Insufficient Growth At Kingfa Sci. & Tech. Co., Ltd. (SHSE:600143) Hampers Share Price

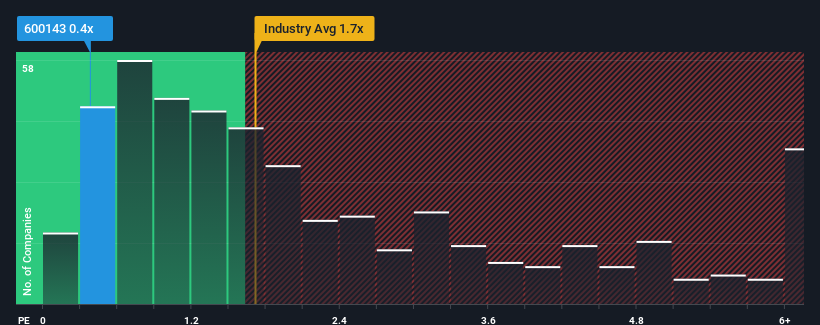

Kingfa Sci. & Tech. Co., Ltd.'s (SHSE:600143) price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Kingfa Sci. & Tech

What Does Kingfa Sci. & Tech's Recent Performance Look Like?

Recent times have been advantageous for Kingfa Sci. & Tech as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kingfa Sci. & Tech will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Kingfa Sci. & Tech's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. The latest three year period has also seen an excellent 36% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.8% during the coming year according to the two analysts following the company. Meanwhile, the broader industry is forecast to expand by 22%, which paints a poor picture.

With this in consideration, we find it intriguing that Kingfa Sci. & Tech's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Kingfa Sci. & Tech's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Kingfa Sci. & Tech maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You need to take note of risks, for example - Kingfa Sci. & Tech has 4 warning signs (and 2 which can't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kingfa Sci. & Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600143

Kingfa Sci. & Tech

Engages in the research, development, production, and sale of plastic products in worldwide.

Good value with moderate growth potential.

Market Insights

Community Narratives