Investors Continue Waiting On Sidelines For Anhui Wanwei Updated High-Tech Material Industry Co.,Ltd (SHSE:600063)

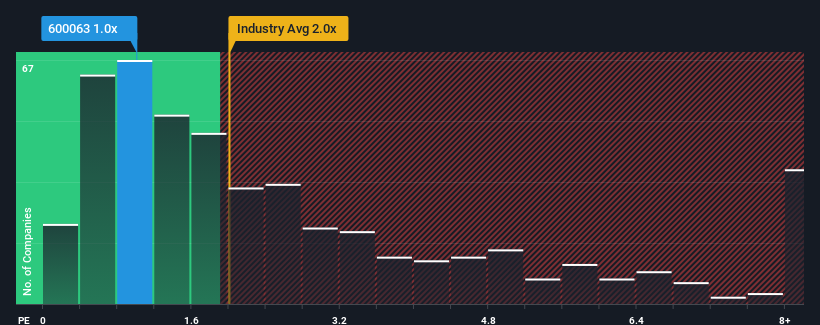

Anhui Wanwei Updated High-Tech Material Industry Co.,Ltd's (SHSE:600063) price-to-sales (or "P/S") ratio of 1x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Anhui Wanwei Updated High-Tech Material IndustryLtd

What Does Anhui Wanwei Updated High-Tech Material IndustryLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Anhui Wanwei Updated High-Tech Material IndustryLtd's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anhui Wanwei Updated High-Tech Material IndustryLtd.Is There Any Revenue Growth Forecasted For Anhui Wanwei Updated High-Tech Material IndustryLtd?

In order to justify its P/S ratio, Anhui Wanwei Updated High-Tech Material IndustryLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is not materially different.

With this in consideration, we find it intriguing that Anhui Wanwei Updated High-Tech Material IndustryLtd's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Anhui Wanwei Updated High-Tech Material IndustryLtd's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Anhui Wanwei Updated High-Tech Material IndustryLtd remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you settle on your opinion, we've discovered 3 warning signs for Anhui Wanwei Updated High-Tech Material IndustryLtd that you should be aware of.

If these risks are making you reconsider your opinion on Anhui Wanwei Updated High-Tech Material IndustryLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600063

Anhui Wanwei Updated High-Tech Material IndustryLtd

Provides chemicals, chemical fibers, new materials, and building materials.

Proven track record and fair value.

Market Insights

Community Narratives