In February 2025, global markets are grappling with geopolitical tensions and economic uncertainties, as evidenced by the recent declines in major U.S. indices like the S&P 500 and Russell 2000. With U.S. services PMI entering contraction territory and consumer spending concerns mounting, investors are increasingly focused on identifying resilient small-cap stocks that can weather these challenging conditions. In such an environment, a good stock is often characterized by strong fundamentals, adaptability to changing market dynamics, and potential for growth even amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Advanced International Multitech | 36.42% | 6.79% | 4.08% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Biggeorge Property Nyilvánosan Muködo Részvénytársaság | 17.83% | 35.24% | 34.64% | ★★★★★☆ |

| Nestlé Pakistan | 29.11% | 13.84% | 15.78% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

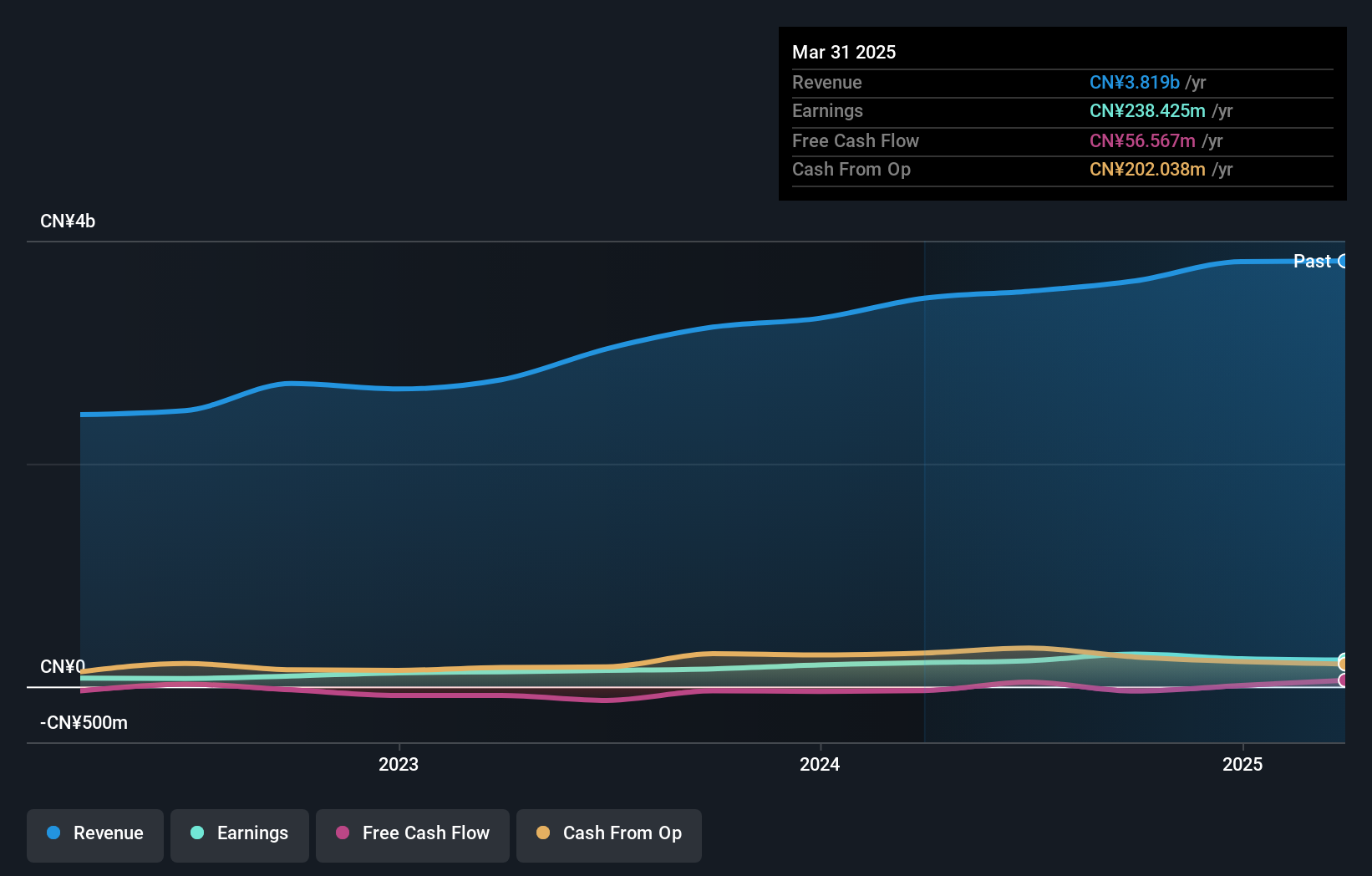

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiwu Huading Nylon Co., Ltd. focuses on the research, development, manufacture, and sale of nylon filaments primarily in China and has a market cap of CN¥4.34 billion.

Operations: Yiwu Huading Nylon Co., Ltd. generates revenue through the sale of nylon filaments, with a focus on the Chinese market. The company has a market capitalization of CN¥4.34 billion and is involved in various stages from research to sales within its industry sector.

Yiwu Huading Nylon Ltd., a smaller player in the market, has shown impressive resilience and growth. Over the past year, its earnings surged by 40%, outpacing the broader chemicals industry which saw a 5.4% dip. The company's debt to equity ratio improved significantly from 26.8% to 10.4% over five years, underscoring prudent financial management. Moreover, with more cash than total debt and positive free cash flow, Yiwu Huading appears well-positioned financially. Trading at approximately 55% below its estimated fair value suggests potential for upside if these trends continue favorably in the future.

- Delve into the full analysis health report here for a deeper understanding of Yiwu Huading NylonLtd.

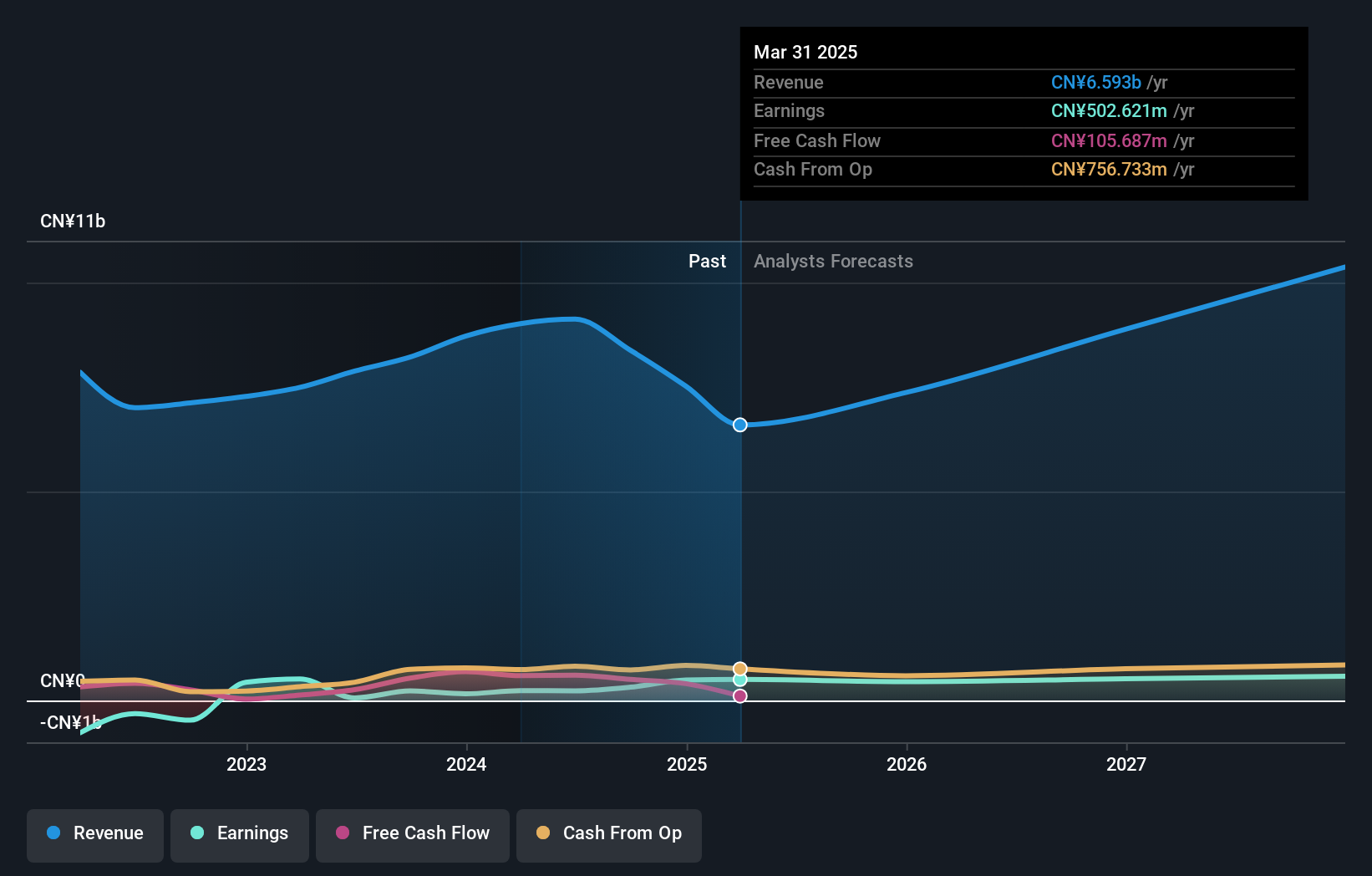

Changzhou Tenglong AutoPartsCo.Ltd (SHSE:603158)

Simply Wall St Value Rating: ★★★★★☆

Overview: Changzhou Tenglong AutoPartsCo., Ltd. engages in the research, development, manufacturing, and sale of auto parts both domestically and internationally, with a market capitalization of CN¥4.50 billion.

Operations: Tenglong AutoParts generates revenue primarily from the sale of auto parts in both domestic and international markets. The company's financial performance is highlighted by a net profit margin trend worth noting for its impact on profitability.

Earnings for Changzhou Tenglong AutoPartsCo. have surged by 83% over the past year, outpacing the industry growth of 10.5%. The company is trading at a price-to-earnings ratio of 16x, which is favorable compared to the broader CN market's 38.1x. Despite an increase in its debt-to-equity ratio from 37.8% to 38.9% over five years, its net debt-to-equity remains satisfactory at 21%. Interest payments are well-covered with EBIT at a robust multiple of 15x, indicating financial stability even though it isn't free cash flow positive currently.

