- China

- /

- Paper and Forestry Products

- /

- SHSE:600963

Yueyang Forest & Paper Co., Ltd.'s (SHSE:600963) Shares Leap 26% Yet They're Still Not Telling The Full Story

Yueyang Forest & Paper Co., Ltd. (SHSE:600963) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

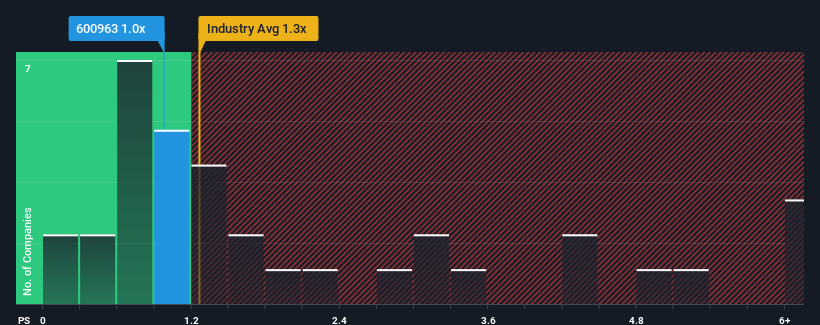

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Yueyang Forest & Paper's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Forestry industry in China is also close to 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Yueyang Forest & Paper

How Yueyang Forest & Paper Has Been Performing

Yueyang Forest & Paper hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yueyang Forest & Paper.Is There Some Revenue Growth Forecasted For Yueyang Forest & Paper?

The only time you'd be comfortable seeing a P/S like Yueyang Forest & Paper's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. The last three years don't look nice either as the company has shrunk revenue by 5.8% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Yueyang Forest & Paper's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Yueyang Forest & Paper's P/S Mean For Investors?

Its shares have lifted substantially and now Yueyang Forest & Paper's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Yueyang Forest & Paper currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Yueyang Forest & Paper has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600963

Yueyang Forest & Paper

Manufactures and sells cultural, industrial, and packaging paper products in China and internationally.

Moderate risk second-rate dividend payer.

Market Insights

Community Narratives