- China

- /

- Metals and Mining

- /

- SHSE:600255

Anhui Xinke New MaterialsLtd And 2 More Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As global markets continue to navigate complex economic landscapes, with notable movements in indices such as the S&P 500 and Nasdaq Composite, investors are increasingly exploring diverse opportunities across various market segments. Penny stocks, though a term from earlier market days, remain relevant for those interested in smaller or less-established companies that might offer significant value. By focusing on stocks with sound financials and potential growth trajectories, investors can uncover promising opportunities within this category.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.59 | MYR2.93B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.75 | MYR129.91M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.30 | CN¥2.11B | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £183.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.235 | £307.76M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.45 | MYR2.5B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,807 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Anhui Xinke New MaterialsLtd (SHSE:600255)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anhui Xinke New Materials Co., Ltd focuses on the research, development, production, and sales of copper alloy strip products in China and has a market cap of CN¥3.68 billion.

Operations: The company generates revenue of CN¥3.28 billion from its processing and manufacturing segment.

Market Cap: CN¥3.68B

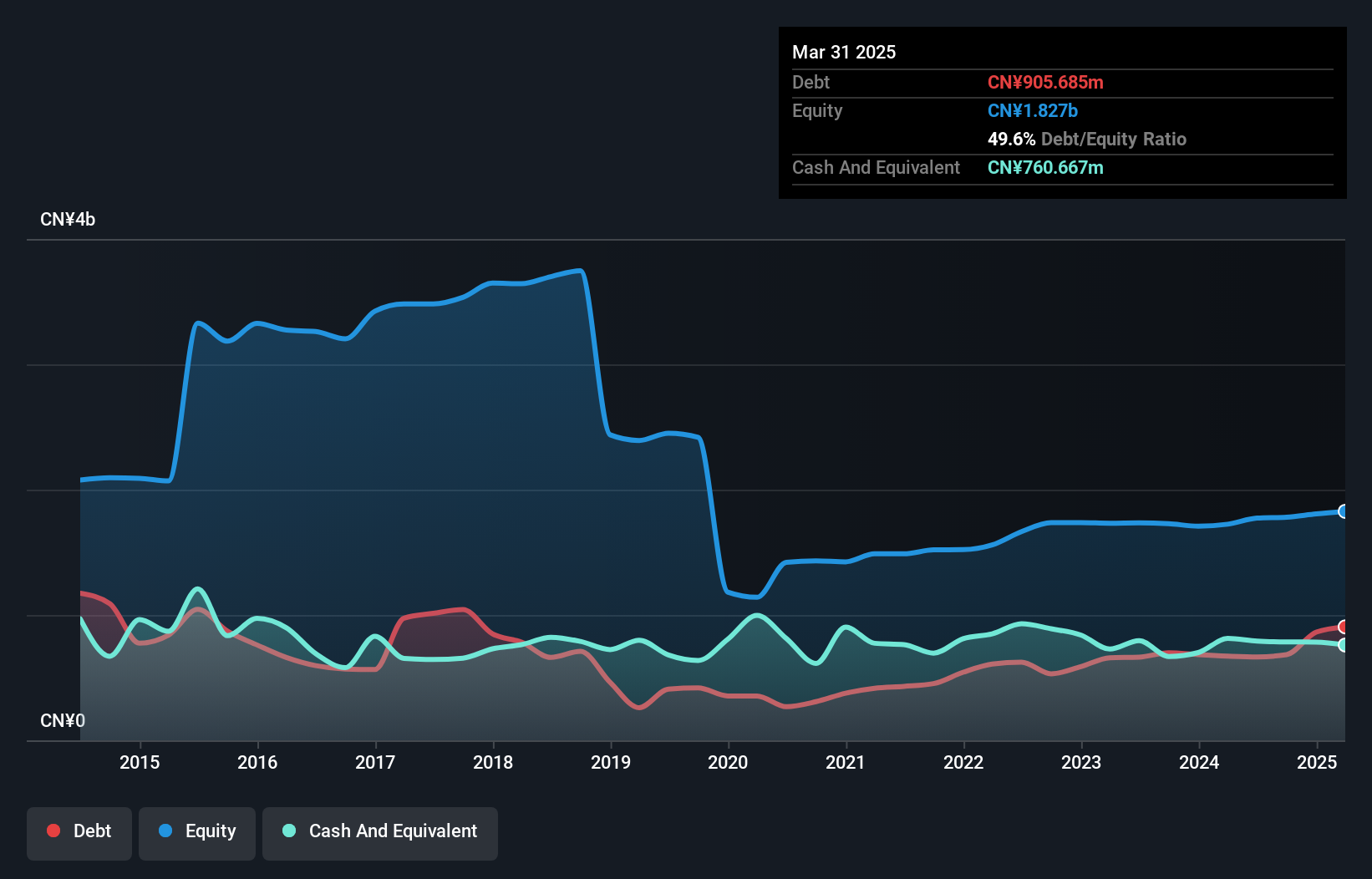

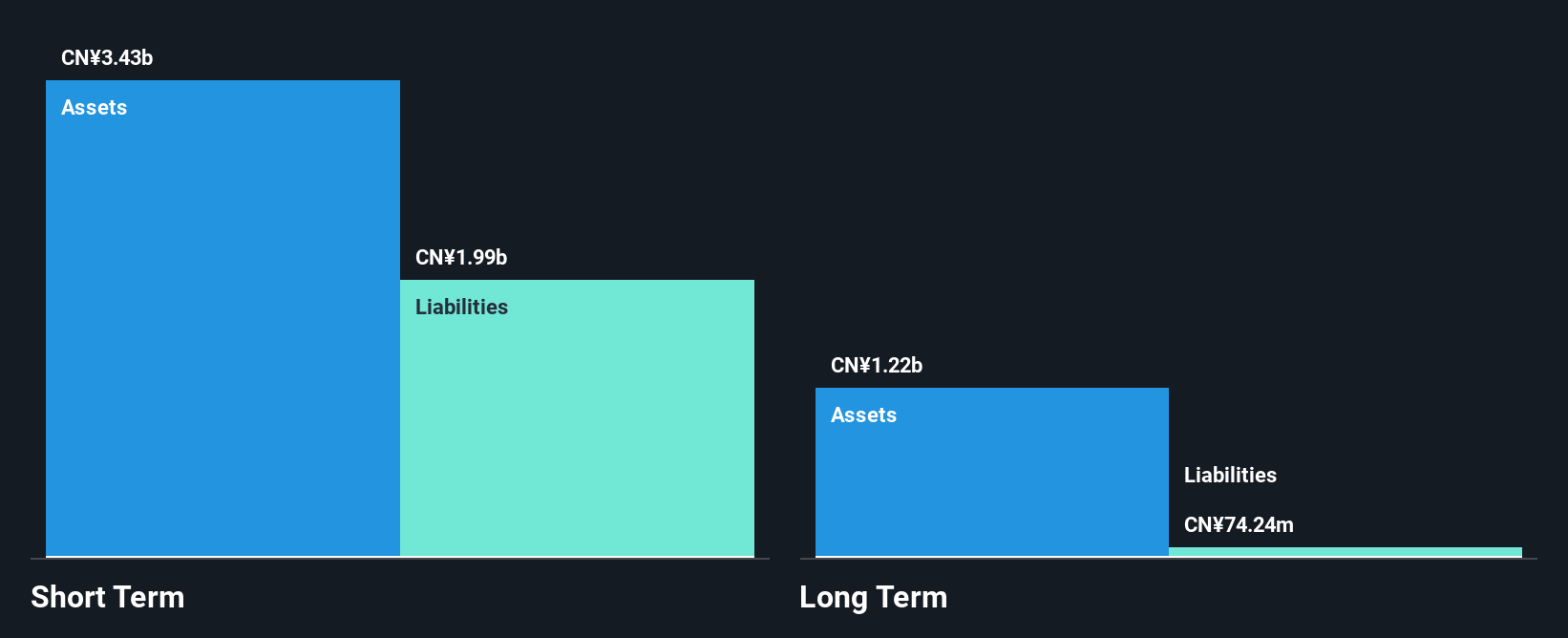

Anhui Xinke New Materials Co., Ltd, with a market cap of CN¥3.68 billion, is currently unprofitable but has managed to reduce its losses over the past five years. The company generates significant revenue from its copper alloy strip products in China, amounting to CN¥3.28 billion. Despite having more cash than total debt and a sufficient cash runway for over three years, it faces challenges with short-term liabilities exceeding short-term assets by CN¥100 million and an increasing debt-to-equity ratio now at 39%. The management team is experienced, although board tenure data is insufficient for assessment.

- Unlock comprehensive insights into our analysis of Anhui Xinke New MaterialsLtd stock in this financial health report.

- Gain insights into Anhui Xinke New MaterialsLtd's historical outcomes by reviewing our past performance report.

Gohigh NetworksLtd (SZSE:000851)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gohigh Networks Co., Ltd. operates in China, focusing on digital intelligence applications, information services, and IT sales, with a market cap of CN¥3.62 billion.

Operations: The company's revenue is primarily derived from its IT Sales Business, which generated CN¥2.99 billion, followed by the Industry Enterprise Business at CN¥1.48 billion, and the Information Service Business contributing CN¥320.91 million.

Market Cap: CN¥3.62B

Gohigh Networks Co., Ltd, with a market cap of CN¥3.62 billion, operates primarily in IT sales, generating CN¥2.99 billion in revenue. Despite being unprofitable and experiencing increased losses over the past five years at a very large rate annually, the company has managed to reduce its debt-to-equity ratio from 42.1% to 33.8%. It maintains a satisfactory net debt-to-equity ratio of 22.6%, with short-term assets exceeding both short-term and long-term liabilities significantly. Recent earnings show slight improvement in net income year-over-year despite declining sales and revenue figures for the half-year ended June 2024.

- Get an in-depth perspective on Gohigh NetworksLtd's performance by reading our balance sheet health report here.

- Understand Gohigh NetworksLtd's track record by examining our performance history report.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and supplies material handling equipment for the non-ferrous metallurgy and port terminals industries in China and internationally, with a market cap of CN¥3.82 billion.

Operations: The company's revenue is primarily derived from Material Handling Equipment, contributing CN¥1.79 billion, along with Accessories and Others generating CN¥242.74 million.

Market Cap: CN¥3.82B

Zhuzhou Tianqiao Crane Co., Ltd., with a market cap of CN¥3.82 billion, has shown significant earnings growth over the past year at 130.4%, surpassing its five-year average decline of 19.2% annually. The company's revenue from material handling equipment reached CN¥1.79 billion, supported by accessories and other segments generating CN¥242.74 million. Recent financials for the half-year ended June 2024 report sales of CN¥680.48 million, up from CN¥555.69 million a year ago, with net income improving to CN¥25.58 million from a loss previously recorded, indicating progress in profitability despite low return on equity at 2.4%.

- Dive into the specifics of Zhuzhou Tianqiao Crane here with our thorough balance sheet health report.

- Examine Zhuzhou Tianqiao Crane's past performance report to understand how it has performed in prior years.

Next Steps

- Dive into all 5,807 of the Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600255

Anhui Xinke New MaterialsLtd

Engages in the research, development, production, and sales of copper alloy strip products in China.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives