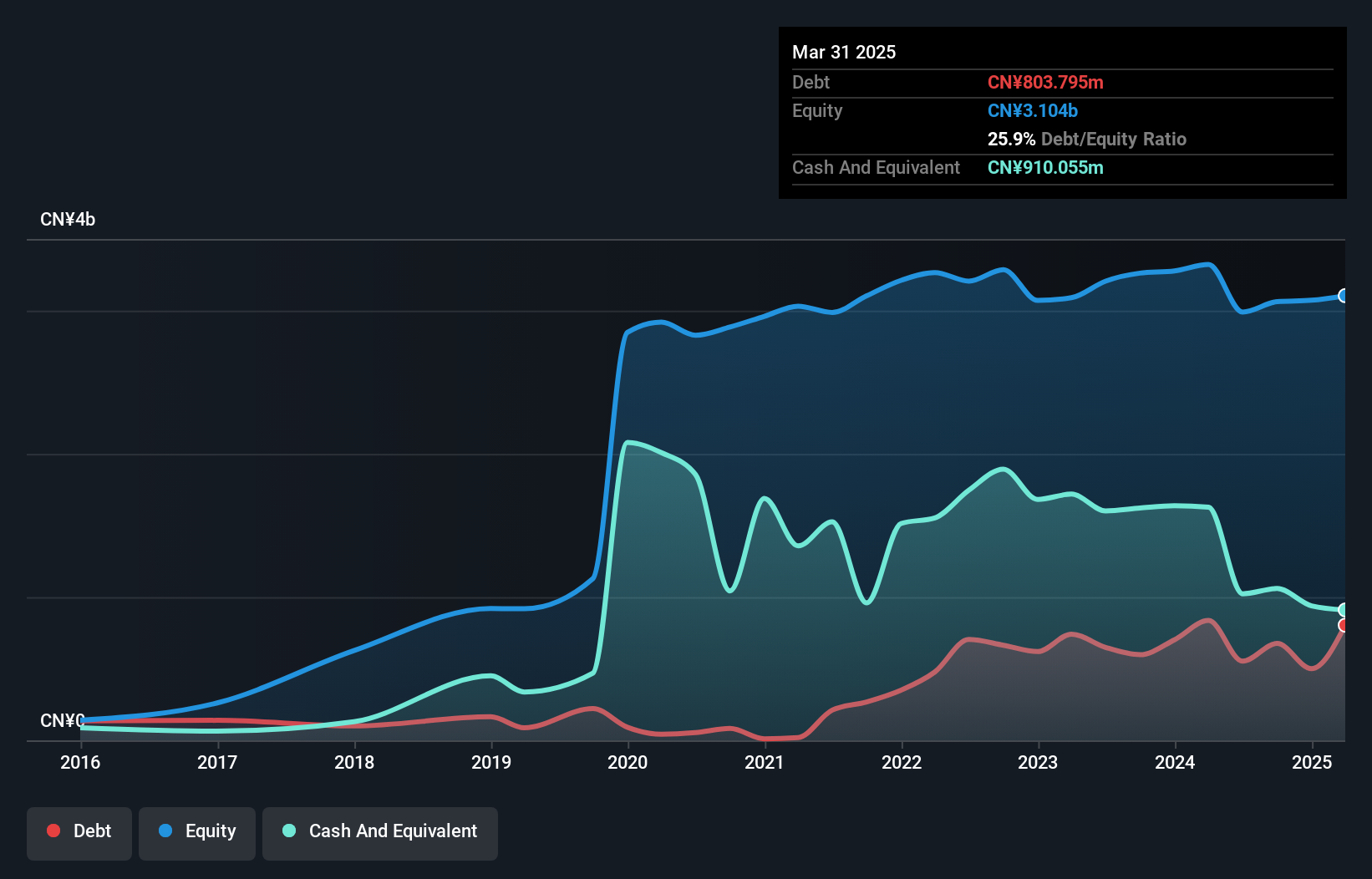

Overview: Keeson Technology Corporation Limited is engaged in the research, development, production, and sale of smart beds, mattresses, and pillows globally with a market cap of CN¥4.08 billion.

Operations: Keeson Technology generates revenue primarily from the sale of smart beds, mattresses, and pillows. The company's gross profit margin shows a notable trend at 41.34%.

Keeson Technology, a nimble player in the market, recently navigated a CN¥64M one-off loss impacting its financials up to September 2024. Despite this setback, the company boasts an impressive earnings growth of 252.8% over the past year, outpacing its industry peers who saw a -1.9% change. With interest payments covered 265 times by EBIT and more cash than total debt, Keeson's financial health seems robust. However, recent volatility in share price and its removal from the S&P Global BMI Index might raise eyebrows among investors looking for stability amidst potential growth prospects forecasted at 12.91% annually.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Simply Wall St Value Rating: ★★★★★★

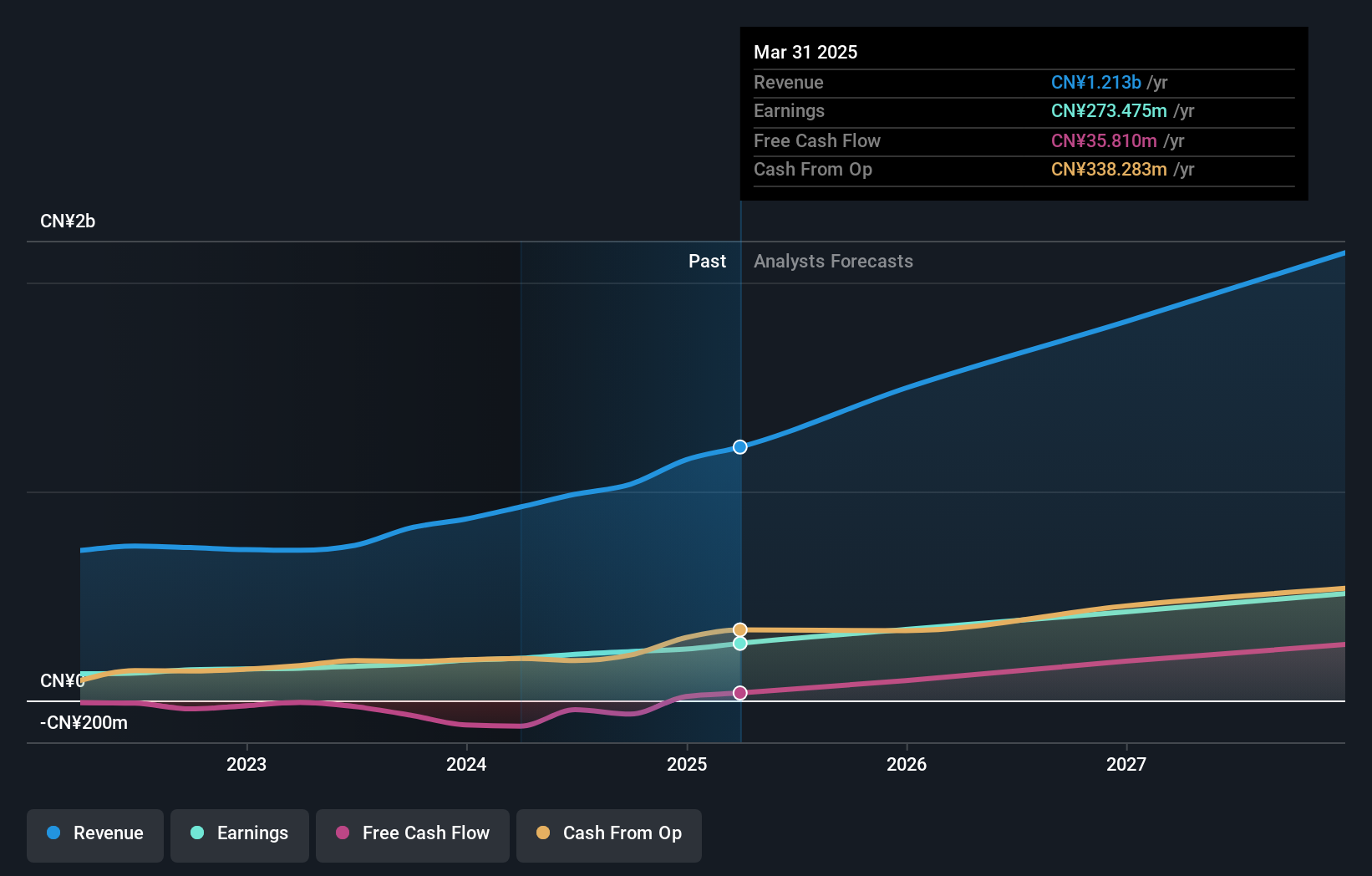

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector and has a market capitalization of CN¥5.36 billion.

Operations: The company generates revenue primarily from its biotechnology products, with a focus on specialized segments. It has reported financial data indicating trends in profitability, notably a net profit margin that fluctuates over recent periods.

Shandong Bailong Chuangyuan Bio-Tech, a small player in the bio-tech sector, showcases promising potential with its earnings growth of 34.5% over the past year, outpacing the industry average of -6.3%. The company is trading at a significant discount, about 44.9% below estimated fair value, suggesting attractive valuation prospects. Despite not being free cash flow positive recently, it has managed to reduce its debt-to-equity ratio from 9.5 to 4.3 over five years and possesses more cash than total debt, indicating prudent financial management and positioning for future growth opportunities in an evolving market landscape.

- Click here to discover the nuances of Shandong Bailong Chuangyuan Bio-Tech with our detailed analytical health report.

Understand Shandong Bailong Chuangyuan Bio-Tech's track record by examining our Past report.

Make It Happen

- Get an in-depth perspective on all 4698 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keeson Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603610

Keeson Technology

Research and develops, produces, and sells smart electric beds and memory foam home products in China.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives