Amidst the backdrop of escalating trade tensions and fluctuating consumer sentiment, global markets have experienced significant volatility, with key indices like the S&P 500 and Nasdaq Composite showing resilience despite broader economic uncertainties. As investors navigate this complex landscape, identifying promising opportunities in lesser-known stocks can be particularly rewarding; these undiscovered gems often exhibit strong fundamentals and growth potential that may not yet be fully recognized by the market.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Synergy Innovation | 16.72% | 13.04% | 53.00% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| TOMONY Holdings | 48.81% | 7.66% | 14.89% | ★★★★★☆ |

| AJIS | 0.78% | 2.14% | -13.06% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hainan Mining (SHSE:601969)

Simply Wall St Value Rating: ★★★★★★

Overview: Hainan Mining Co., Ltd. is engaged in the mining, processing, and sale of iron ore in China with a market capitalization of CN¥13.69 billion.

Operations: The company's revenue is primarily derived from its ore segment at CN¥2.10 billion, closely followed by the hydrocarbon segment at CN¥1.97 billion.

Hainan Mining, a standout in the mining sector, has demonstrated robust earnings growth of 13% over the past year, outpacing the industry's -1.7%. Its debt-to-equity ratio improved from 32.1% to 26.1% over five years, indicating effective debt management. The company reported net income of CNY 706 million for 2024, up from CNY 625 million in the previous year. Although sales dipped to CNY 3.9 billion from CNY 4.5 billion, its high-quality earnings and a price-to-earnings ratio of 20.7x below the CN market average suggest potential value for investors exploring opportunities beyond mainstream options.

- Take a closer look at Hainan Mining's potential here in our health report.

Evaluate Hainan Mining's historical performance by accessing our past performance report.

Suzhou Nanomicro Technology (SHSE:688690)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Nanomicro Technology Co., Ltd. specializes in the production and distribution of spherical, mono-disperse particles for diverse global industries, with a market capitalization of CN¥9.14 billion.

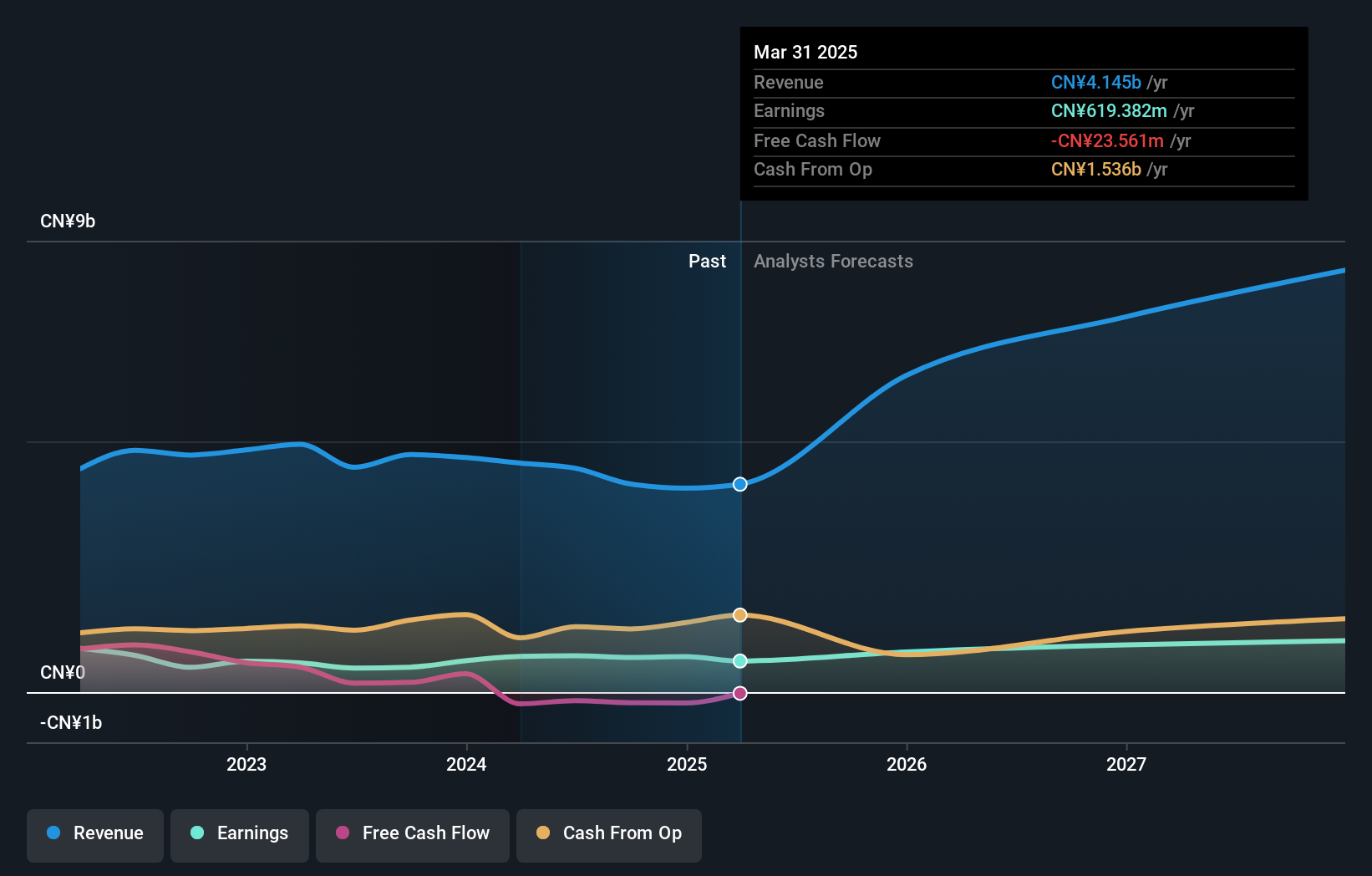

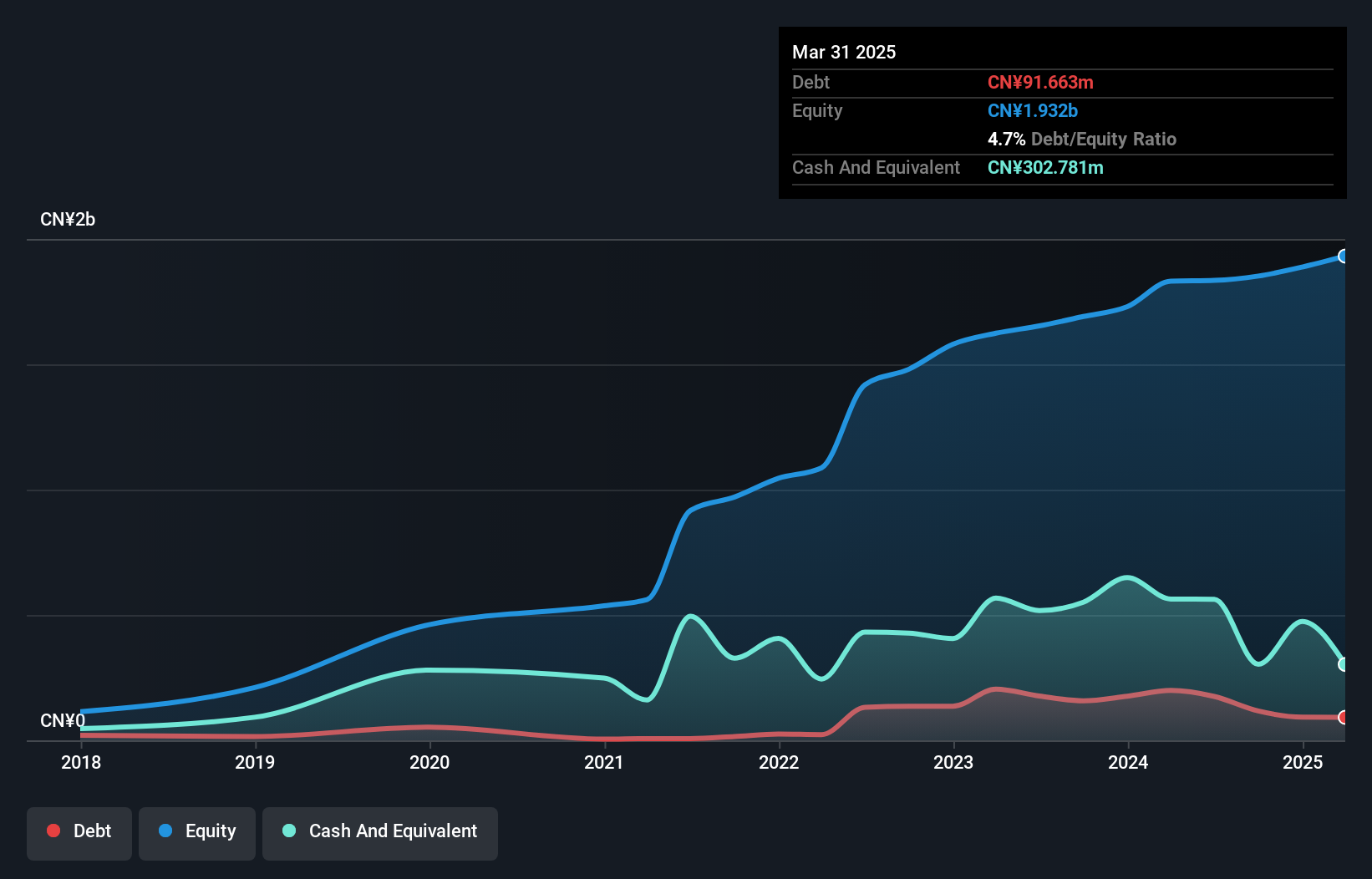

Operations: The company generates revenue primarily from the sale of spherical, mono-disperse particles across various industries. It reported a gross profit margin of 54.3% in its latest financial period.

Nanomicro Technology, a small player in the chemical sector, has demonstrated notable earnings growth of 18.3% over the past year, outpacing its industry peers who saw a 4% drop. The company's debt management appears prudent with cash exceeding total debt and a reduced debt-to-equity ratio from 11.4 to 7.3 over five years. Despite these strengths, free cash flow remains negative, which might concern some investors. Recent financial results show sales climbing to CNY 782 million from CNY 587 million last year and net income rising to CNY 81 million from CNY 69 million, reflecting solid operational performance amidst market challenges.

Kyushu Financial Group (TSE:7180)

Simply Wall St Value Rating: ★★★★★☆

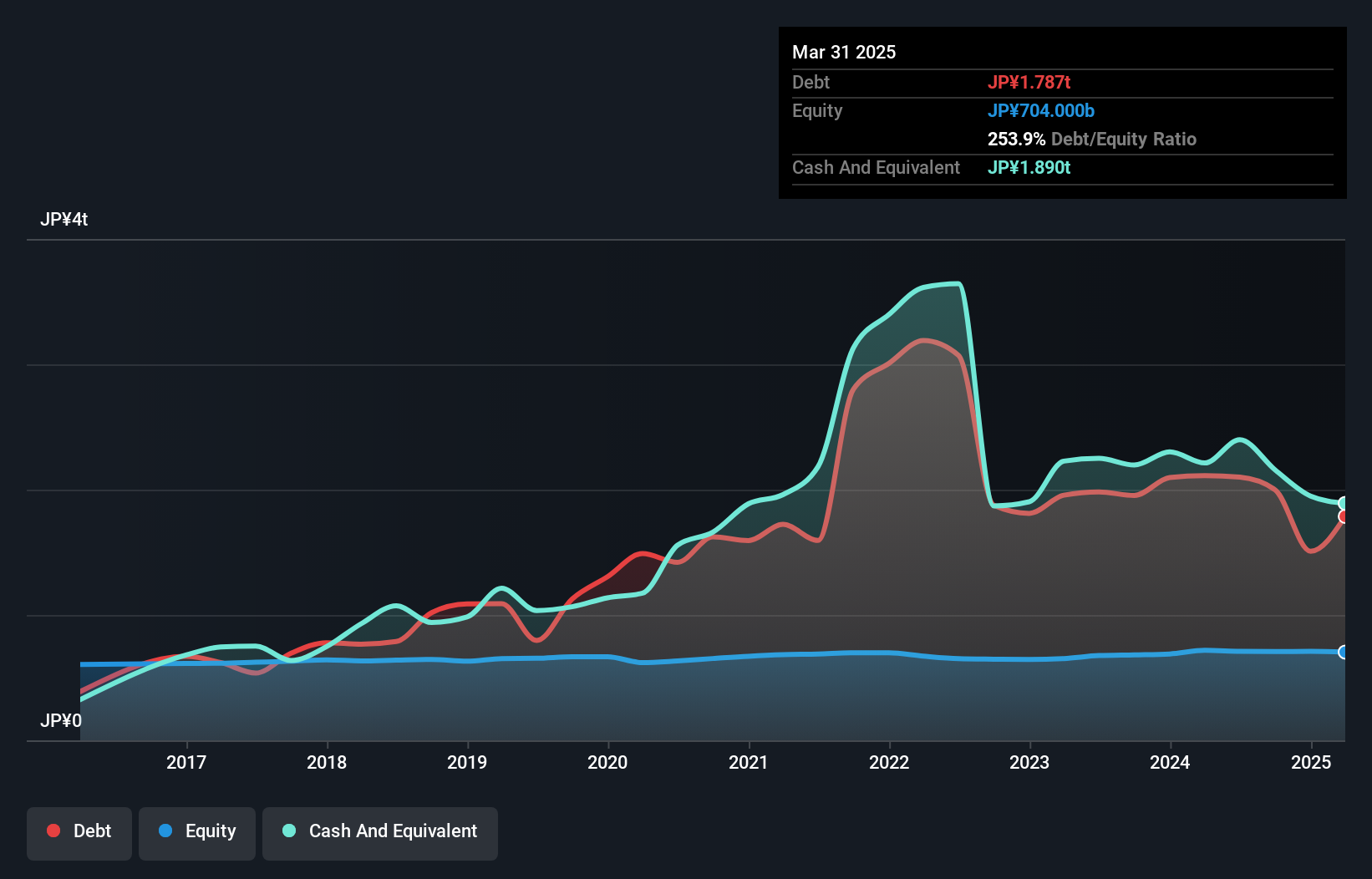

Overview: Kyushu Financial Group, Inc. operates through its subsidiaries to offer a range of financial products and services in Japan, with a market capitalization of ¥2.61 billion.

Operations: Kyushu Financial Group generates revenue primarily through its financial products and services offered in Japan. The company has a market capitalization of ¥260.84 billion.

Kyushu Financial Group, with total assets of ¥13,485.3 billion and equity of ¥709.9 billion, is trading at an attractive 42.4% below its estimated fair value. Despite earnings growing 9.9% annually over five years, recent growth lagged the industry at just 2%. The group holds ¥10,628.5 billion in deposits against loans of ¥8,826.7 billion with a net interest margin of 0.9%. Bad loans are appropriately low at 1.7%, though allowance coverage is only 49%. Upcoming board changes and a dividend increase to JPY11 per share reflect strategic shifts amidst high-quality past earnings and stable funding sources.

Summing It All Up

- Embark on your investment journey to our 3224 Global Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyushu Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7180

Kyushu Financial Group

Through its subsidiaries, engages in the banking business in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)