- China

- /

- Metals and Mining

- /

- SHSE:600888

Improved Earnings Required Before Xinjiang Joinworld Co., Ltd. (SHSE:600888) Shares Find Their Feet

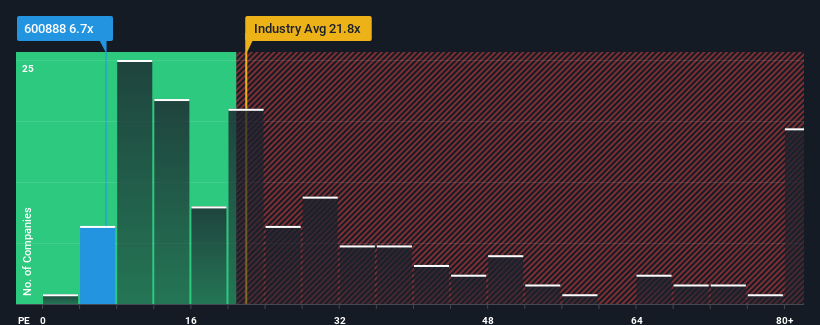

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 27x, you may consider Xinjiang Joinworld Co., Ltd. (SHSE:600888) as a highly attractive investment with its 6.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For example, consider that Xinjiang Joinworld's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Xinjiang Joinworld

Does Growth Match The Low P/E?

Xinjiang Joinworld's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 102% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Xinjiang Joinworld's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Xinjiang Joinworld maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Xinjiang Joinworld that you need to be mindful of.

If these risks are making you reconsider your opinion on Xinjiang Joinworld, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600888

Xinjiang Joinworld

Engages in the research and development, production, and sale of aluminum products in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives