Sentiment Still Eluding Lihuayi Weiyuan Chemical Co., Ltd. (SHSE:600955)

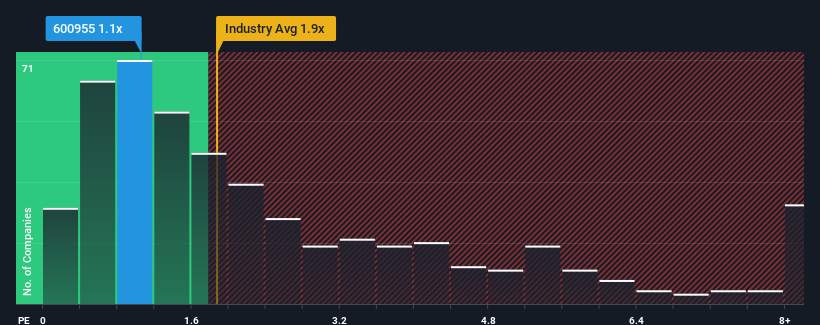

Lihuayi Weiyuan Chemical Co., Ltd.'s (SHSE:600955) price-to-sales (or "P/S") ratio of 1.1x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Lihuayi Weiyuan Chemical

What Does Lihuayi Weiyuan Chemical's Recent Performance Look Like?

Lihuayi Weiyuan Chemical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Lihuayi Weiyuan Chemical's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Lihuayi Weiyuan Chemical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 31% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 41% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it odd that Lihuayi Weiyuan Chemical is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Lihuayi Weiyuan Chemical's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Lihuayi Weiyuan Chemical currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Lihuayi Weiyuan Chemical (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600955

Lihuayi Weiyuan Chemical

Together with its subsidiary, engages in the production and sale of polymer materials and fine chemicals in China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives