- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6834

Undiscovered Gems In Global Markets And 2 Other Promising Small Caps With Solid Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer sentiment, record-high layoffs, and contrasting performances across sectors, small-cap stocks are facing unique challenges and opportunities. With the S&P 600 for small-cap stocks reflecting broader market sentiment and economic indicators highlighting both potential growth areas and risks, investors are increasingly seeking out undiscovered gems that can weather current uncertainties. Identifying promising small caps often involves looking for companies with strong fundamentals, innovative approaches in their industries, or resilience in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jetwell Computer | 34.75% | 16.24% | 27.51% | ★★★★★★ |

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| TI Cloud | NA | 12.55% | 6.36% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Thai Steel Cable | NA | 4.17% | 18.81% | ★★★★★★ |

| HG Metal Manufacturing | 3.75% | 8.47% | 6.94% | ★★★★★★ |

| Lee's Pharmaceutical Holdings | 12.63% | 1.31% | -43.22% | ★★★★★☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hangzhou Minsheng Healthcare (SZSE:301507)

Simply Wall St Value Rating: ★★★★★★

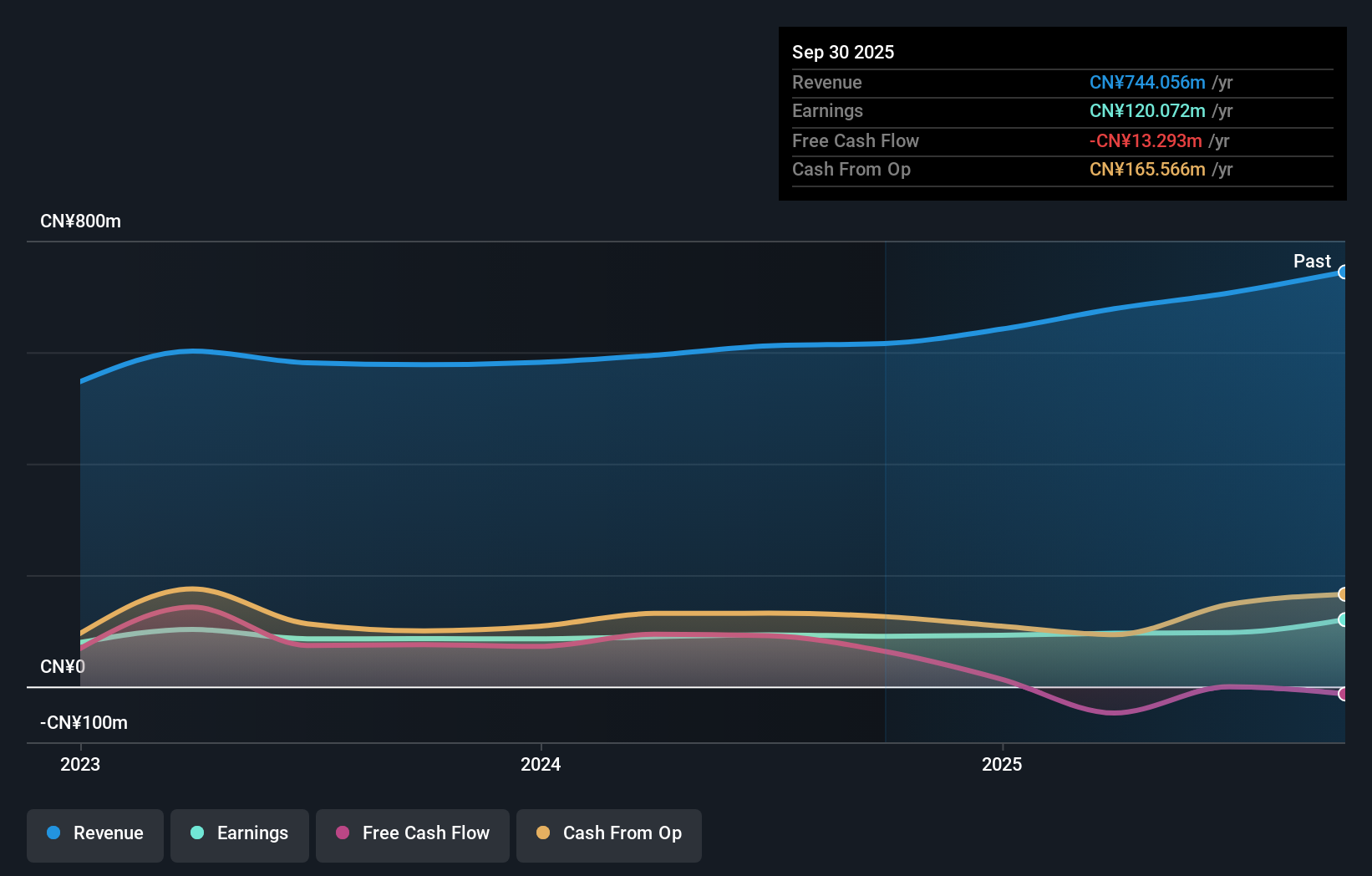

Overview: Hangzhou Minsheng Healthcare Co., Ltd. is involved in the research, development, production, and sale of vitamins and mineral supplements, OTC drugs, and health foods in China with a market cap of CN¥5.89 billion.

Operations: The primary revenue stream for Hangzhou Minsheng Healthcare is its vitamins and nutrition products, generating CN¥744.06 million. The company's financial performance can be further analyzed by examining its cost structure and profit margins, though specific figures are not provided here.

Hangzhou Minsheng Healthcare has been making waves with impressive earnings growth of 33.2%, outpacing the Personal Products industry's -4.8%. Over the past year, revenue reached CN¥622.65 million, up from CN¥519.85 million, while net income rose to CN¥114.42 million compared to CN¥86.18 million previously. The company is debt-free and recently announced a share repurchase program worth CN¥28.71 million, aiming to buy back up to 2,400,000 shares for equity incentives at no more than CN¥21.06 each. A large one-off gain of CN¥25.7M also impacted its financial results recently.

SEIKOH GIKEN (TSE:6834)