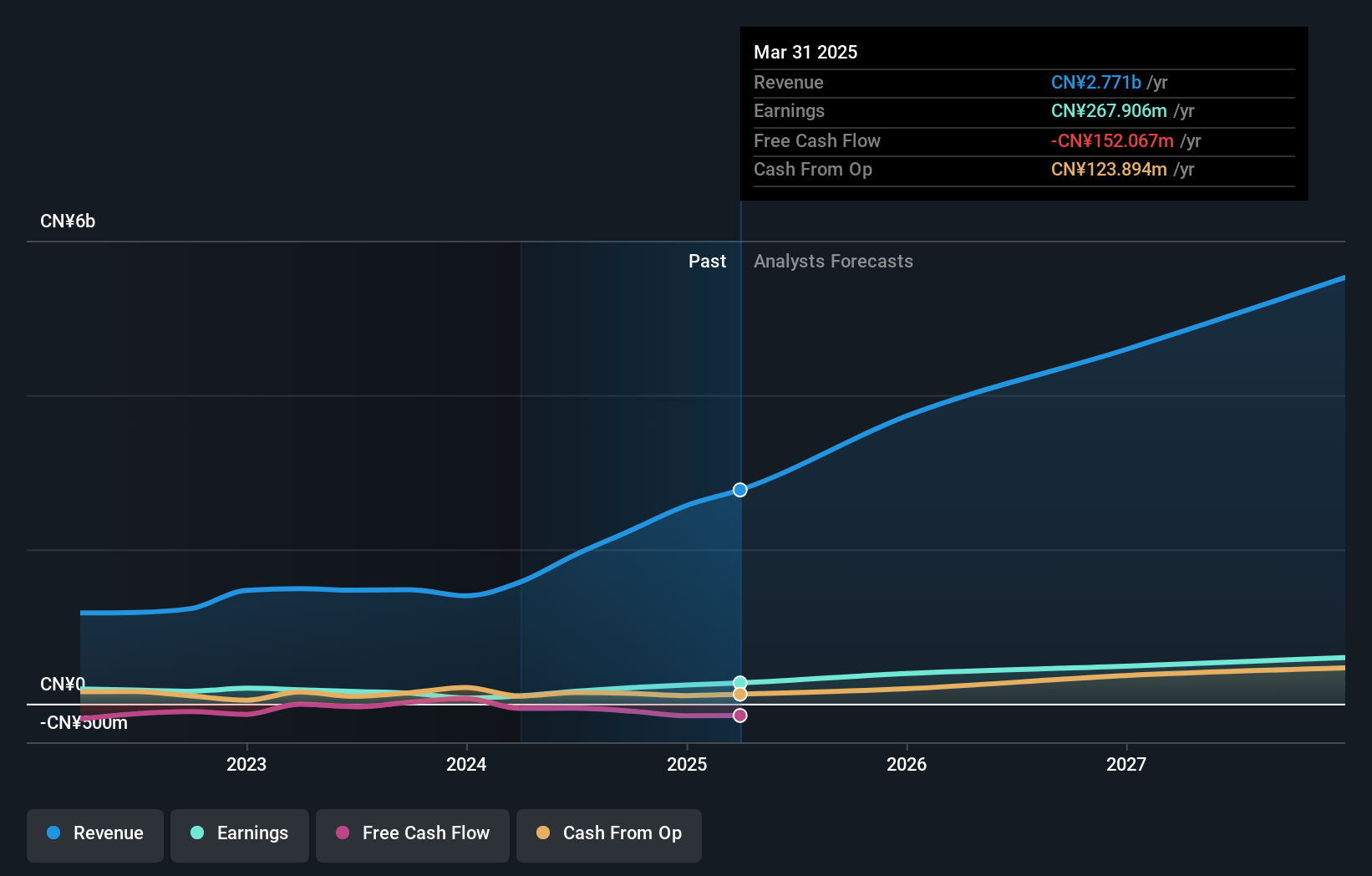

Dongguan Tarry ElectronicsLtd (SZSE:300976)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongguan Tarry Electronics Co., Ltd. operates in China, focusing on the manufacturing and sale of precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment with a market cap of CN¥6.68 billion.

Operations: Tarry Electronics generates revenue primarily from its manufacturing industry segment, totaling CN¥2.24 billion. The company's financial performance is highlighted by a notable gross profit margin trend, reflecting its efficiency in managing production costs relative to sales.

Dongguan Tarry Electronics, a smaller player in the electronics sector, showcases impressive earnings growth of 53% over the past year, outpacing the industry average of 1.6%. The company operates debt-free, which eliminates concerns about interest coverage and indicates a strong financial position. Its price-to-earnings ratio stands at 32.7x, offering better value compared to the broader CN market's 38.1x. Despite not being free cash flow positive recently, it has managed its capital expenditures effectively with significant investments totaling CNY 230 million in recent quarters. A recent dividend announcement highlights ongoing shareholder returns with CNY 8 per ten shares distributed in February 2025.

- Dive into the specifics of Dongguan Tarry ElectronicsLtd here with our thorough health report.

Gain insights into Dongguan Tarry ElectronicsLtd's past trends and performance with our Past report.

Turning Ideas Into Actions

- Reveal the 4751 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601113

Yiwu Huading NylonLtd

Engages in the research, development, manufacture, and sale of nylon filaments primarily in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives