Shareholders 43% loss in Tongkun Group (SHSE:601233) partly attributable to the company's decline in earnings over past three years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Tongkun Group Co., Ltd. (SHSE:601233) shareholders have had that experience, with the share price dropping 44% in three years, versus a market decline of about 19%. On the other hand the share price has bounced 5.1% over the last week.

While the last three years has been tough for Tongkun Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Tongkun Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Tongkun Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

The modest 0.3% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 18% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Tongkun Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

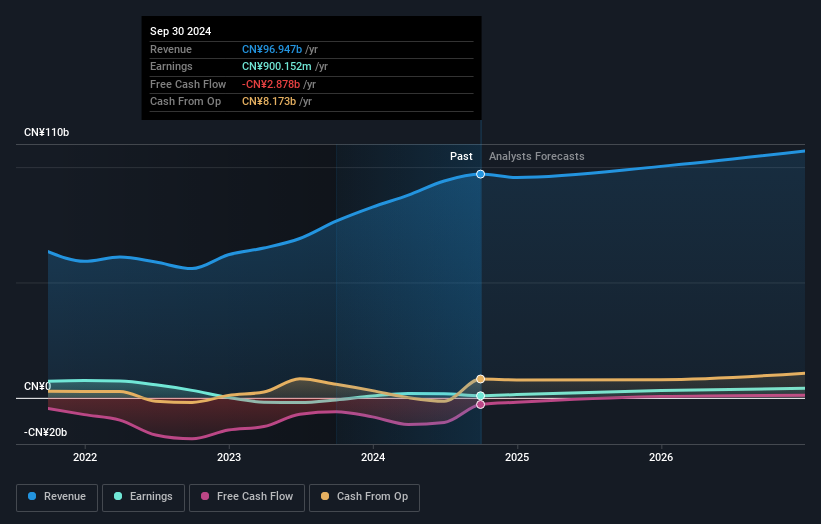

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Tongkun Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Tongkun Group will earn in the future (free analyst consensus estimates)

A Different Perspective

Tongkun Group shareholders are down 16% for the year (even including dividends), but the market itself is up 7.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Tongkun Group (including 1 which shouldn't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tongkun Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601233

Undervalued with moderate growth potential.

Market Insights

Community Narratives