Simply Wall St Value Rating: ★★★★★★

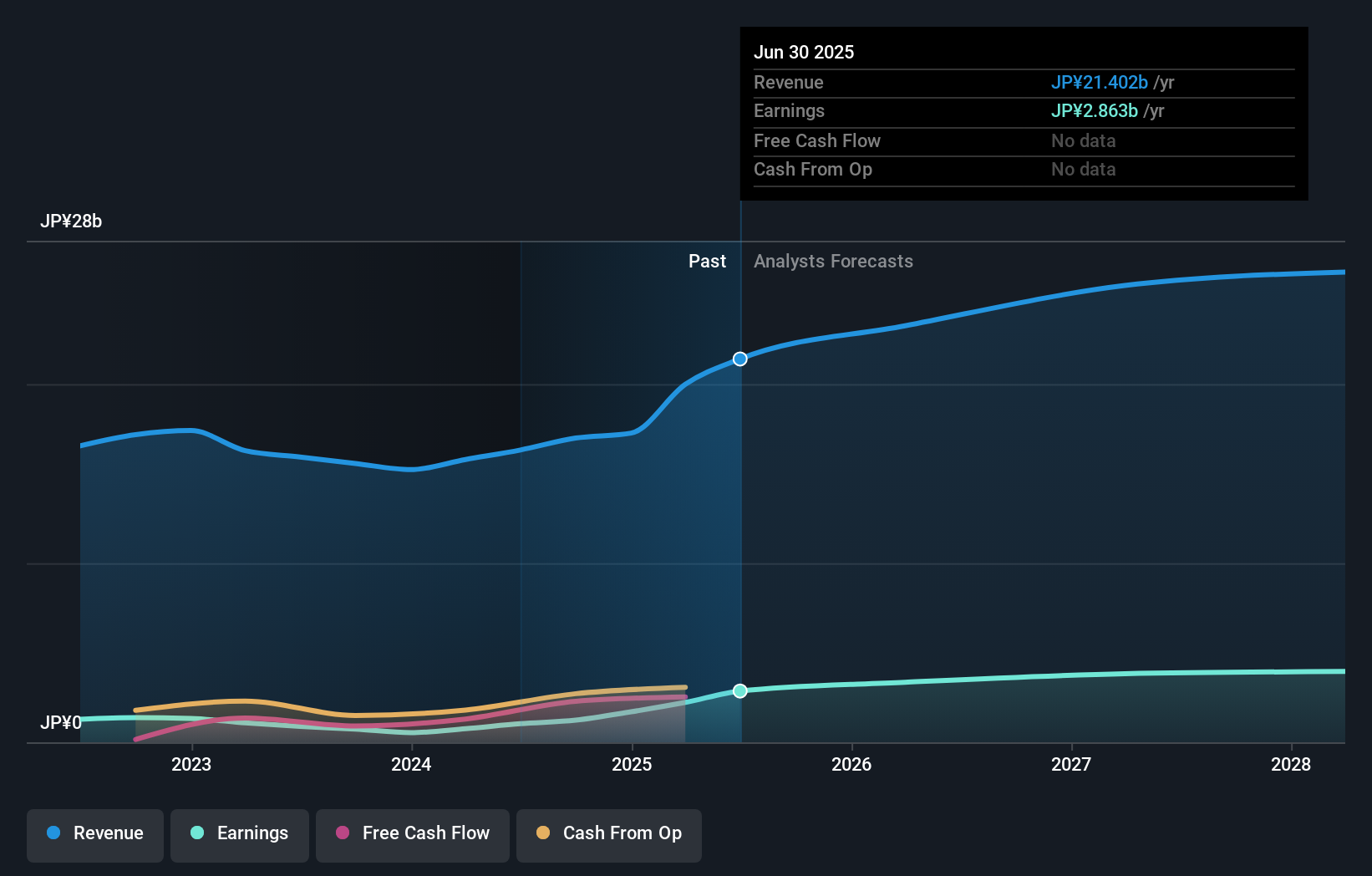

Overview: SEIKOH GIKEN Co., Ltd. specializes in the design, manufacture, and sale of optical components, lenses, and radio over fiber products both in Japan and internationally, with a market capitalization of approximately ¥99.06 billion.

Operations: The company generates revenue primarily from its Optical Products Related segment, contributing ¥11.88 billion, and Precision Equipment Related segment, adding ¥9.56 billion.

SEIKOH GIKEN, a nimble player in the electronics sector, has been making waves with its impressive earnings growth of 175.8% over the past year, outpacing the broader industry. The company is debt-free and boasts high-quality earnings, which speaks to its robust financial health. Recent inclusion in the S&P Global BMI Index highlights its growing recognition on a global scale. Despite experiencing share price volatility recently, SEIKOH GIKEN remains profitable with no concerns about cash runway. Looking ahead, earnings are projected to grow at an annual rate of 11.37%, suggesting potential for continued expansion and value creation for stakeholders.

- Navigate through the intricacies of SEIKOH GIKEN with our comprehensive health report here.

Explore historical data to track SEIKOH GIKEN's performance over time in our Past section.

Jinan Acetate Chemical (TWSE:4763)

Simply Wall St Value Rating: ★★★★★★

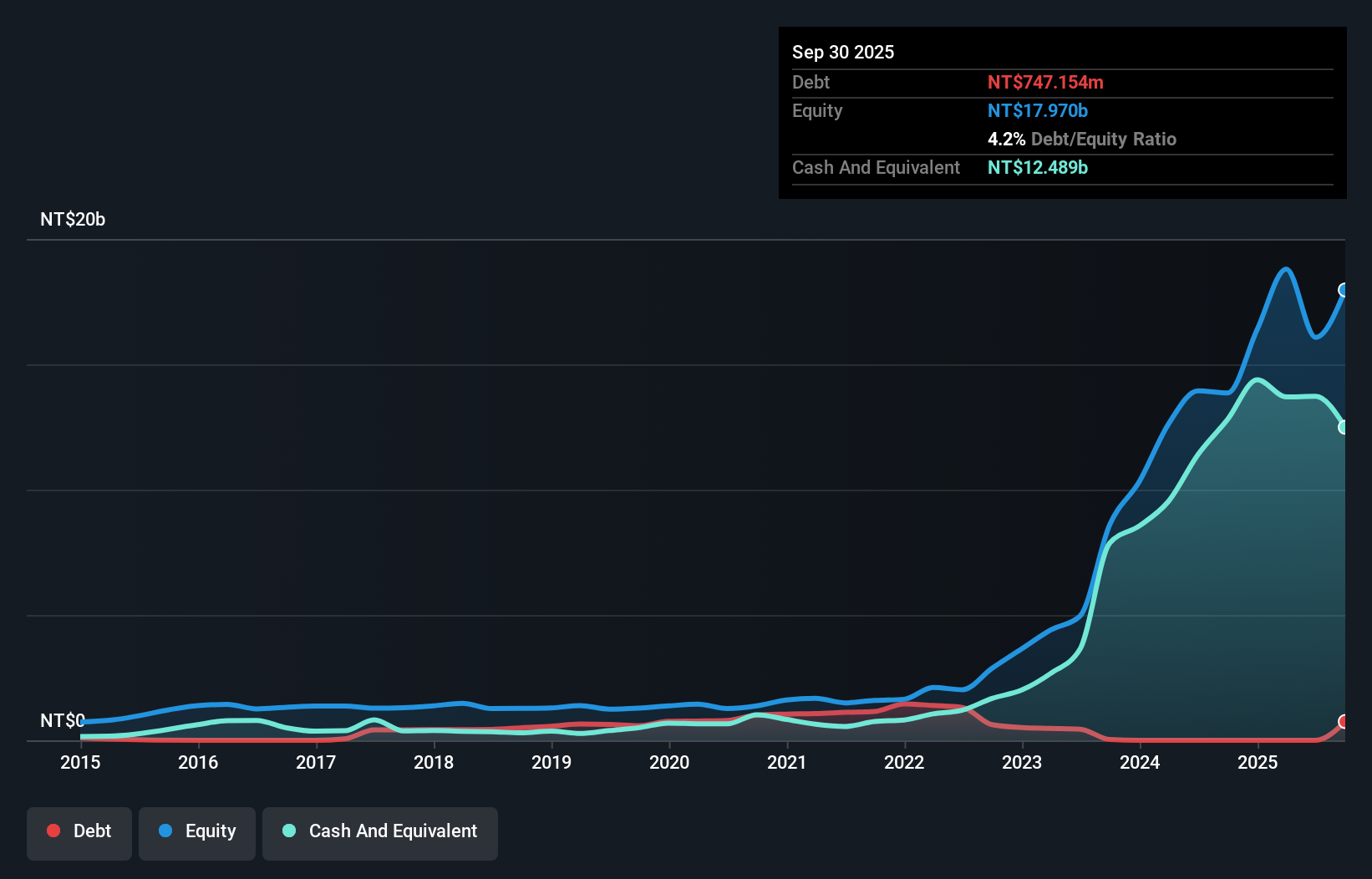

Overview: Jinan Acetate Chemical Co., Ltd. operates in the research, development, production, and sale of cellulose acetate and related products across multiple continents with a market cap of NT$55.49 billion.

Operations: The company generates revenue primarily from the research and development and manufacturing of fiber acetate products, amounting to NT$16.92 billion.

Jinan Acetate Chemical, a dynamic player in the chemicals sector, showcases a robust profile with no debt, contrasting sharply with its 62.3% debt-to-equity ratio five years ago. The company is trading at 44.2% below its estimated fair value and has outpaced industry earnings growth by achieving a 10.6% increase over the past year while the industry saw -10.4%. Despite recent challenges reflected in third-quarter sales of TWD 2,447 million compared to TWD 4,372 million last year, Jinan's revenue is forecasted to grow by an impressive 22.65% annually, indicating potential for future gains.

- Get an in-depth perspective on Jinan Acetate Chemical's performance by reading our health report here.

Understand Jinan Acetate Chemical's track record by examining our Past report.

Make It Happen

- Explore the 2976 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6834

SEIKOH GIKEN

Engages in design, manufacture, and sale of optical components and lens, and radio over fiber products in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives