Take Care Before Diving Into The Deep End On Lihuayi Weiyuan Chemical Co., Ltd. (SHSE:600955)

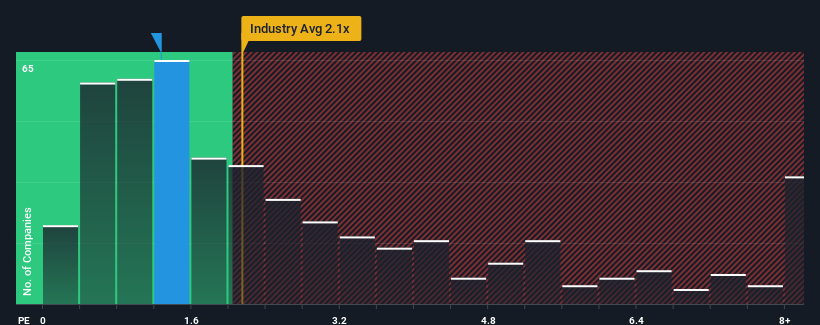

Lihuayi Weiyuan Chemical Co., Ltd.'s (SHSE:600955) price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.1x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Lihuayi Weiyuan Chemical

What Does Lihuayi Weiyuan Chemical's Recent Performance Look Like?

Lihuayi Weiyuan Chemical could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Lihuayi Weiyuan Chemical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Lihuayi Weiyuan Chemical's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. Still, the latest three year period has seen an excellent 61% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the two analysts watching the company. With the industry only predicted to deliver 14% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Lihuayi Weiyuan Chemical is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Lihuayi Weiyuan Chemical's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Lihuayi Weiyuan Chemical currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Lihuayi Weiyuan Chemical (of which 1 is a bit unpleasant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600955

Lihuayi Weiyuan Chemical

Together with its subsidiary, engages in the production and sale of polymer materials and fine chemicals in China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives